Workforce strategy: Tax considerations for a sustainable, effective plan

ARTICLE | May 15, 2023

Authored by RSM US LLP

Whether it’s remote work, fringe benefits, or equity pay, the tax costs of compensation and benefit offerings do not have to stand between your organization and a successful, sustainable workforce strategy. In fact, understanding the tax implications can help you align your compensation philosophy with your business objectives and what your workers value.

The tax planning and compliance considerations are often complex, so we have curated these insights to help foster your understanding. Because when your organization thoughtfully considers its options for compensating, incentivizing, recruiting, and retaining employees, you commit to cultivating a workforce that differentiates your organization in the marketplace and positions it for long-term success.

Which of the following actions is your organization planning or considering over the next 12 months due to staffing challenges?

62%

Increasing compensation levels

44%

Enhancing employee benefits

*RSM US Middle Market Business Index survey, October 2022

Dig deeper

- Compensation philosophy

- Remote work and hybrid work

- Equity pay and incentive structures

- Fringe benefits

Compensation philosophy

Maximizing the return on your investments in workforce

A compensation philosophy amounts to a set of practical principles designed to maximize employee performance in roles that drive overall business performance. An organization that defines its business goals and key drivers can home in on the roles required to achieve its objectives, and then on the compensation and benefit offerings necessary to attract and retain talented employees for those roles.

“Being a CFO in some industries is more difficult than others. Maybe you have international operations. So, how much does your CFO contribute to your bottom line? Now think about the range of applicants. Do you need somebody really good, or just above average? And how much are you willing to pay?”

Mark Ritter, senior director, RSM US LLP

Related insights

- A total rewards approach to executive compensation

- ESG and compensation transparency: HR’s role in managing new trends

Remote work and hybrid work

Flexibility enabled by tax planning and compliance

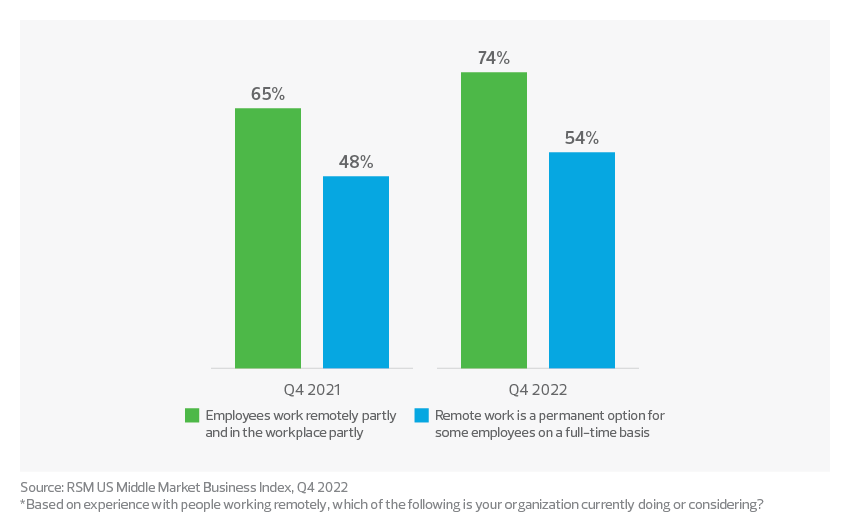

As workers convey their preferences for the flexibility allowed by remote and hybrid work, employers that understand the compliance costs of such arrangements can assess their value to the business’s overall workforce strategy. A sustainable plan for remote or hybrid work should comply with state and local laws. This involves tracking employees’ locations, understanding reciprocal agreements between states where applicable, and meeting reporting and withholding requirements for every jurisdiction in which they take on tax obligations.

Related insights

- Employer compensation considerations for remote workers

- Remote work pay strategies that account for geographic differences

- Remote workforces are complicating state tax nexus and withholding

- RSM US Middle Market Business Index special report: Workforce

“Effective compensation and benefits offerings depend on company culture, current owners and what your employees value. You can be super creative, but you don’t want to cause too much tax or make these too complicated for employees to understand. Tax shouldn’t drive them, but it is part of the equation.”

Anne Bushman, partner and leader of the Washington National Tax compensation and benefits group, RSM US LLP

Equity pay and incentive structures

Driving performance of key employees

What do middle market employees want?

22% vs. 12% equity/share ownership

36% vs. 24% incentive compensation arrangements

*Source: RSM/Big Village survey, Fall 2022

Equity-based incentives can effectively support organizational performance when they are designed for executives and key employees who truly drive the business. Some inherent complexities, though, such as the value of stock in private companies, can create a lack of transparency that undermines the incentivizing force.

Related insights

- Tax withholding for equity compensation

- Frequently asked questions about stock options and tax implications

- 9 frequently asked questions about phantom stock plans

Fringe benefits

Tax-efficient support of creativity in compensating workers

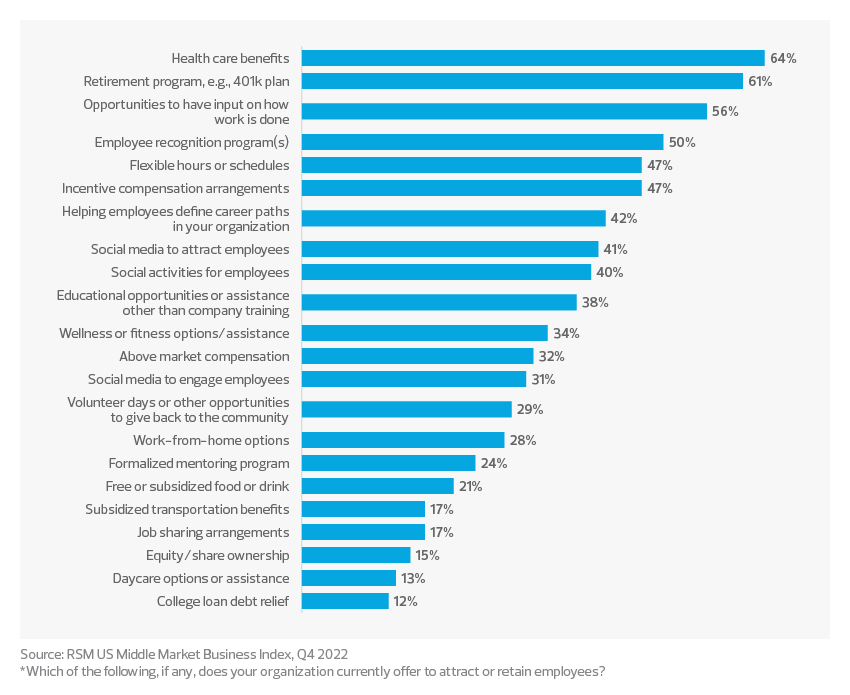

Cash may be king, but it’s not the only way to compensate an employee or make them feel valued. Fringe benefits are an opportunity for a company to be creative, respond to workers’ preferences and differentiate itself in the labor market. Regardless of whether the benefits involve relatively high dollar amounts, such as 401(k) contributions or health insurance, or are less expensive, like transportation subsidies or education assistance, delivering them tax-efficiently can improve the return on the company’s investment.

Related insights

- Beware of traps with paid time off policies

- Health savings accounts: A tax-free way to pay for medical expenses

- SECURE 2.0’s new tool for helping employees with student loans

- Attract and retain employees through educational assistance programs

- Qualified transportation fringe benefit under tax reform

This article was written by RSM US LLP and originally appeared on May 15, 2023.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/services/business-tax/workforce-strategy-tax-considerations-sustainable-effective-plan.html

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each are separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/aboutus for more information regarding RSM US LLP and RSM International. The RSM(tm) brandmark is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

MBE CPAs is a proud member of RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise, and technical resources.

For more information on how the MBE CPAs can assist you, please call us at (608) 356-7733.