What is CAS Accounting & How It Benefits Your Business

Authored by: Ryan Weber — Partner, CPA, CVA | Date Published: September 15, 2025

Most business owners know the drill. You start a company to do what you love, then spend half your time buried in spreadsheets and tax forms instead of actually running the business the way you’d hope.

Traditional accounting has always been about looking backward, telling you what happened last quarter after it’s too late to do anything about it. But what if your accountant could actually help you make better decisions before problems hit your bottom line?

That’s exactly what Client Accounting Services (CAS) does. It’s not just bookkeeping with a fancy name. At MBE CPAs, our CAS team works as an extension of your business. We handle everything from daily financial tasks to proactive planning. This frees you up to focus on the areas of your business where you want to spend your time and attention.

Here’s what makes our CAS approach different from the accountant you call once a year during tax season, and why more businesses are choosing this comprehensive partnership.

Featured Topics:

What Is CAS Accounting?

When you think of accounting services, you might think of receiving help during tax season or for a specific task. This traditional mindset is quite different from year-round advisory, which focuses on real-time financial support and specific strategy design. CAS Accounting is the modern support approach offered by accounting teams that builds a relationship with the client and provides thoughtful business advice.

CAS Accounting focuses on these key aspects:

- Quality Insights: Deep industry knowledge and specialized skills

- Strategic value: Forward-thinking advice that drives business decisions

- Growth: Scalable solutions that evolve with your business

- In-depth financial management: Comprehensive oversight of all financial operations

Between all your day-to-day tasks, the last thing you want to worry about is whether your books are up to date or if you’re missing a tax deadline. CAS handles these tasks that used to keep you working late into the night, giving you more time to focus on core business operations and tactical growth initiatives. Think of it as having a complete accounting perspective without a degree.

Why Are Businesses Moving to CAS?

CAS accounting firms understand the desire for business partnerships when it comes to the services they offer. The businesses searching for CAS are looking to outsource all their accounting needs, and the reasons why vary from company to company.

Here are the top reasons why businesses adopt CAS:

- Deeper client relationships: Businesses are willing to pay for more forward-looking advisory services that are built on insight. By moving to CAS, businesses have more time to focus on their operations while the accounting firm simultaneously provides forecasting and risk management to inform decision-making.

- Attracting and retaining talent: Finding employees with the right knowledge can take time, so instead of hiring an in-house team, businesses can get quality financial advice on an as-needed basis from a CAS provider. This saves the business time spent on hiring and training, as well as a significant amount of money.

- Leveraging technology: CAS leverages cloud technology to provide real-time financial data, allowing businesses to use current reports to make timely decisions about budgeting, forecasting, and managing cash flow.

- Cost efficiency: Maintaining a CAS relationship costs significantly less while providing you with access to a team of specialists who have diverse industry experience.

Remember trying to reach your accountant during tax season, only to get their voicemail because they’re swamped? While your accountant is always focused on your success, the seasonal nature of tax work means there are only so many hours in the day.

This is why many business owners are now adding CAS to their traditional accounting. CAS doesn’t replace what your accountant already does; it enhances it. These services provide customized, year-round advice and support, so you get proactive insights exactly when you need them.

Instead of waiting until the end of the year to review your full business activity, you’ll have someone helping you understand your numbers and plan your next steps throughout the year. This helps answer key questions as they arise, allowing you to make smarter, more informed decisions about your business’s future.

What are the Key Services Included in Client Accounting Services?

Your restaurant business has completely different needs than the marketing agency down the street, or your friend’s construction business. That’s why having a customized plan through CAS is so important. It helps guarantee your financial strategies are aligned with your business goals and challenges.

The main CAS accounting services include:

- Basic Bookkeeping

- Preparing Financial Statements & Reports

- Payroll

- Tax Services

- Bill Paying

- Consulting Services

Advanced CAS offerings may also include cash flow forecasting, KPI development, financial modeling, and even merger and acquisition support. Whether these additional offerings would apply to you, CAS accounting offers tailored support to help your business grow.

How Does CAS Differ from Traditional Bookkeeping?

Traditional Bookkeeping may be outdated, yet it still offers many benefits to clients who outsource their accounting services. The reason it has been relied on for decades is that businesses will always need support with preparing financial statements and filing taxes.

The main difference is that traditional accounting is reactive. You hear from your clients when something has gone wrong or when tax season is approaching. These are the clients who are not looking for planning or strategy when it comes to their finances.

CAS offers year-round guidance, staying on top of your urgent business needs and proactively approaching tax season, emergencies, or anticipated growth. Maybe you need help managing project-based cash flow or handling seasonal demand fluctuations. CAS advisors are building relationships with their clients, not just telling you the approach that worked with their last client.

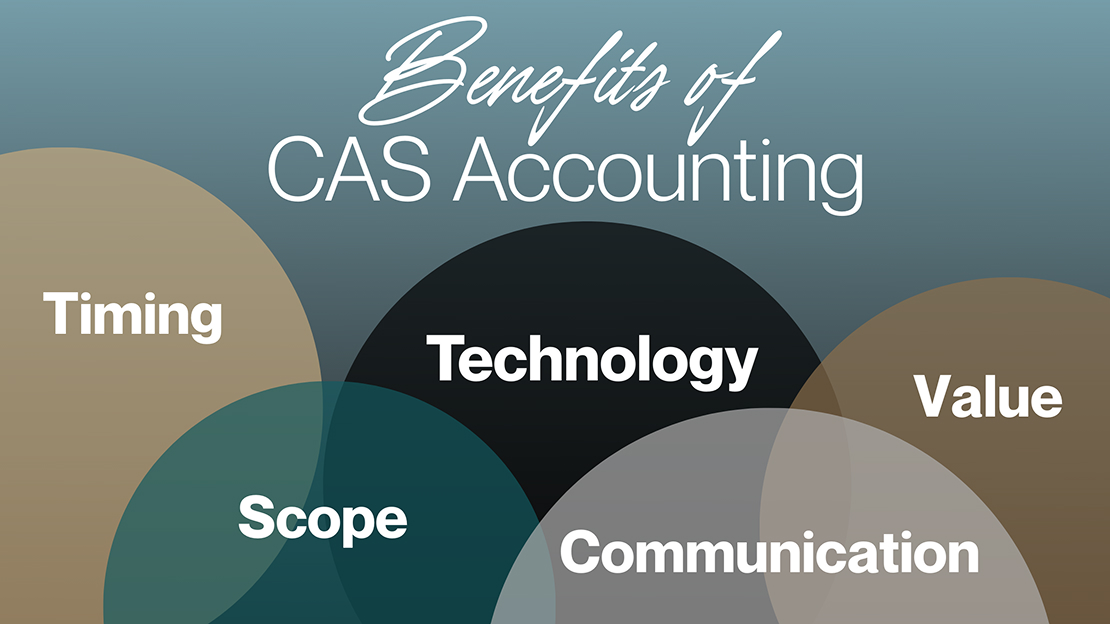

A snapshot of key differences:

- Timing: CAS is proactive

- Scope: Comprehensive business advisory

- Communication: Regular touchpoints

- Technology: Real-time access

- Value: Year-round outsourced support & insights

Smart business owners want to see measurable returns on their investments. This is not to say that traditional accounting would not be beneficial for your business, but it may be time to take the next step towards something more comprehensive.

Is CAS Right for Your Business?

A CAS firm doesn’t just offer one service, but a well-rounded suite from bookkeeping to tax advisory services. You may be drowning in the recordkeeping of your business and looking for a solution to get back on track. Your business has day-to-day activities to be taken care of, so why are you focusing on accounting?

Consider CAS if you’re asking yourself:

- “How do I know if my business is truly profitable?”

- “What should I be paying myself as a business owner?”

- “How can I improve my cash flow?”

- “Am I missing tax-saving opportunities?”

- “What financial metrics should I be tracking?”

Conclusion

If your business is growing or your market is changing, your financial support system should, too. By consulting MBE’s CAS team, you’re not just outsourcing tasks and freeing up your plate, but also gaining a financial advisor and consultant all in one.

Ask yourself if you can afford to operate your business without the insights and guidance that can lead you to success. It’s time that you explore the ongoing support services that our advisors at MBE CPAs provide to improve your tax position while keeping your goals and objectives in mind.

Get your nose out of your records and let our advisors take over from now on. We believe in your business success, so you should, too.