Know When to Make or Buy to Improve Your Supply Chain

Authored by: Amy Gumtz — Partner, CPA | Date Published: September 23, 2025

Every business owner has faced this moment: staring at a proposal that could reshape their company’s cost structure forever. The question they struggle with is whether they manufacture this component in-house or source it externally. This is a make-or-buy decision, the process of understanding the true economic impact across time horizons, risk scenarios, and strategic objectives.

Ready to discover how to properly evaluate relevant costs and reveal hidden risks? Not every choice is as obvious as it seems, because getting it wrong can leave you with stranded assets.

Featured Topics:

What Is a Make-or-Buy Decision?

You’re stuck, another late night at work has you wondering if there’s a better way to handle production. That familiar question is nagging you: should you keep manufacturing in-house or outsource to a supplier?

Choosing between manufacturing a product in-house or purchasing from an external supplier is what we refer to as a Make-or-Buy decision. These decisions aren’t just about comparing costs but finding the right balance for your capacity-constrained operation.

However, there are still other factors that sway companies from choosing one way or the other:

- Quality control

- Supply chain stability

- Flexibility and capacity

While cost is a significant factor, make-or-buy decisions analyze long-term business goals and how the optimal choice will mitigate potential risks. By optimizing resource use and concentrating on high quality, businesses can enhance their competitive advantage and improve profitability.

Common scenarios of make-or-buy decisions:

- Capacity constraints: When a company has limited resources or bottlenecks, decision makers evaluate outsourcing options to solve the issue of slowing production.

- Specialized equipment needs: Deciding whether to manufacture specialized equipment internally or purchase from an external supplier involves a significant investment and risk for the business and can divert resources to non-core equipment.

- Demand fluctuations: When companies face surges of high and low demand, manufacturers must decide whether producing in-house or buying will allow them to scale quickly and avoid excess resources and products.

What Are the True Costs You Need to Compare?

Every time you consider outsourcing production, you’re deciding how much control you’re willing to give up. Maybe you’re already stretched thin across day-to-day operations and can’t decide the time needed to properly evaluate your options. Making an informed decision requires evaluating various factors specific to your business, not the method that worked for the company across the street.

Consider the varying costs of producing in-house or outsourcing your goods:

In-House Manufacturing Costs

- Direct materials and labor: There are significant upfront investments for infrastructure, equipment, machinery, and labor that businesses must allocate funds for. These costs can limit growth opportunities if production is inefficient.

- Allocated overhead and equipment depreciation: Manufacturing overhead includes rent for the factory, insurance premiums, and other indirect costs not specifically tied to production. Choosing the right method for allocating overhead should reflect the practicality of the business’ needs.

- Hidden costs: These costs are often overlooked because they are not direct product expenses but accumulate and impact profitability over time. Addressing costs like production downtime, rework and scrap, and skilled labor will help mitigate inefficiencies down the road.

Outsourcing Costs

- Supplier pricing plus transportation: Relying on suppliers creates a dependency on their performance and ability to meet deadlines. Their efficiency and timing related to shipping goods to your company’s facility or end consumer will also impact your operations and create a trickle-effect on costs.

- Quality inspection and supply chain management: Differing quality control measures, communication gaps, or geographical distance can lead to variations in product quality. It’s important to consider the total supply chain management cost as a percentage of revenue, encompassing planning, sourcing, delivering, and returning processes. Establishing quality control processes and maintaining open lines of communication with suppliers can prevent these costs.

- Risk mitigation and backup supplier expenses: These costs are incurred to identify risks associated with outsourcing, including supply chain disruptions, quality issues, and intellectual property theft. Having a backup supplier is a method to mitigate supply chain disruption risks and reduces reliance on a single source for your critical components.

Where in-house involves higher control, outsourcing allows for scalability. Determine whether your company has the resources and risk tolerance for in-house production or if outsourcing better aligns with your growth and flexibility goals.

How To Perform the Break-Even Analysis

A break-even analysis is a financial tool businesses use to determine the point where total costs and revenue are equal. In other words, the business is not making a profit or incurring a loss. Finding the break-even point helps companies compare the cost of producing in-house against purchasing from an outside supplier.

Think back to the last time you had a clear picture of your true production costs. Maybe you never had one, which is what makes a break-even analysis vital to your future financials. These analyses cut through the accounting confusion and show you exactly what each unit costs to produce. More importantly, it tells you whether your current production goals are realistic given your capacity constraints, or if it’s time to outsource before you hit your breaking point.

Here are the steps for a break-even analysis:

- Determine Your fixed costs and variable costs.

Fixed costs include rent, taxes, insurance, wages and salaries. Variable costs include raw materials, production supplies, utilities, and packaging. - Calculate the product’s contribution margin, which is the difference between the selling price and the variable costs

(Price per unit – Variable cost per unit) - Using fixed costs and contribution margin, calculate the break-even point.

The formula divides the total fixed production costs by the price per individual unit minus the variable cost per unit.BEP = Total Fixed Costs/ (Price Per Unit – Variable Cost Per Unit)

Making decisions about production planning, pricing strategies, and inventory management should also consider the impacts of capacity utilization. Having a high-capacity utilization can indicate strong financial performance but also overutilization, whereas low-capacity utilization can signal lost revenue opportunities. If your company is expanding, demand for goods and services typically increases, which is when a make-or-buy decision can be made to aid in this growth.

When companies analyze their make-or-buy decision, a commonly made mistake is using inaccurate or outdated cost data. Miscalculating your break-even point and failing to consider the right costs will lead you in the wrong direction, which can have long-term impacts on operations.

Other mistakes in make-or-buy decisions:

- Ignoring hidden costs and capacity constraints

- Over-emphasizing short-term savings

- Failing to consider tax implications and cash flow timing

Your manufacturing strategy can significantly impact the growth, competitiveness, and success of your company in the market. To navigate this decision with confidence, consider talking through strategies with an experienced professional.

What Non-Financial Factors Should Influence My Decision?

The approach to make-or-buy decisions is not the same for every company, for there are many factors that can sway a business owner one way or another. To determine the most suitable strategy, carefully consider your unique circumstances and resources, as well as the non-financial factors of the decision.

Non-Financial factors to consider:

- Quality control and consistency requirements

- Intellectual property protection concerns

- Supply chain reliability and risk

- Customer requirements and regulatory compliance

- Strategic core competency considerations

In 2025, manufacturers face many challenges with supply chain disruptions, labor shortages, technological innovations, and tax compliance. With the right strategies and experienced insight, manufacturers can overcome these challenges and position themselves for long-term success.

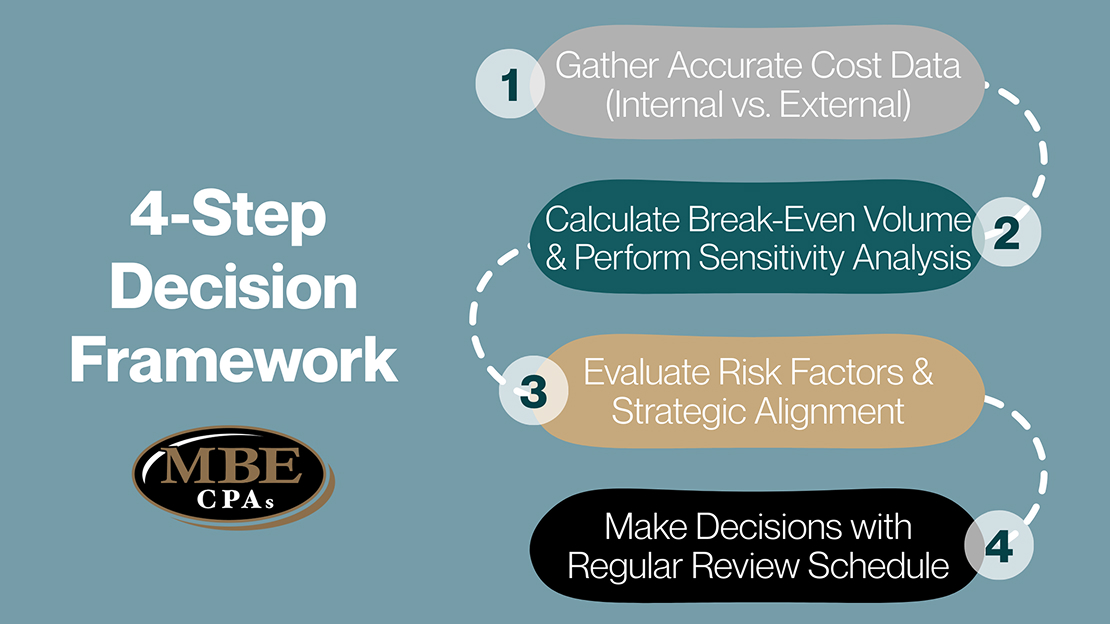

A Simple 4-Step Decision Framework

To ensure you make all major company decisions with confidence, follow guidelines from a team of professionals.

Step 1: Gather Accurate Cost Data (Internal vs. External)

Step 2: Calculate Break-Even Volume and Perform Sensitivity Analysis

Step 3: Evaluate Risk Factors and Strategic Alignment

Step 4: Make Decision with Regular Review Schedule

Your ability to navigate complex decisions determines your business’s success and future profitability. Identifying the right strategy that fits your company’s unique needs can be done by contacting an experienced advisor.

How MBE CPAs can Help with Complex Decisions

Business owners don’t need to navigate these decisions alone. At MBE CPAs, we understand the struggle of balancing operations, financial tasks, and day-to-day activities. By working with our team of professional advisors, you can manage these pressing decisions with confidence and ensure that your next move won’t hurt your company.

Decisions you don’t have to make alone:

- Multi-million-dollar decisions or significant capacity changes

- International sourcing and transfer pricing implications

- Complex tax considerations (Section 263A, state taxes)

- Strategic supply chain transformation needs

Our business consulting and advisory services draw upon their industry knowledge and professional experience to help our clients achieve their goals. We work closely with you to determine the best strategies for your specific industry, so you can access the right solutions at every stage of your business journey.

Conclusion

Making informed make-or-buy decisions is critical for organizational success as these choices directly impact cost efficiency and future profitability. Companies that evaluate factors such as core competencies, quality requirements, and capacity constraints are better positioned to optimize their operations.

With the help of MBE CPAs, your company can develop strong decision-making frameworks and regularly reassess these choices as industry conditions evolve. We help organizations monitor the allocation of their resources while simultaneously focusing on activities that create the greatest value.

MBE CPAs can help you with activities from simplifying your accounting procedures to identifying opportunities to reduce costs and improve your bottom line.