Is Your Manufacturing Business Compliant for 2026?

Authored by: Glen Erdman — Director, EA | Date Published: December 15, 2025

As we enter the final weeks of 2025, manufacturers across the United States face a pivotal moment regarding their quality levels. New audit standards, evolving regulatory requirements, and heightened scrutiny from financial auditors are creating a perfect storm for compliance.

When was the last time your manufacturing business underwent a comprehensive review? If you’re the owner of a manufacturing business, you might be about to get a wake-up call.

Featured Topics:

What Are the New Quality Management Standards?

The American Institute of CPAs is implementing comprehensive Quality Management Standards that fundamentally transform how accounting firms approach quality for manufacturing clients.

- For manufacturers, a company audit involves examining whether their processes, systems, and facilities meet specific standards. And now these requirements are shifting from checkbox compliance to dynamic risk assessment.

- Learn more about the importance of routine audits as a policy development tool.

Effective December 15, 2025, the process shift will directly impact how your company’s analysis is planned, executed, and reviewed.

The new framework primarily focuses on significant changes to SQMS 1, which governs the entire quality management system for accounting firms.

Key Changes to SQMS1

SQMS 1 addresses the overall system an accounting firm uses for quality management.

Here’s what’s different:

- Expanded quality components: Auditors must now consider eight interconnected quality components when planning your review.

- Risk-based approach: Expect your auditors to dig deeper into inventory valuation, multi-step production, and cost accounting systems based on assessed risk rather than standard procedures.

- Enhanced scalability: Procedures will be tailored to company size, industry segment, regulatory environment, and technology systems.

- Integration of policies with risks: Policies must directly address identified risks in manufacturing engagements.

What Changes for Manufacturing Audits?

Your December 2025 analysis will look different. At first glance, changes to how CPA firms manage quality might seem to affect auditors but not the companies they review.

However, every manufacturer of similar sizes used to receive roughly the same procedures, questions, and timelines. Now, SQMS 1 affects manufacturers by changing what auditors look for, how they look for it, and what they do when they find issues.

Firms operating under these new standards will:

- Ask more questions about your risk environment

- Require enhanced documentation

- Spend more time on quality reviews

- Focus on specialized areas

If the firm you’re partnered with has received inspection findings related to Critical Audit Matters, expect them to apply heightened procedures to your 2025 inspection.

- Critical Audit Matters are issues communicated to the committee that relate to material accounts or disclosures. Now, auditors must adequately address these CAMs and whether their disclosures provide meaningful information.

For manufacturers in regulated industries, like pharmaceuticals, medical devices, food and beverage, quality management system reviews are intensifying.

FDA Inspection Trends

- Increased focus on data integrity and electronic records

- Enhanced scrutiny of supplier qualification and oversight

- Deeper examination of Corrective and Preventive Action systems

- Greater emphasis on process validation and verification

What are the implications for your manufacturing review?

These FDA compliance issues can trigger financial statement impacts:

- Warranty reserves and product recall accruals

- Inventory obsolescence from product holds or quarantines

- Revenue recognition impacts from delayed product releases

- Legal and remediation cost accruals

Tips for Manufacturers: Pay special attention to acquired inventory, especially work-in-process and finished goods. Fair value step-ups can create complex accounting as you sell through acquired inventory.

If your manufacturing business needs guidance in preparing for the new procedures, contact us today for a year-end readiness assessment. Time is running out, but preparation is still possible.

The Cost of Non-Compliance for Manufacturers

If you haven’t partnered with a manufacturing-specialized CPA firm before, December 2025 is the time to start that conversation. Head into next year with a strengthened compliance posture.

Manufacturing companies that enter 2026 unprepared for the new processes face significant risks:

- Extended delays: Manufacturers may face penalties from missed filing deadlines or will have to divert management time to inspect issues rather than operations.

- Increased costs: Additional hours dedicated to audits for your poorly documented process or fees for rush work to meet deadlines.

- Regulatory scrutiny: You may receive warning letters from the FDA or OSHA citations that affect operations.

What are the implications for your manufacturing review?

An automotive parts supplier received notes on previous annual reviews from informal documentation of their cost accounting process, but it had never been elevated to a control deficiency.

Action taken: The supplier hired a manufacturing accounting consultant to improve their cost accounting system and documentation procedures.

The result? When their 2025 inspection began, auditors spent less time understanding their system because they had already implemented improvements, demonstrating a commitment to quality and compliance.

Manufacturing companies often have long-standing processes that were never formally documented or critically evaluated. Use December as an opportunity to document and improve processes, not just preserve the outdated norm.

Before your auditors arrive, conduct your own internal assessment and remediate issues.

Action Items for Manufacturers

You may have been in business for multiple decades, and your annual assessment has always been routine. Until now.

December 2025 represents your last opportunity to remediate control deficiencies before year-end testing. Post-closing adjustments made in 2026 may complicate your financial statements and extend your timeline.

Under the new quality management standards, auditors must thoroughly document their risk assessments and responses. Control deficiencies that might have been noted but not elevated in prior years may now rise to significant deficiency or material weakness levels.

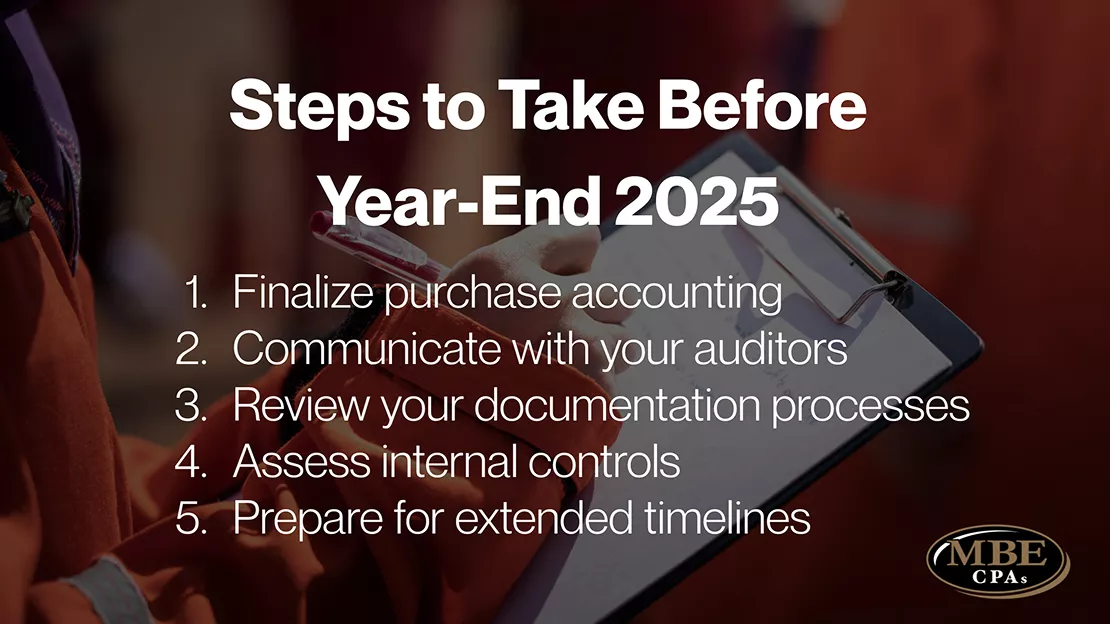

Follow these steps before year-end 2025:

- Finalize purchase accounting: Complete valuation studies and purchase price allocations before year-end.

- Communicate with your auditors: Schedule a meeting to understand how they’re implementing the new QMS and what additional information they’ll need.

- Review your documentation processes: Check that your accounting policies, significant estimates, and judgments are thoroughly documented.

- Assess internal controls: The risk-based approach will shine a spotlight on control deficiencies. Address known issues now.

- Prepare for extended timelines: Budget additional time for your 2025 review to accommodate the more comprehensive procedures.

December is slipping away, along with the rest of 2025. Manufacturers who adapt to these evolving procedures will realize continuous improvement, while those who wait will risk being unprepared for the new normal of heightened scrutiny.

MBE CPAs offers a variety of Audit and Assurance services to meet your financial statement and regulatory reporting requirements.

Contact your audit team today and start your year-end preparation. Your 2026 success depends on what you do in December 2025.