Understanding the True Value of Your Business

Authored by: Ryan Weber — Partner, CPA, CVA | Date Published: December 18, 2025

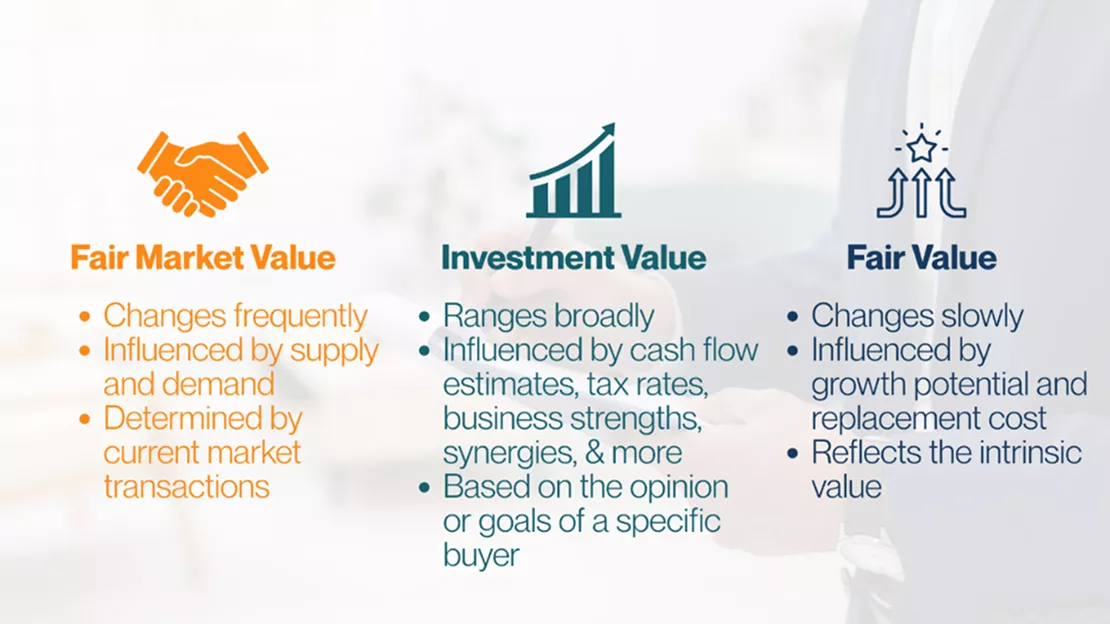

If you’ve ever wondered, “What’s my business worth?” you’ve probably noticed the answer varies depending on who is asking and why. Whether you are gifting shares to family, buying out a partner, or considering an acquisition offer, your business can be valued in three very different ways.

There are multiple standards for determining value. The standard that works for your tax return might shortchange you in a legal dispute, while a strategic buyer may offer even more than either. These distinctions can mean hundreds of thousands or even millions of dollars to you personally. If you’ve ever felt confused by conflicting valuations from different advisors or concerned about leaving money on the table, you’re not alone. This guide clarifies the three valuation standards you need to know and helps you understand which one applies to your situation.

Featured Topics:

What Is Fair Market Value and How Is It Determined?

Fair Market Value (FMV) is the standard you’ve probably heard most often, especially if you’ve dealt with estate planning, gift taxes, or charitable contributions.

Fair Market Value (FMV) is the price a property would sell for. It occurs between a willing buyer and a willing seller. Neither side is forced to buy or sell. Both have a reasonable understanding of the relevant facts.

What makes FMV unique:

- Both parties are hypothetical and anonymous

- No one is forced to transact

- Everyone has equal access to information

- The transaction happens in an open, unrestricted market

Where you may encounter FMV:

- Estate planning

- Charitable donation deductions

- ESOPs and certain retirement plans

- Some shareholder disputes

- Certain types of litigation

Think of FMV as the “market price” for your business if you could list it on a public exchange where informed buyers and sellers could freely trade. For closely held businesses, discounts may be applied for lack of marketability and lack of control to value minority interests that can’t be easily sold.

For example, if you own 20% of a family business and want to gift that stake to your children. The IRS requires an FMV (Fair Market Value) appraisal. While the entire business might be valued at $10 million, your 20% minority interest isn’t automatically worth $2 million. After accounting for discounts related to lack of control and lack of marketability, the appraised value of your stake could be reduced to $1.3–$1.5 million for gift tax purposes. This is because a potential buyer would pay less for a minority position that they cannot control or readily sell.

What Does the Law Require for Fair Value?

Fair Value is a legal standard, not an economic one. It exists because courts recognized that Fair Market Value doesn’t always produce equitable results, particularly in situations involving oppressed minority shareholders.

The definition of Fair Value varies by jurisdiction and context, but it generally eliminates or reduces the discounts that would apply under FMV.

Where you’ll come across Fair Value:

- Shareholder dissent and appraisal rights

- Divorce proceedings (in many states)

- Partner buyouts under operating agreements

The key difference

Fair Value typically does not apply discounts to a minority shareholder for lack of control or marketability. The reasoning is that when you are forced out of a company or exercising your legal rights, it would be unfair to penalize you for factors beyond your control.

Suppose a majority shareholder decides to merge the company at a price you believe undervalues your stake. By exercising your appraisal rights under state law, you are entitled to Fair Value, your proportionate share of the enterprise value without minority or marketability discounts. As a result, your 20% stake might be valued at $1.8–$2 million instead of $1.3–$1.5 million.

It’s important to note that Fair Value standards can vary significantly by state and even by the specific type of legal proceeding. This is why having the right valuation professional is critical.

What Is Investment Value and Why Does It Matter?

Investment Value is the most subjective of the three standards, yet it is often the most relevant in actual M&A transactions. It represents the worth of a business to a specific investor, reflecting their unique requirements, expectations, and potential synergies.

What makes Investment Value unique:

- It’s specific to one buyer

- It includes synergies and strategic benefits

- Cost of capital reflects the specific buyer’s risk profile

- Personal factors come into play

Where you’ll encounter Investment Value:

- Negotiated transactions and M&A deals

- Strategic acquisitions

- Management buyouts

- Any situation with a known, specific buyer

For example, your manufacturing business might have a Fair Market Value (FMV) of $5 million to a hypothetical buyer. However, to a competitor able to eliminate duplicative overhead, consolidate facilities, and cross-sell to your customer base, the Investment Value could be more. These synergies create real value, but only for that buyer.

This explains why most businesses do not sell for their Fair Market Value. Instead, they are typically sold for a price closer to Investment Value, negotiated between what the seller is willing to accept and what the specific buyer believes the acquisition is worth to them.

Conclusion

Each valuation standard exists for a distinct purpose. Fair Market Value protects tax authorities and promotes consistency. Fair Value protects minority shareholders from potential oppression. Investment Value captures the true economic potential in real-world transactions.

Costly mistakes happen when people assume all valuations are the same or commission an analysis under the wrong standard. Before engaging a valuation professional, make sure you both understand which standard applies. The right answer to “What’s my business worth?” is always: “Worth to whom, for what purpose, and under what standard?”

Have questions about which valuation standard applies to your situation? Contact a valuation professional at MBE CPAS. Getting this right from the start saves time, money, and stress down the road.