States Cutting Individual Income Tax in 2026

Authored by: Brett Leibfried — Partner, CPA | Date Published: February 3, 2026

What would give you a sigh of relief this year? What if we told you that nine states are lowering their income taxes this year—would your story for 2026 take a significant turn?

Most headlines are focusing on rising costs, but we’re locked in on this serious tax break. However, any seasoned accountant will tell you that a lower tax rate doesn’t mean a simpler tax season. For many, it means your 2026 preparation needs to start now.

Featured Topics:

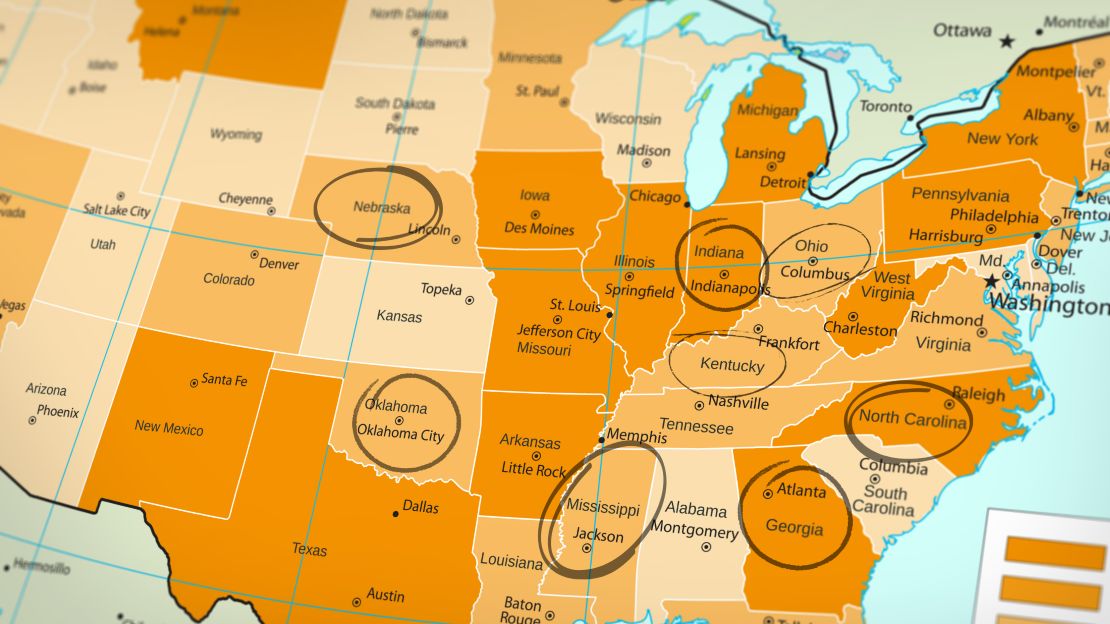

Is Your State on the Income Tax Cut List?

As U.S. residents flock from city to city to chase the best cost of living, states are now competing to be the most business or resident-friendly in the country. This year, nine states are leading the charge with tax cuts effective January 1st, 2026.

These aren’t minor adjustments. We’re talking about substantial reductions that can stimulate economic growth, attract businesses, and make states more competitive.

Here is the state list:

- Kentucky: Dropping from 4% to 3.5%.

- Nebraska: Lowering rates from 5.2% to 4.55% (part of a plan to hit 3.99% by 2027).

- Ohio: Transitioning to a flat tax of 2.75% for most earners.

- Mississippi: Reducing rates to 4.0% as it eyes a total phase-out.

- North Carolina: Dropping the flat tax to 3.99%.

- Montana: Lowering the top marginal rate to 5.65%.

- Oklahoma: Dropping from 4.75% to 4.5%.

- Georgia: Continuing its gradual decline to 5.09%.

- Indiana: Lowering to 2.95%.

Read more about the other states that made notable tax changes in 2026.

The story doesn’t end with state tax cuts. The OBBBA raises the state and local tax deduction cap from $10,000 to $40,000, creating additional savings for many taxpayers. But only those who itemize their deductions rather than taking the standard deduction.

When combined with state rate reductions, the compound effect could be substantial. Before moving forward, it’s important that taxpayers understand the full picture to avoid traps.

What Changes from the Income Tax Cuts?

On paper, a tax cut sounds like a simple win, and many taxpayers assume basic preparation will automatically optimize their situation. However, as accountants, we look at the “fine print” of these legislative changes.

Here’s why you’ll want professional insight into these changes:

- The “Withholding” Trap: If you don’t adjust to these dropping rates correctly, you may accidentally over-or-under-withhold and risk facing penalties at tax time. Knowing how to adjust withholdings can benefit business owners by allowing them to reinvest in their businesses.

- Multi-State Issues: With the rise of remote work, it’s important to check your “tax home.” If you live in a state that is moving to a flat tax, but you work for a company in a high-tax state, you must understand which state taxes you, so you don’t overpay.

- Favored Business Structures: These tax cuts often favor higher-income brackets or business owners. For S-Corps or Partnerships, these state-level changes can alter your “Pass-Through” entity tax. We help you answer whether to accelerate or defer your income.

Want to avoid other tax issues? Here are five common traps small businesses fall into.

Knowing these changes exist is just the first step. Understanding how they affect your specific situation and planning accordingly is where real savings emerge.

Common Questions About Tax Changes

After handling your own taxes for years, you hear about your state’s tax changes but aren’t sure how you’ll be affected. Rather than continuing without optimizing your plan, ask the questions that keep you up at night. We have the answers.

Here are common questions we hear:

Q: “Should I adjust my withholding immediately?”

The right adjustment depends on your specific situation. We recommend scheduling a withholding review within the first quarter of 2026 to optimize the new rates.

Q: “I work in one state but live in another. How do these cuts affect me?”

Generally, you’ll pay taxes to the state where you work and receive credit in your resident state. This can vary when either state is cutting rates. You’ll likely benefit, but we recommend having a professional complete the calculation analysis. Watch out for state reciprocity rules.

Q: “Should I accelerate or defer income?”

This depends on federal rates, other income sources, and your future plans. If your state rate is dropping and you expect similar income levels, accelerating income into lower-rate years can make sense.

How to Prepare for 2026 Taxes

Whether you’re a small business owner, a family trying to build savings, or someone planning for retirement, these changes matter.

Here’s what we advise taxpayers to start now:

- Review your current withholding and compare it to the new state rates.

- Gather your 2025 tax documents early.

- Analyze your quarterly estimated payment schedule.

- Schedule a tax planning consultation.

Learning these steps is one thing, but implementing them requires time, experience, and attention to detail that many business owners simply don’t have. That’s where professional help makes all the difference. With help from a tax partner, you can maximize your savings from these tax changes.

Partnering with MBE CPAs looks like this:

- Personalized tax projections

- Payroll & withholding optimization

- Quarterly check-ins for business owners

- Audit support & compliance

The decisions you make in January, February, and March will determine how much you ultimately save. An initial consultation can reveal several tax planning opportunities; all you have to do is find time in your schedule this quarter.