Could Deferred Crop Insurance and Income Averaging Help You?

Authored by: Kevin Block — Partner, CPA | Date Published: November 12, 2025

The late July sky darkened in minutes, and a fierce wind tore across your corn fields, flattening rows that once stood tall and green. After the storm passed, you stepped into the silence, boots sinking into wet soil, and took in the tangled mess. In a single afternoon, 180 acres of your best corn were ruined. When the insurance check finally arrives in December, you feel both relief and a new worry. The money helps now, but you know it brings a fresh set of tax concerns for next year.

A welcome insurance check might push you into a higher tax bracket you weren’t planning for, especially if your remaining acres produced well. The decision to defer income often comes at a tricky time, and deferral is an all-or-nothing choice for each crop type.

Fortunately, you’re not without options. By understanding how deferred crop insurance works in combination with farm income averaging, you can turn these challenges into valuable planning opportunities. Let’s take a closer look at how these strategies work and how they might benefit your operation.

Featured Topics:

How Can Crop Insurance Deferral Help You?

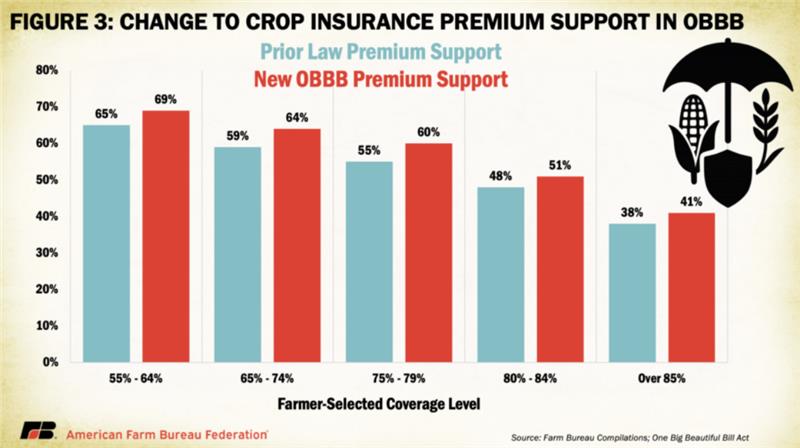

Crop insurance deferral allows cash-method farmers to delay reporting insurance payments received in the current year. This tax provision, continued under the One Big Beautiful Bill Act (OBBBA), provides farmers with a method to align income timing with their usual business cycle. The Act included several measures affecting agriculture, and this deferral remains one option that may factor into tax planning decisions.

How the Deferral Works

The concept mirrors how you naturally operate your farm. If you typically harvest corn in October but sell it the following spring when prices improve, your income pattern follows that timing. When hail destroys that same corn in July and insurance pays you in December, the deferral election allows you to report that insurance income in the year you would have normally sold the crop.

Eligibility Requirements

To qualify for this election, you must meet specific requirements:

- Use cash-method accounting (not accrual).

- Receive insurance proceeds in the same year the crop was damaged.

- Demonstrate that more than 50% of the income from that crop would normally be reported the following year.

- Apply the election to your entire farming operation for that crop type.

Applying the Deferral

Consider your situation if you farm 800 acres of soybeans with revenue protection crop insurance. In August, severe flooding destroys 300 acres of your crop, and you receive $85,000 in crop insurance proceeds in December. Since you typically store your soybeans and sell them in early spring to capture better prices, you can defer this insurance income to the following year.

How Do These Payments Interact with Farm Income Averaging?

Farm income averaging addresses one of agriculture’s biggest challenges, which is highly variable income. This volatility can push farmers into higher tax brackets during good years, creating a tax penalty for success.

Income averaging works by allowing you to calculate tax on current-year farm income using rates from the previous three years. Instead of paying tax on a $200,000 income spike all in one year, you spread that calculation across four years, potentially capturing lower tax rates from years when your income was more modest.

What Counts as Elected Farm Income?

The key component is elected farm income, which includes:

- Selling crops and livestock from normal operations.

- Receiving government payments related to farming activities.

- Selling farm equipment used substantially in operations.

- Earning other income directly attributable to your farming business.

However, it excludes land sales and certain rights transactions that aren’t considered regular farming income.

Can Deferred Crop Insurance Be Averaged?

Here’s where the real planning opportunity emerges. When you defer crop insurance proceeds to the following year, those proceeds become farm income in the year you report them. This means they can absolutely be designated as elected farm income for averaging purposes.

Let’s return to your soybean situation. In the following year, when you report the $85,000 in deferred insurance proceeds, your total farm income jumps to $245,000, significantly higher than your typical $160,000-$180,000 range. Without planning, this income spike could push you into the 24% tax bracket instead of your usual 12% bracket.

By electing to treat the insurance proceeds as elected farm income for averaging, you can spread this income across the previous three years. If those years had lower income levels, the averaging calculation applies lower marginal rates to portions of the insurance proceeds, reducing your overall tax liability.

When Should You Consider Using Deferred Crop Insurance?

This combination works best when several factors align:

- Receive substantial insurance proceeds in a year with already strong farm income.

- Have base years with lower income due to poor prices or weather challenges.

- Face income spikes that push you into significantly higher tax brackets.

- Have time to properly evaluate and coordinate both elections.

Timing considerations matter significantly. You must decide on the deferral election by the due date of your return for the year you receive the proceeds, while the income averaging election is made when you file the return for the year the income is recognized.

How Does This Fit into Your Broader Tax Planning Strategy?

The interaction between crop insurance deferral and income averaging represents sophisticated tax planning that goes beyond basic compliance. Rather than responding only when insurance payments arrive, this approach allows you to adjust the timing of income recognition to better fit with your broader financial reporting.

Documentation Requirements

To implement these strategies properly, you’ll need to:

- Document your normal business practice for crop sales.

- Attach proper election statements to returns for deferral years.

- Obtain copies of tax returns from the three base years for averaging calculations.

- File Schedule J with your individual return when electing income averaging.

- Secure professional guidance to coordinate timing and calculate optimal benefits.

These approaches can be combined with other farm deductions as part of an overall tax planning strategy to reduce liabilities while remaining compliant.

How MBE CPAs Can Help You

At MBE CPAs, we work with farming families throughout the country to identify these planning opportunities before they become urgent decisions. This comprehensive approach:

- Analyzes your typical income patterns and seasonal cash flows.

- Anticipates tax law changes that may affect future planning.

- Coordinates retirement planning needs and succession considerations.

- Aligns equipment replacement schedules and depreciation timing.

The goal isn’t just to minimize current-year taxes but to create predictability and efficiency across multiple years of farm operations.

You wouldn’t plant corn without checking soil conditions first, right? Same goes for your finances. Let’s sit down and figure out which of these moves makes sense for your farm.