Fly, Stay, and Save Big on Taxes

Authored by: Frank Vinopal — Partner, CPA | Date Published: December 11, 2025

You spent three days at an industry conference, meeting potential partners who could transform your business. You pitched your services to a major client two states away, and the conversation went better than expected. You brought back ideas from the workshop that your team is already excited to implement. You covered flights, hotels, meals with business owners, and a rental car that kept you on time. This trip was truly valuable for your business.

But here’s what many small business owners don’t realize: those expenses aren’t just the costs of doing business. They’re potential tax deductions that can significantly reduce what you owe come April.

As someone who’s worked alongside small business owners for years, I’ve seen too many partnerships leave money on the table simply because they weren’t clear on what qualifies as a deductible business travel expense. The IRS actually allows substantial deductions for legitimate business travel, but the key is understanding the rules and properly documenting everything.

Let me walk you through what you need to know to maximize your small business travel deductions while remaining fully compliant with IRS requirements. We’ll tackle this together.

Featured Topics:

What Travel Expenses Can You Deduct?

The good news: most ordinary business travel costs are deductible when you travel away from your tax home for business purposes. Understanding which transportation expenses qualify can make a substantial difference in your tax savings.

Transportation Costs

- Airfare, train tickets, or bus fare to your business destination

- Rental car expenses (business use only) or the standard mileage rate when driving your own vehicle

- Taxi, Uber, or Lyft rides between business locations

- Tolls and parking fees related to business travel

Lodging and Accommodations

- Hotel or motel stays during business trips

- Alternative accommodations, such as Airbnb, are available for business travel.

- Reasonable lodging costs based on your destination

Meals and Incidental Expenses

- Tax-deductible meals during travel

- Tips for service staff

- Shipping costs for business materials or samples

Other Deductible Expenses

- Conference registration fees and business seminar costs

- Wi-Fi and phone calls for business purposes

- Baggage fees and shipping costs

- Laundry or dry cleaning on extended trips

How Much of Your Meals Can You Write Off?

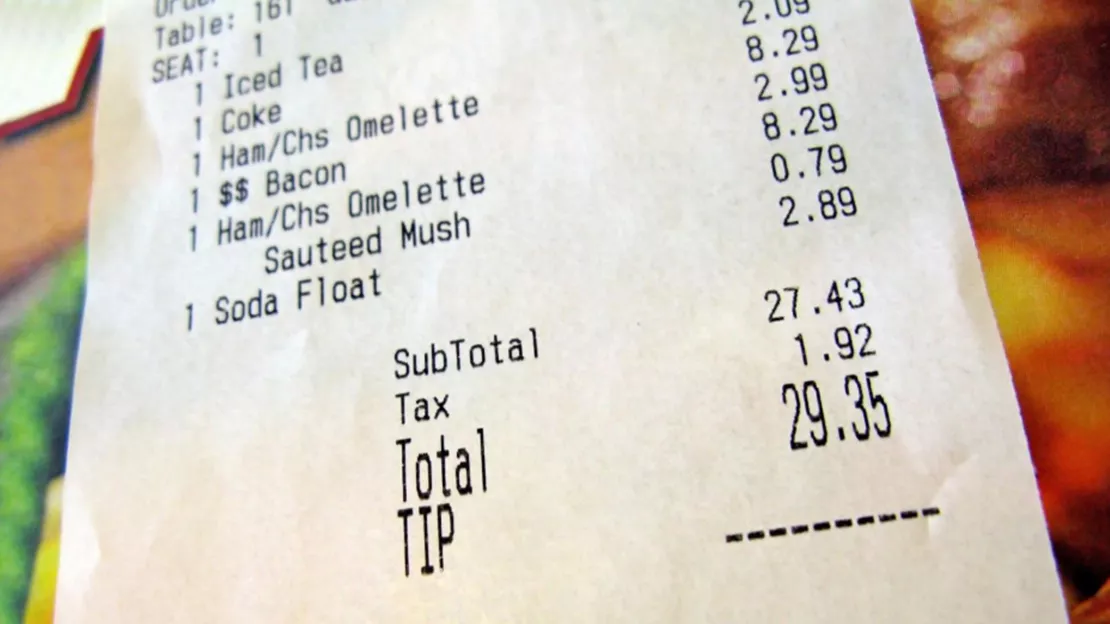

This is where many business owners get confused, and understandably so. The standard rule is that business meals are limited to a 50% deduction. That means if you spend $100 on a business dinner with a client, you can deduct $50.

You can simplify meal tracking by using the IRS’s “per diem rates.” Think of per diem as a daily allowance the IRS sets for meals and lodging in different cities. Instead of tracking every meal receipt, you can use predetermined amounts that vary by destination. A business trip to New York City has a higher per diem tax deduction than a trip to a smaller town because the cost of living differs. This method can save you considerable time, though you’ll still need to maintain records proving the business purpose of your trip.

There are some exceptions where meals are 100% deductible, such as meals provided at company-wide events, food made available to the general public (like an open house), and meals treated as taxable compensation to an employee.

What About Mixing Business with Personal Travel?

Life happens. Sometimes you extend a business trip to visit family or explore a new city. The IRS understands this, but there are specific rules you need to follow.

When a trip combines business and personal activities, you may only deduct expenses directly related to the business portion. Here’s how it works:

Domestic travel: Your trip must be primarily for business. If most of your time is spent on business activities, your transportation costs are fully deductible. Personal days during the trip aren’t deductible.

International travel: For trips longer than a week, your travel is considered business-related and deductible if you spend 25% or less of your time abroad on personal activities, meaning 75% must be spent on business.

The key is honest record-keeping. Document your business activities daily, and separate personal expenses from business ones.

What Common Mistakes Should You Avoid?

Over the years, working with small business owners, I’ve noticed several patterns that lead people to inadvertently reduce their deductions. Let’s make sure you don’t fall into these traps.

Poor Documentation

This is the biggest issue I see. The IRS expects clear documentation, including the dates and locations of expenses, the business purpose of the trip, the names of attendees and their business relationship with you, and receipts for all expenses of $75 or more.

How to avoid this: Start using an expense tracking app the moment you book your trip. Snap photos of receipts immediately after each transaction. At the end of each day, spend five minutes noting who you met with and what you discussed. Creating a detailed travel expense report as you go, rather than trying to reconstruct everything later, protects your deductions and saves you the headache.

Entertainment vs. Meals Confusion

Entertainment expenses, such as concert tickets, golf outings, or sporting events, are not deductible, even if business is discussed during the event. However, meals consumed at entertainment events may be deductible if the food and beverage costs are separately stated from the entertainment costs on the receipt.

How to avoid this: When you’re out with clients or partners at entertainment venues, ask for itemized receipts that clearly separate food and beverage charges from entertainment costs. For example, if you take a client to a baseball game, the ticket price isn’t deductible, but the hot dogs and drinks purchased separately from a vendor can qualify for the 50% meal deduction. Only the meal portion qualifies, so make sure your receipts break out these costs individually.

Unreasonable Expenses

The IRS allows deductions for “ordinary and necessary” expenses. A reasonable hotel in your destination city? Deductible. A luxury suite when a standard room would suffice? That might raise questions.

How to avoid this: Book accommodations that reflect what other professionals in your industry would choose. If you’re unsure whether something is reasonable, ask yourself if you’d be comfortable explaining the expense to the IRS. When in doubt, reach out to us for guidance before booking.

Mixing Personal and Business Use

If you rent a car and use it for both business and personal purposes, you can only deduct the portion used for business. Keep a log of business vs. personal mileage.

How to avoid this: Use your phone’s notes app or a simple mileage tracker to record the odometer reading and the purpose of each drive. Note whether each trip was for business meetings, client visits, or personal activities. This takes seconds but provides the documentation you need.

How Can Technology Make This Easier?

We live in an age where your smartphone can be your best ally in tax preparation. Modern expense-tracking apps can automate expense management, reduce errors, speed up reimbursements, and provide real-time insights into travel spending.

Popular options include:

Expensify: Automates expense tracking with receipt scanning and mileage tracking

Zoho Expense: Budget-friendly option for growing businesses

QuickBooks: Integrates directly with your accounting software

These apps help address one of the biggest challenges in managing travel expenses: the reliance on manual data entry, which is almost inevitably error-prone and can lead to inaccurate reporting.

My recommendation? Pick one app and commit to using it consistently. Snap photos of receipts immediately, categorize expenses on the go, and you’ll thank yourself when tax season arrives.

Takeaways

Business travel tax deductions can deliver significant savings if you understand the rules and maintain good records. Managing travel and expenses skillfully means more money stays in your business where it belongs. The partnership between you and your tax professional works best when you’re organized and informed.

Every dollar you legitimately deduct stays in your business, fueling growth and supporting your goals. This isn’t about gaming the system. It’s about claiming what’s rightfully yours under tax law.

If you’re unsure about specific expenses or how these rules apply to your unique situation, let’s schedule a conversation. Working together, we can develop a system that captures every legitimate deduction while keeping you fully compliant. MBE CPAs is here to support you in building strong financial practices that benefit your business for years to come. That’s what a real partnership looks like.