How ABC Costing Can Transform Your Manufacturing Profits

Authored by: Glen Erdman — Director, EA | Date Published: September 12, 2025

It is no secret that manufacturers face expansive challenges, from rising prices to capacity constraints. These unprecedented issues test your resilience and the strategies you develop that best fit your business’s needs. However, the approaches for cost allocation are not “one-size-fits-all,” and thinking that they can put you in financial danger.

Where traditional computing methods may work for the distributor down the street, you might need a structure that breaks down your expenses based on volume, usage, or other drivers. For manufacturers, activity-based costing (ABC) is more than just a better way to allocate costs. It gives you a stronger understanding of your business that can help you succeed.

Featured Topics:

Why Is Traditional Costing Failing Manufacturers?

In a simpler manufacturing world, allocating overhead using broad measures like labor or machine hours works reasonably well. However, today’s manufacturing reality is not such a straightforward process, and using this method might create an incorrect structure for your business.

Traditional costing uses a single driver to allocate overhead charges, assigning the same overhead rate to all products. Whether the chosen driver is machine or labor hours, this method doesn’t accurately assign these prices because products have different required activities.

What are activities?

Activities are the specific tasks and processes that consume resources within a company. These can differ by level, meaning they can be performed on a per-unit basis, each time a group of products is processed, or to specifically serve a customer.

These activities could vary between:

- Equipment set-up

- Assembling a product

- Processing orders

- Inspections performed

Let’s break it down:

Modern manufacturers typically manage diverse product portfolios that strain traditional evaluation until it breaks. When compared to activity-based costing, an error that traditional computing tends to make is over- and under-costing.

- Over- and under-costing: Standard products that run efficiently through production in high-volume are treated the same as low-volume customized products. Straightforward products with basic quality control do not consume equal resources as those that require complex supply chain coordination, and traditional valuation leads to an over- and under-costing dilemma.

- When overhead is a hefty portion of your total expense, traditional methods might not provide the most accurate data, especially when your products vary significantly. If your organization falls into this category, it might be time to look at a new calculation method.

Imagine that your business is short on labor, and you’re struggling to increase your team. Now, you’re facing rising wages, high turnover, and shrinking pools of skilled workers. Some of your operations are highly automated, others are labor-intensive. This is where traditional systems continue to struggle.

In a mixed-cost environment, traditional systems misallocate payments for automation investments, which require different levels of benefits, training, and wages. Overall, this system fails to capture the true cost of labor-intensive operations.

Since modern manufacturing is far from a perfect scenario, a method that understands how outlays are allocated throughout your business will move you closer to perfect operations.

What is Activity-Based Costing?

You have multiple product lines involving many different processes and inputs. A common challenge in this case is acquiring accurate data that allows for easier classification of production overhead. This is where activity-based costing (ABC) will be your friend.

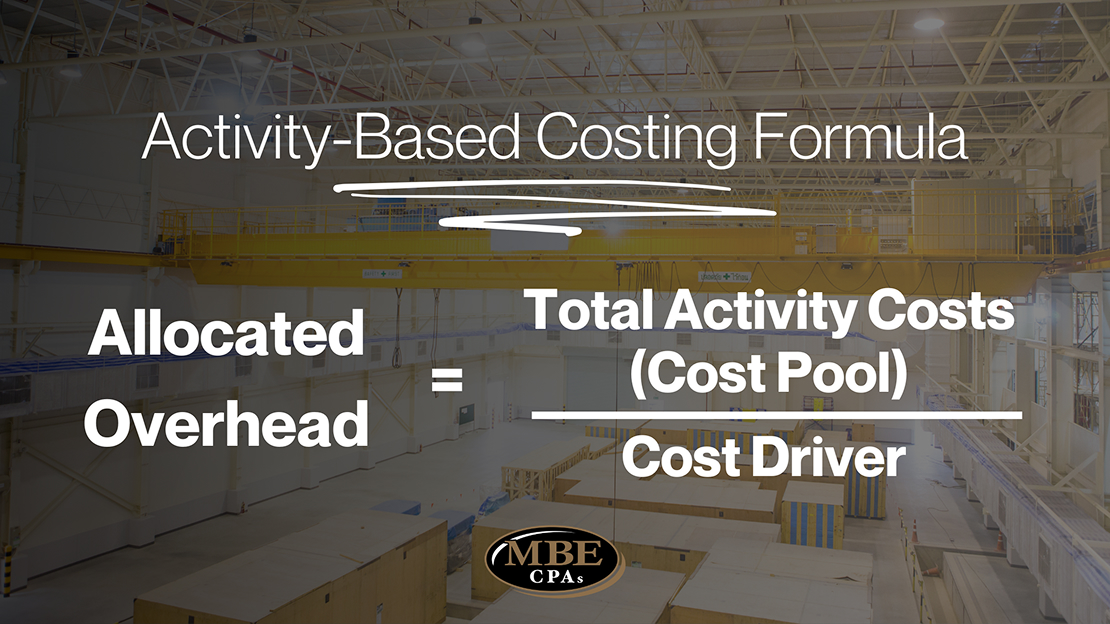

Activity-based costing helps calculate related overhead and indirect charges, which reveals the cost driver rate. This allows corporations to develop an appropriate pricing strategy based on their recognized overhead.

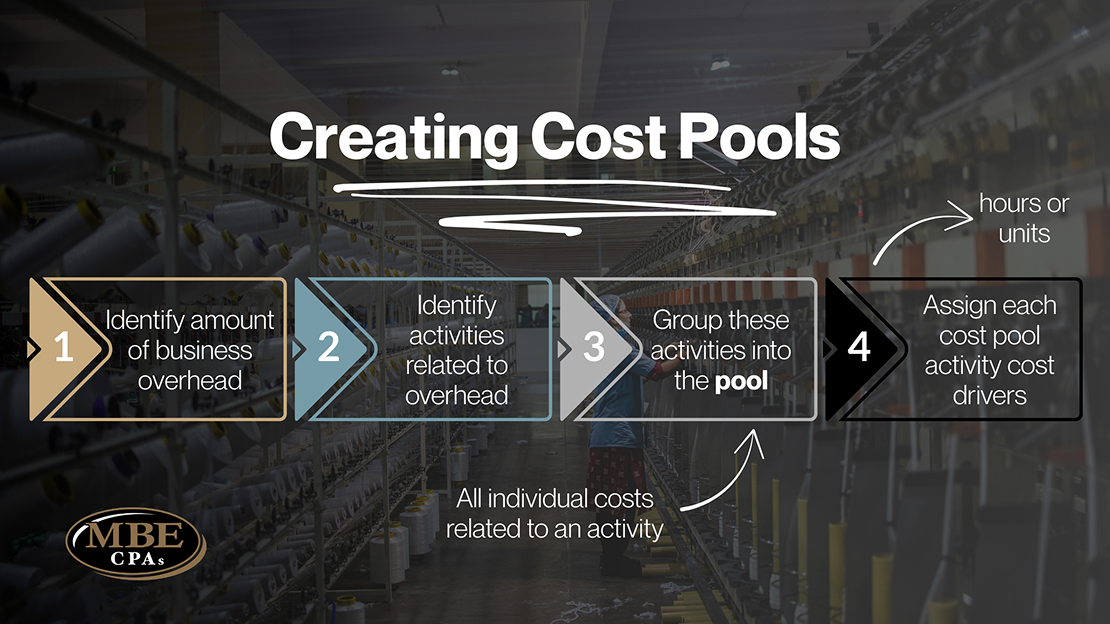

Use these steps for ABC calculations:

- Identify all activities required to create the product.

- Divide the activities into cost pools (all the individual costs related to an activity).

- Calculate the total overhead of each pool and assign each the relevant activity cost drivers (hours or units).

- Calculate the cost driver rate by dividing the total overhead in each pool by the total cost drivers.

- Multiply the cost driver rate by the number of cost drivers.

For a better picture of ABC calculations, the formula is illustrated below.

Identifying True Cost Drivers

When a customer requests a specialized component with unique materials or overnight delivery, traditional valuation might misallocate overhead based on machine hours. Missing the true cost drivers leads to systematically underpriced custom work that appears profitable but actually destroys value.

The direct causes of an expense and its effect on the total price are called cost drivers. To keep your business open, it is important that expenses are computed correctly so you can perform an accurate analysis. Let’s take manufacturing as an example: If the price of production exceeds your revenue, you run the risk of shutting down operations.

When computing ABC, these drivers are the most relevant portion, showing the cause of why each specific expense occurred.

True Cost Drivers include:

- Engineering time for custom design review

- Procurement efforts for specialized materials

- Additional quality control procedures

- Multiple production setups and changeovers

- Special packaging and expedited shipping

- Customer service time for project coordination

These drivers are assigned to each activity in your business, best reflecting its resource consumption.

Let’s look at examples of drivers and activities they may be attached to:

- Setup costs: Driven by the number of setups

- Quality control: Driven by the number of inspections

- Engineering Support: Driven by hours spent per product

By using ABC, you can start mapping your manufacturing activities to understand what really drives spending in your business.

Strategic Decision-Making with ABC

Using ABC data for strategic pricing, product rationalization, customer profitability analysis, and optimizing resource allocation.

With accurate ABC data, you can price products based on their true cost to serve. This becomes crucial when customers are pushing back on prices due to their own pricing pressures. ABC helps you identify:

- Which products can see price increases without losing profitability

- Where you have room to negotiate on price while maintaining margins

- When to turn down business that appears profitable but actually is destroying value

ABC also extends beyond product overhead to reveal customer profitability patterns. Some customers might appear to be valuable but are actually consuming excessive resources from their order volume.

ABC additionally will identify:

- Frequent order changes and expedited requests

- Complex technical requirements and support needs

- Difficult payment terms and collection issues

- Demanding quality requirements beyond standard procedures

Manufacturers understand the weight of each resource decision, so start letting ABC guide your investments. The data revealed by this method might reveal an investment that significantly reduces your disbursements or additional automation that improves your margins.

Implement ABC into Your Manufacturing Setting

Successful ABC implementation in manufacturing requires a practical approach that acknowledges current operational realities.

Here’s a step-by-step guide on how to start:

- Start Asking Questions: Before diving into an activity analysis, identify the questions you need ABC to answer. Guide your ABC implementation priorities to help focus on activities that drive meaningful decisions.

- Which products are profitable?

- Where should we focus on our limited capacity?

- Which customer relationships should be invested in?

- How do setup charges affect volume?

- Address Your Current Challenges: ABC provides spending justifications by showing which activities consume the most resources, helping you evaluate the efficiency of your automation projects. Your current challenge could be disruptions to your supply chain, which ABC can help navigate by understanding which products are worth premium prices when you are low in materials.

- Build on Existing Data: By connecting your existing data to activities, you have the data required to calculate ABC. Look at your labor hours, material costs, machine hours, and setup times.

- Update your ABC System: Validate your system regularly by monitoring the changes in your activities, cost drivers, and overhead charges over time. Utilize feedback to improve your ABC system, which can be from your managers, employees, or customers.

For businesses with limited resources, various issues may arise after implementing ABC methods. Here’s what to watch for:

- Significant resources and background: The process of identifying the relevant pools and drivers may not be possible for small businesses to maintain.

- Carefully assess the trade-offs involved and consult with experienced professionals to optimize the approach for your unique circumstances.

- Correct Identification of cost drivers: Inaccuracies and distorted expense allocations may affect profitability assessments and the overall strategy development.

- If you are not confident in your ability to perform ABC on your own, consider outsourcing to MBE CPAs.

When being perfect isn’t obtainable, start by strengthening the systems you already have in place. You don’t need complete data to begin gaining insights that will reshape your profitability.

Conclusion

Manufacturing demands precision in every decision. The smartest choices are made with accurate information, giving you the clarity to overcome challenges. With ABC, you can determine the true cost of your products and allocate resources to the activities that truly need them. This approach transforms cost accounting from a simple compliance exercise into a powerful tool for your business.

At MBE CPAs, we can help you implement this methodology. We’ll work with you to analyze your operations and identify the key activities that drive your costs. Our experience will ensure you move beyond traditional, inaccurate methods to a system that provides a clear and detailed view of your expenses. By understanding the true profitability of each product and process, you can make more informed decisions for greater profitability and sustainable growth.