Improve Month-End Reporting Speed and Accuracy Digitally

Authored by: Ryan Weber — Partner, CPA, CVA | Date Published: December 12, 2025

For many small business owners and their accounting teams, month-end closing feels like a recurring nightmare. You spend weeks reconciling this month’s numbers, searching for missing receipts, and trying to figure out why the bank balance doesn’t match your books. This multi-week scramble pulls you away from running your business.

It doesn’t have to be this way. Let’s identify the business decisions you’re making that prevent you from moving quickly and seizing growth opportunities.

Featured Topics:

What Is a Month’s-End Close?

At month’s end, businesses review, record, and reconcile all financial transactions from the previous month. This accounting procedure finalizes all financial business activity for the preceding month. Preparing necessary financial statements will not only protect your business from financial risks but also provide you with more timely visibility into financial performance.

Depending on your business’s size, industry, or complexity, the specific requirements will differ.

Here are common closing practices:

- Gathering bank and loan statements

- Recording unentered invoices

- Reconciling accounts

- Counting inventory

- Tracking fixed assets

- Preparing financial reports

You may struggle with the challenges of your end-of-month reporting process. To optimize this recurring event, aim for consistency so this monthly process can be as precise as your year-end close.

Embracing Your Challenges with Digital Automation

Your business’s month-end process is overwhelming. You know you need to obtain the required information from across your organization and enter it manually. Eliminating manual processes and embracing digital automation will transform your late nights at month-end.

Here’s what digital automation actually means in practice:

- Improving standardization: A consistent monthly close process helps catch small issues before they become a larger problem. Modern automation can simplify the monthly closing process by reducing manual work and errors and freeing up time to make informed decisions rather than scrambling to connect numbers.

- Following the Generally Accepted Accounting Principles (GAAP) will help you maintain consistency across your business and support your monthly closing process.

- Real-Time Data Capture: Using mobile apps will capture expenses the moment they happen and automate your allocation process. Categorize your receipts, attach them to the right job, and sync them to your accounting system.

- Automated Bank Reconciliation: Connect your accounting software directly to your business bank accounts and credit cards, and watch your transactions automatically match your expenses. What used to be a tedious process of comparing paper statements line by line now takes minutes.

- Integration Across Systems: Your business uses multiple software: inventory management for tracking parts, and both scheduling and payroll software for your team. What you need to know is that all these systems can be integrated. Consider adapting your accounting system to eliminate manual entry, reduce the risk of transposing numbers, and duplicate data entry across multiple platforms.

What used to require hours of manual entry from spreadsheet exports can now happen in real time without manual intervention. The effectiveness of your business’s monthly closure is a signal of your financial management health.

How to Adopt a Digital Process

If you’re currently drowning in manual processes, the idea of going fully digital might feel overwhelming. Good news: you don’t have to transform everything overnight.

You may be wondering, “How do I start?”

Let’s begin by addressing the questions you might be asking:

Q: What are the most common mistakes during a month-end close?

We often see businesses not double-checking all statements before closing the month, which is crucial since no more journal entries should be made for that month once it’s closed. Other mistakes include failing to reconcile subsidiary ledgers, missing adjusting entries, and not reviewing financial statements for unusual variances before distribution.

Q: Do I need to follow GAAP for my small business?

Even small businesses benefit from following GAAP principles because they keep your financial statements consistent, comparable, and credible. If you ever plan to seek financing or sell your business, GAAP compliance is an invaluable asset.

Q: How long should the month-end close process take?

The ideal timeframe for your business will vary depending on your overall size and complexity. High-performing teams typically complete the process in 5-7 business days, mid-sized teams average 8-10 business days, and small teams or outsourced bookkeeping firms should aim to close their books within two weeks.

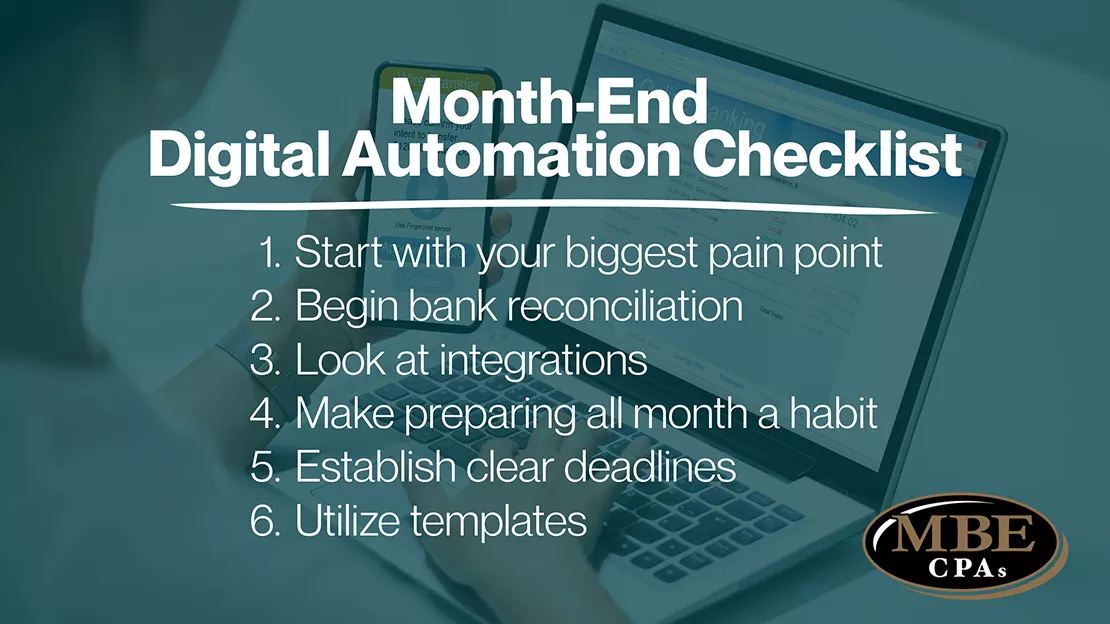

Here’s how to start:

- Start with your biggest pain point. For most businesses, that’s expense tracking and receipt management. Implement a mobile expense capture solution and watch how much time you save by eliminating that one manual process.

- A good start is to create daily or weekly reports to monitor your business activities and goals, and ensure those reports use a format that aligns with or feeds into the month-end reporting.

- Begin bank reconciliation. If you’re still downloading statements and matching transactions manually, connecting your bank feeds to your accounting software will give you an immediate return. Most modern platforms make this connection simple and secure.

- Look at integrations. What other systems are you using that generate financial data? Your payment processor, your inventory system, your point-of-sale software? Many of these can integrate with your accounting platform, eliminating duplicate data entry and reducing errors.

- Make preparing all month a habit. Each digital improvement makes the next one easier and the realized benefits obvious. A few days before the end of the month, create a checklist of everything that needs to be ready for the report.

- Establish clear deadlines: If you’re working with an advisor, establishing a clear cut-off date for submitting transactions, receipts, and approvals helps you provide the files and information they’ll need to meet regulatory and internal deadlines.

- Learn more about working with an accounting advisor.

- Utilize templates: Templates and checklists for every step in the process can shave entire days off your month-end close process. Your sign-off checklist may be the key reason for your success in reducing the month-end close from three weeks to just three days.

By implementing digital automation and following proper accounting procedures, you’ll transform your month-end close from a dreaded marathon into a streamlined process that actually adds value to your business.

Start Measuring Success

An average accountancy team reports that its month-end closing takes more than six days. However, with proper systems and procedures, many companies close much more quickly.

MBE CPAs is not an average accountancy team. Start producing accurate, timely financial information that enables better business decisions when you partner with our advisors. We enable modern accounting with our digital automation, understanding the challenges of consistency and control.

Work together with MBE CPAs from anywhere.