Is It Time for Outsourced Accounting?

Authored by: Ryan Weber — Partner, CPA, CVA | Date Published: September 16, 2025

Hiring, operations, sales—how do you have time for all your responsibilities as a business owner? All the tasks that are piling up on your to-do list may be overwhelming, so don’t let accounting become one of them. By outsourcing accounting to professionals, you can concentrate on your core business strengths and growth opportunities.

The question you need to ask yourself is whether your growing business is ready to outsource your accounting services.

Featured Topics:

Signs Your Business Needs to Outsource

Small businesses spend on average over 82 hours annually on tax preparation alone, the plausibility of outsourcing these activities has never been more vital.

When we talk about outsourced accounting, we’re referring to the delegation of tasks to an external firm rather than managing an in-house team. This will allow your business to focus on primary activities rather than losing time on finance and accounting functions.

The biggest sign that your business should outsource your accounting services is if you struggle with inconsistent financial reporting. It’s essential that your business has accurate reporting if you are to make informed decisions. Needing support is not a sign of failure, it’s a sign of growth.

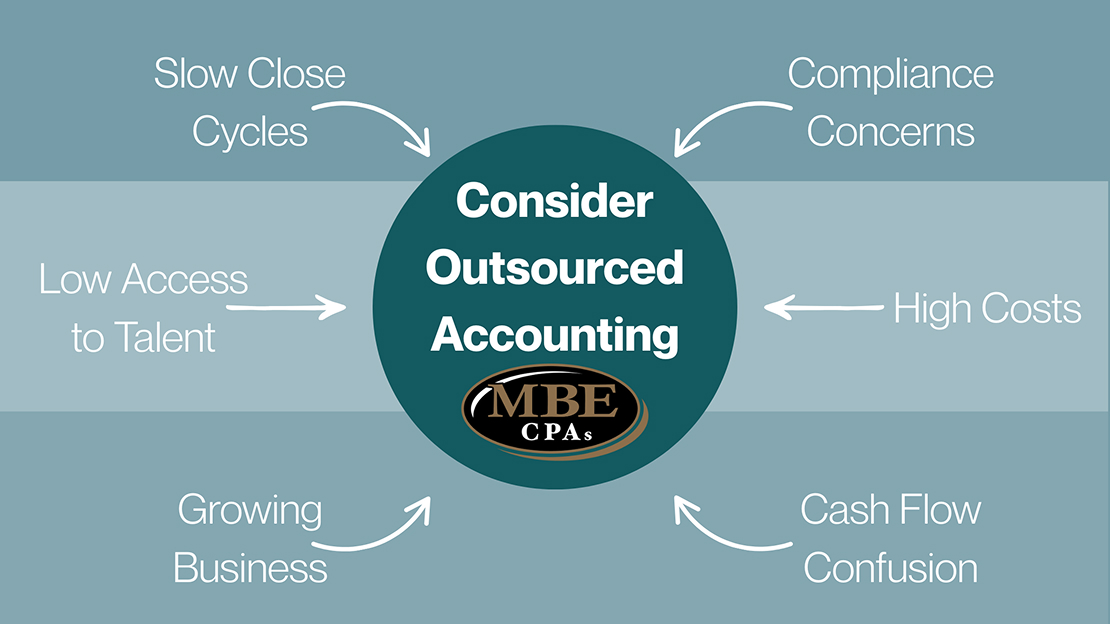

Here are more signs that your business is ready for extra assistance:

- Slow close cycles: Whether you struggle to close your books on time or your team has an inefficient and slow system, consider outsourced accounting to develop a routine process.

- Cash flow confusion: You may need help keeping track of cash inflows, outflows, and projections to avoid unpredictability.

- Compliance concerns: Accurate reporting enables you to gain valuable insights and avoid issues that can hinder your business’ progress.

- Your business is growing: With rapid growth, the volume of financial transactions can become complex and staffing issues may arise.

- Difficulty with accessing accountants: An in-house team may not have the specialized knowledge you need, making financial management time-consuming.

- High costs of internal team: An in-house team may be producing a high overhead cost from maintaining up-to-date books and employee insurance.

If you have recognized one or more of these issues, considering a third-party firm to manage these financial tasks may be your next strategic move. Reducing costs and maintaining compliance will allow your business to continue to grow and not be held back by unrelated business activities.

What Services Can Be Outsourced?

From basic bookkeeping to specialized support, finding the right team of advisors can look different for each business. Outsourced accounting can include varying levels of financial management within a business.

Whether you choose to outsource only the day-to-day functions or receive a higher analysis of your business strategy, MBE CPAs allows your business to focus on its core competencies.

Core Accounting Services

These fundamental activities are the foundation of most outsourcing arrangements in which more advanced analysis is built. Many businesses start here and expand as they experience the benefits firsthand.

- Auditing & bookkeeping

- Tax calculation

- Accurate preparation of financial reporting

Core services focus on transactional recording and operational efficiency, keeping your business running smoothly.

Controller Services

These activities oversee a wide range of financial management functions that deal with compliance and forecasting, keeping businesses in line. Acting as the bridge between day-to-day functions and strategy, controller services involve a higher level of analysis.

- Budgeting and forecasting

- Providing strategic insights and identifying trends

- Compliance and risk management

Outsourcing controller services to an experienced team will generate higher-level decision making, helping to identify trends and interpret financial data to determine your future direction.

Falling behind on accounting services does not determine the success of your business. Struggling to keep up with the bookkeeping timeline means that your business would benefit from outsourcing financial services to improve your capabilities and remain competitively advantageous.

Benefits of Outsourced Accounting

You’re already wearing a dozen different hats as a business owner. Do you really want to add “accounting department manager” to that list? Partnering with a third-party firm like ours can be monumental for your business. If you’re considering making this move, here’s what you’ll gain:

- Money back in your pocket – No more salaries, benefits, or training costs for in-house staff

- Growth without growing pains – We scale with you, whether you’re expanding or streamlining

- Sleep better at night – Your financial data stays protected with enterprise-level security

- Do what you love – Focus on running your business instead of dealing with all the numbers

- See the bigger picture – Get clear, professional reports that actually help you make decisions

- Protect what you’ve built – Professional oversight reduces your risk of costly financial mistakes

Now, you might be wondering about the cost. Yes, outsourced accounting is an investment, but here’s the thing —it typically pays for itself many times over by protecting you from expensive mistakes and freeing you up to focus on growing your revenue.

The bottom line? Take a close look at what different firms offer and how they align with your specific needs. You’ll be able to make the right call for your business once you see how the numbers actually work out.

Why You Should Choose MBE CPAs

At MBE CPAs, our services go beyond bookkeeping. If your business operates in manufacturing, restaurant, franchise, agribusiness, or beyond, explore our specialized advisory services to improve your business operations and financial health.

Outsourcing your finances is a big decision, and we understand that. We will provide:

- A full understanding of your industry

- Tactical and strategic services

- Modern tools

- Clear communication

Our experienced accountants focus on your financial health so you can spend less time on bookkeeping and tax preparation, and more time growing your business. With our business solutions, you can trust that your financial management is in good hands, allowing you to focus on success.

How we can help you:

- Accounting & Bookkeeping

- Audit

- Business Consulting & Advisory

- Tax Planning & Compliance

- Trust and Estates

- Valuations

With professional accounting services, you’ll be less likely to face mistakes that can result in penalties or trigger an audit. Outsourced accounting services can include as little or as many tasks as your business needs covered. By partnering with MBE CPAs, we will discover the strategy that best suits your needs and align your business trajectory toward financial success.

Conclusion

You’re spending too many hours buried in spreadsheets when you should be growing your business. Maybe you’re wrestling with QuickBooks, trying to figure out why your numbers don’t add up, or feeling overwhelmed by all those features you’re not even sure you need. It’s time to get that time back, and that’s exactly where we come in.

When you partner with us, you’re not just outsourcing your bookkeeping. You’re investing in your peace of mind. We handle the numbers so you can focus on running and growing your business. As QuickBooks Pro Advisors, we know the platform inside and out, so we can either clean up the mess you’re dealing with or set you up with a system that makes sense for your business. Whether you’re a startup or an established company, we’ll create a solution that fits your specific needs and budget.

Here’s what we’re really about: helping you build a more profitable, sustainable business. When you’re not worried about whether your books are accurate, your QuickBooks are set up correctly, or your taxes are filed properly, you can put all that mental energy into strategy, customer relationships, and the big-picture thinking that actually moves the needle.

Ready to reclaim your time and reduce your stress? Let’s talk about how MBE CPAs can support your financial future and give you back the freedom to focus on what matters most to you.