Keep Your Farm Safe with Risk Management

Authored by: Kevin Block — Partner, CPA | Date Published: December 1, 2025

The morning dew catches the light just right as you walk through your fields. In these moments, everything feels perfect. Corn is tall, soybeans are filling out, and your livestock is healthy and flourishing. But deep down, you know that perfect moment can shift in an instant. A sudden hailstorm could flatten your crops, commodity prices could plummet overnight, or that piece of equipment you’ve been nursing along could finally give up during harvest.

Given these challenges, finding new ways to protect your agribusiness is vital for maintaining the security of your operation now and in the years to come. In this article, we’ll focus on practical steps you can use to safeguard your business and support its long-term health.

Featured Topics:

- What Are the Five Pillars of Agricultural Risk?

- How Can You Weather-Proof Your Financial Foundation?

- Building Weather Resilience

- What Is the Power of Accurate Financial Forecasting?

- Essential Forecasting Components

- What Kind of Risk Management Tools Are There?

- Production Protection Strategies

- Financial Risk Mitigation

- How Can You Adapt to Market Volatility?

- Market Intelligence Systems

- Marketing Strategy Development

- How Do You Build Your Financial Risk Management Plan?

- How MBE CPAs Supports Your Agricultural Success

- Partnership with MBE Wealth

What Are the Five Pillars of Agricultural Risk?

Knowing what obstacles your agribusiness faces is the first step to building a strong defense. Most operations deal with five main kinds of risk: production, market, financial, institutional, and human. These types of risk can affect your revenue, operations, and long-term plans, and each requires a specific approach.

Production Risk

Production concerns are often at the top of your mind. Shifting weather can impact your yields, while disease outbreaks threaten livestock or crops. Equipment failures at key times and pest infestations can put your hard work at risk, so it’s important to have plans in place for your specific operation.

Market Risk

Your business is shaped by changing markets. Fluctuations in commodity prices, shifts in consumer demand, trade policy changes, and currency swings all play a role in your profitability. Understanding these factors can help you make choices that support your operation’s future.

Financial Risk

Keeping your agribusiness on solid financial ground is always important. Changing interest rates can affect loan payments, and cash flow issues often arise between seasons. You also need to make sure you have access to credit in tougher periods and that your income can comfortably cover your obligations.

Institutional Risk

Rules and policies from outside your business can also shape how you operate. Changes in government policy, new regulations, tax law updates, or trade agreements can all influence the market you compete in and the decisions you make.

Human Risk

The people who keep your operation running are another important focus. Health issues, family succession, the loss of a key team member, or the need for new technological skills can all impact your day-to-day and long-term plans.

How Can You Weather-Proof Your Financial Foundation?

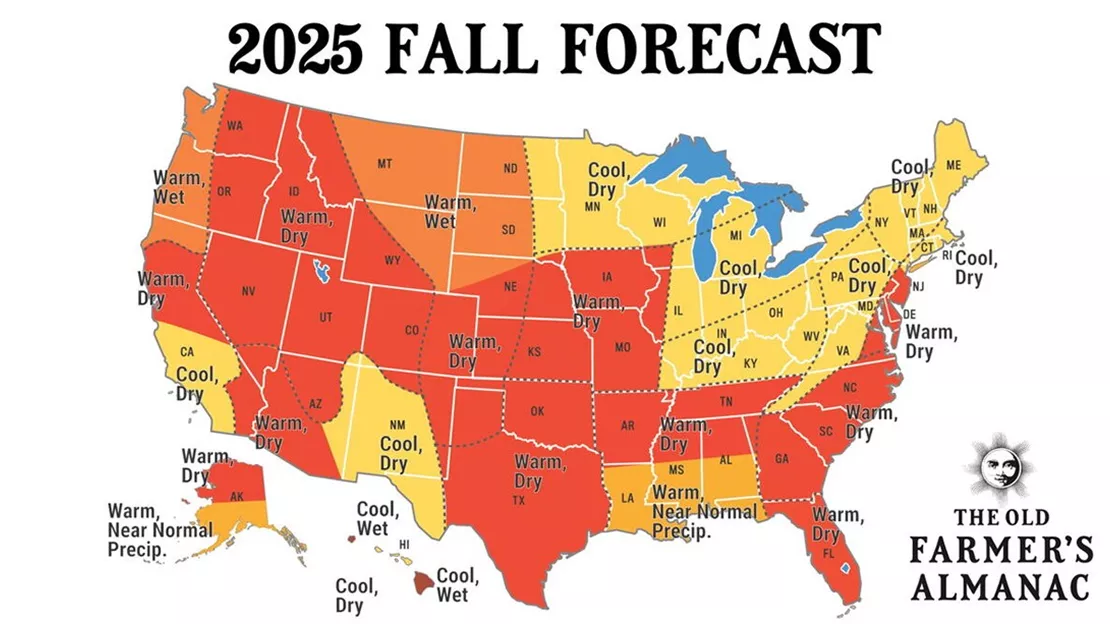

The 2025 Farmer’s Almanac shows just how unpredictable fall can be for agribusinesses. While many areas may experience warmer-than-average temperatures, sudden cold snaps are expected to affect the North Central states and the interior Northeast from late October to November. Meanwhile, the Great Lakes, Northeast, and parts of the Southeast are expected to face an unusually wet season. These shifting conditions can quickly change your harvest plans and have a big impact on yields, crop quality, and livestock health.

Since the weather can be unpredictable, it’s even more important for your agribusiness to plan ahead and build financial stability. Preparing for weather-related challenges helps your business withstand tough seasons, instead of simply reacting when issues arise.

Building Weather Resilience

Diversification Strategies

Try planting a mix of crops with varying maturity dates to stagger your harvests and spread out potential losses. If possible, farming in multiple areas or combining livestock with crops can help stabilize your operation. Seeking income opportunities during less busy seasons can also help balance your finances.

Emergency Fund Preparation

Setting aside an emergency fund enough to cover three to six months of operating costs is a smart move for any agribusiness. Make sure you have flexible credit available for emergencies, keep some equipment reserves, and consider ways to guard against sudden price jumps for your inputs.

Technology Integration

Using weather monitoring tools provides you with real-time data to make informed decisions on your farm. Precision agriculture technology helps you utilize your resources more wisely. Investing in irrigation can protect your crops from drought, while crop monitoring technology lets you spot problems before they become costly.

What Is the Power of Accurate Financial Forecasting?

What is farm insurance really worth if your operation doesn’t have a solid financial foundation to support smart coverage decisions? The most successful agribusinesses rely on detailed budgeting and forecasting that reaches far beyond basic profit and loss statements.

Essential Forecasting Components

Cash Flow Management

For your business, this means building monthly cash flow projections that align with the seasons. Plan ahead for your harvest and market timing, schedule input purchases, and think through how you’ll handle equipment needs.

Budget Development

Project your input costs by monitoring market trends and plan for labor, including any seasonal worker requirements. Remember to schedule equipment maintenance and replacement, and only invest in technology that aligns with your business goals and available cash.

Tax Planning Integration

Take advantage of timing your income and expenses. For your agribusiness, planning ahead for depreciation on equipment purchases can really help your bottom line. Being proactive about your Section 199A deduction and considering tax planning over several years will help you retain more of your revenue.

MBE CPAs’ tax planning team focuses on agricultural tax strategies that help you minimize your tax burden while staying compliant. Our advisory team is here to support you year-round, keeping your budget forecasts on track and your business prepared for what’s ahead.

What Kind of Risk Management Tools Are There?

A premium risk management plan uses multiple tools working together to create comprehensive protection. Let’s examine the essential components that should be included in your farm’s protection toolkit.

Production Protection Strategies

Consider Multi-Peril Crop Insurance (MPCI) to safeguard your yields, or Whole-Farm Revenue Protection if your operation is more diversified. Select the coverage level that aligns with your comfort level with risk and manage your premiums by timing your coverage choices to match your cash flow and business cycle.

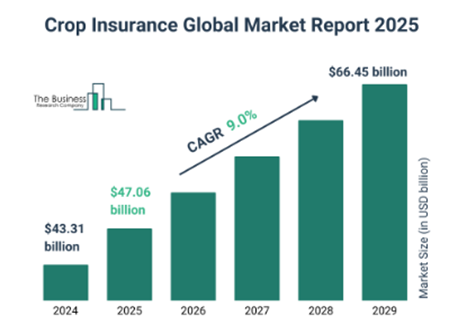

The Crop Insurance Global Market Report 2025 forecasts significant growth, showing the market size will rise from $43.31 billion in 2024 to an estimated $66.45 billion by 2029. This expansion represents a compound annual growth rate of 9.0%, indicating a major increase in the use of crop protection across the agriculture industry.

Advanced Risk Tools

Forward contracts let you lock in prices for future sales, while options can set a floor on your prices. You may also consider using futures markets for key commodities or exploring revenue insurance for your specialty crops. These tools help you manage uncertainty and steady your income.

Financial Risk Mitigation

Working Capital Management

Stay on top of your inventory and collect payments promptly to keep cash flowing. Try to negotiate better payment terms with your suppliers and consider setting up seasonal credit lines to cover short-term needs so your operation doesn’t miss a beat.

Interest Rate Protection

Fixed-rate loans can offer stability for the long haul, and interest rate hedges can help prevent surprises if rates change. If rates drop, you might restructure your debt to save money, and always time your major purchases to get the best value for your business.

How Can You Adapt to Market Volatility?

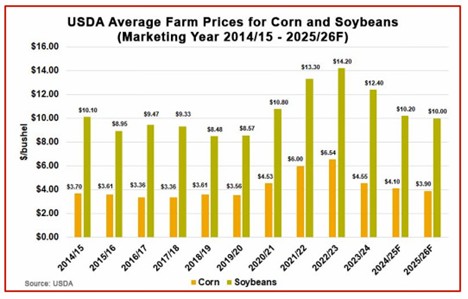

Market conditions in 2025 continue to present both opportunities and challenges. Many common farmers’ problems stem from being caught off guard by market changes rather than lacking production capacity.

Market Intelligence Systems

Price Monitoring

Keep track of real-time commodity prices and look at historical trends. Knowing how prices shift by season and region can help your operation stay ahead of the competition.

Market Diversification

Consider building multiple sales channels to reach new buyers and explore opportunities to offer value-added products or services. Selling directly to consumers or joining a cooperative can help you avoid relying on a single customer and create greater stability for your operation.

Marketing Strategy Development

Timing Decisions

Consider your harvest timing and whether it makes sense to store your crops or sell them immediately. Utilize seasonal price patterns and plan your contracts to maximize your operation’s profitability each year.

Price Discovery

Review what local grain elevators are offering, and factor in your transportation costs to determine your true margin. Watch for quality premiums and learn about basis patterns. These details enable you to make more informed business decisions regarding sales.

How Do You Build Your Financial Risk Management Plan?

Creating a strong approach requires coordination between multiple professionals and careful attention to your operation’s unique characteristics.

Step 1: Risk Assessment

- Identify your operation’s specific risk exposures.

- Quantify potential financial impacts.

- Prioritize risks based on probability and severity.

- Document your risk tolerance levels.

Step 2: Tool Selection

- Choose appropriate coverage levels.

- Implement marketing strategies aligned with your risk tolerance.

- Establish emergency fund targets.

- Create backup plans for critical operations.

Step 3: Implementation and Monitoring

- Regular review of coverage adequacy.

- Quarterly financial performance analysis.

- Annual risk management plan updates.

- Continuous market condition monitoring.

How MBE CPAs Supports Your Agricultural Success

At MBE CPAs, we understand that farming requires specialized financial knowledge. Our team combines extensive agricultural accounting experience, tax planning skills, and advisory services designed to meet the specific needs of farming operations.

Our Agricultural Services

- Tax Planning and Preparation: We offer agricultural tax strategies developed for agribusinesses, help you maximize your Section 199A deduction, and guide you through estate and succession planning, including support for multi-generational farm transitions.

- Advisory Services: Our team offers comprehensive budgeting, cash flow guidance, risk assessment, and long-term planning support. We also help you fine-tune your business structure, so your operation is ready for the future.

- Ongoing Support: You get monthly financial statement prep, quarterly business reviews, and annual planning sessions. Our year-round tax planning helps keep you prepared for whatever comes your way.

Partnership with MBE Wealth

For comprehensive financial planning beyond tax preparation, our partnership with MBE Wealth provides:

- Retirement planning for farm families.

- Investment management for excess cash.

- Estate planning coordination.

- Education funding strategies.