Preserve Your Wealth for Generations

Authored by: Troy Hilyard — Partner, CPA | Date Published: September 9, 2025

Imagine building a lifetime of wealth, only to see a significant portion vanish due to avoidable taxes. Did you know that up to 40% of your estate could be lost to taxes without proper planning? Discover how to protect your legacy with tax strategies.

At MBE CPAs, we understand that preserving and transferring assets across generations requires more than just good intentions; it demands insightful tax planning. You’ve worked hard to build your wealth. Let us help you protect it.

Featured Topics:

- Why is Estate Planning Essential for Multi-Generational Wealth?

- What are the Key Estate and Gift Tax Rules in 2025?

- How Can You Minimize Taxes with Estate Planning Strategies?

- Why Should You Work with a CPA for Estate Planning?

- What Does a Successful Multi-Generational Estate Plan Look Like?

- How Can MBE CPAs Help You Build a Lasting Legacy?

Why is Estate Planning Essential for

Multi-Generational Wealth?

As your trusted accounting and wealth advisory firm, we understand that preserving wealth across generations requires more than traditional financial management. It demands strategic estate planning that addresses both current tax implications and future family objectives. Our experience working with high-net-worth families has shown us that effective multi-generational planning goes well beyond basic will preparation. It requires creating comprehensive tax-efficient structures while managing changing tax laws and evolving family dynamics that can span decades.

Our firm has witnessed firsthand the consequences when families fail to implement proper estate planning strategies. Industry data reveals a concerning pattern: approximately 70% of family wealth dissipates by the second generation, with 90% lost by the third generation. Through our client work, we’ve identified the primary culprits behind this wealth erosion: inadequate tax planning and asset protection strategies, unresolved family governance issues, and insufficient preparation of next-generation family members for their fiduciary responsibilities.

At our firm, we approach multi-generational estate planning as a collaborative process that integrates advanced tax strategies with family education and governance structures. Our team works closely with your legal counsel to implement sophisticated trust arrangements that optimize estate and gift tax outcomes while maintaining operational flexibility. We assist in developing succession plans for family enterprises that preserve business value and help create seamless transitions. Additionally, we believe strongly in preparing the next generation through financial education programs that instill the knowledge and values necessary for responsible wealth stewardship. This integrated approach transforms estate planning from a compliance exercise into a strategic foundation for enduring family prosperity.

What are the Key Estate and Gift Tax Rules in 2025?

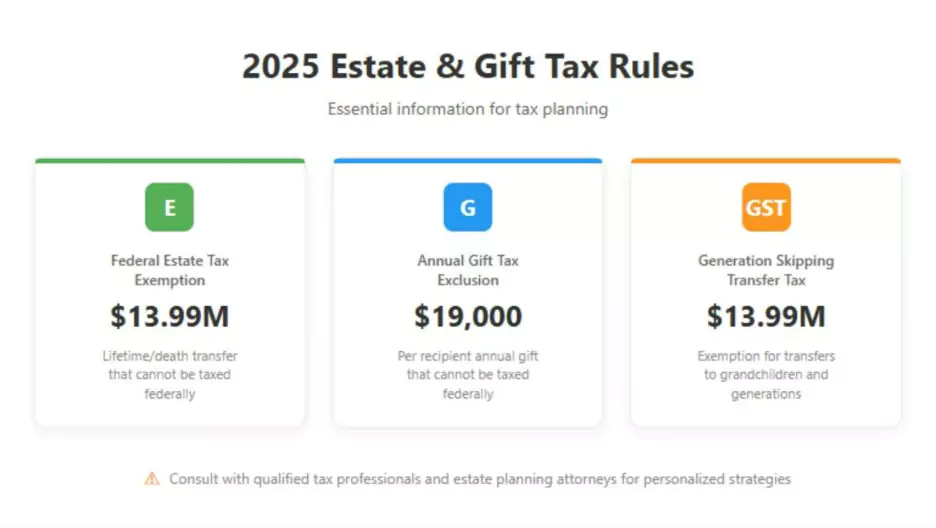

Understanding the current tax landscape is crucial for effective estate planning. Here’s what you need to know for 2025:

- Federal Estate Tax Exemption (2025): Individuals can transfer up to $13.99 million during their lifetime or at death without federal estate or gift taxes.

- Annual Gift Tax Exclusion (2025): Individuals can gift up to $19,000 per recipient annually without incurring gift tax or reducing lifetime exemption.

- Generation-Skipping Transfer Tax (GSTT): Applies to gifts or bequests to grandchildren or great-grandchildren, with an exemption equal to the estate tax exemption ($13.99 million in 2025).

- Estate Tax Rates: Estates exceeding the exemption face federal tax rates up to 40%.

- Sunset of Exemptions: The estate and gift tax limits didn’t get reduced in 2025, as many people had expected. Instead, the One Big Beautiful Bill made the higher limits permanent. This means families can pass along more wealth without facing extra taxes, and there’s now more certainty for future planning.

With tax laws changing so frequently, we make it our business to stay on top of what’s happening. When new legislation affects estate planning, we review how it impacts each of our clients’ situations and reach out with updates. We’ve found that the families who plan, especially with these exemption changes looming, are the ones who preserve the most wealth for future generations. If you’re wondering how these rules might affect your family’s plan, let’s work through it together.

How Can You Minimize Taxes with Estate Planning Strategies?

The good news is that there are proven strategies to significantly reduce the tax burden on your estate, even with current exemption limits in place. These approaches range from straightforward annual gifting to more sophisticated trust structures, each designed to work within the existing tax framework while preserving wealth for your beneficiaries. The key is understanding which combination of strategies makes sense for your family’s situation. Let’s explore the most effective methods our clients use to minimize estate taxes and maximize what they pass on to the next generation.

How Can You Use the Lifetime Gift and Estate Tax Exemption?

Use the $13.99 million exemption to transfer assets during your lifetime or at death. For instance, gifting appreciated assets, such as real estate, can reduce taxable estate while retaining control through trusts. MBE CPAs collaborate with clients’ financial planners and attorneys to maximize exemptions and certify compliance. This is a crucial aspect of estate planning for generational prosperity.

How Does Annual Gifting Reduce Your Taxable Estate?

Gift up to $19,000 per recipient annually to multiple family members to reduce estate size without tax consequences. Imagine a couple gifting $38,000 ($19,000 x 2) annually to each child and grandchild – this can significantly reduce their estate over time. This illustrates the power of the generational gifting concept.

What Is Upstream Gifting and How Does It Save on Taxes?

A powerful strategy to minimize capital gains tax on highly appreciated assets involves “upstream gifting.” This entails gifting assets to an older family member, such as a grandparent, who can then include these assets in their estate plan for the benefit of grandchildren. Upon the grandparent’s passing, the assets will receive a stepped-up basis, effectively wiping out the accrued capital gains. A vital consideration is to confirm that the grandparents’ overall estate, even with the gifted assets, stays below the applicable estate tax thresholds (currently $13.99 million federally in 2025, but expected to change in the following years), to prevent estate taxes from consuming the tax savings.

How Do Irrevocable Trusts Help with Tax Efficiency?

Use irrevocable trusts (e.g., Irrevocable Life Insurance Trusts or ILITs) to remove assets from the taxable estate while controlling distribution. For example, an ILIT can minimize estate taxes by holding life insurance proceeds outside the estate. MBE CPAs guides clients through trust setup and tax implications in collaboration with estate attorneys.

How Can Charitable Giving Lower Your Estate Taxes?

Use Donor-Advised Funds (DAFs) or charitable trusts to receive immediate tax deductions while directing funds to charities over time. Donating appreciated assets to a DAF avoids capital gains tax and reduces the taxable estate.

How Can Business Succession Planning Protect Your Prosperity?

Implement buy-sell agreements or key person insurance to assist with smooth business transitions and minimize tax burdens. MBE CPAs provides industry-specific succession planning for real estate and other businesses to preserve resources.

Why Should You Work with a CPA for Estate Planning?

MBE CPAs complements attorneys and financial advisors by focusing on tax optimization and compliance. Our team offers personalized strategies designed for many industries, assisting with tax-efficient asset transfers. Our guidance encompasses trust accounting, asset valuation, and IRS representation, which are crucial for navigating complex tax laws. For example, we collaborate with MBE Wealth to integrate tax and investment methods for comprehensive planning, supporting your family’s wealth strategy.

What Does a Successful Multi-Generational

Estate Plan Look Like?

Consider a family with a $20 million estate, comprising real estate and a business, that wants to transfer its fortunes to its children and grandchildren. MBE CPAs recommends a combination of annual gifting ($19,000 per family member), an ILIT to hold life insurance, and a trust to transfer business assets, effectively reducing the taxable estate below the $13.99 million threshold. The outcome? The family saves millions on estate taxes, secures a step-up basis for real estate, and maintains control over business succession. (Note: This is a hypothetical example for illustrative purposes.)