Quarterly Estimated Taxes: Planning for Small Businesses

Authored by: Brett Leibfried — Partner, CPA | Date Published: December 2, 2025

Despite having a great year in your business, you discover in April that you owe the IRS in taxes and additional underpayment penalties. The IRS doesn’t want you to pay all your taxes at once in April. They want you to pay as you earn throughout the year, which is what quarterly estimated taxes are for.

If you’re self-employed, run a small business, or have significant income that isn’t subject to withholding, paying quarterly estimated taxes isn’t optional. Let’s break down what you should know about staying compliant with quarterly estimated taxes.

Featured Topics:

What’s the "Pay-As-You-Go" Tax System?

The U.S. operates on a pay-as-you-go tax system, which means you pay income tax as you earn throughout the year.

However, when you’re self-employed, no one withholds taxes from your income. Every dollar you receive is gross income, and it’s your responsibility to set money aside.

Here are a few common mistakes made by self-employed workers:

- Filing late

- Not separating business and personal expenses

- Underpaying estimated taxes

For 2025, the underpayment penalty rate is 8% annually and is compounded daily. This penalty applies separately to each quarterly period. Even if you pay everything you owe by January, you’ll still owe penalties for the earlier quarters you missed.

That’s where quarterly estimated tax payments come in.

Here’s the key principle: The IRS is asking for money as you earn it, not all at once, months later. Failing to comply can cost you hundreds or even thousands of dollars in penalties.

There are two ways this can happen:

- If you’re a W-2 employee, your employer withholds taxes from every paycheck and sends that money to the IRS on your behalf. By the time Q4 ends, you’ve already paid most of your tax bill.

- Making quarterly estimated tax payments throughout the year.

These processes help you avoid interest, penalties, or a surprise tax bill.

Who Needs to Pay Quarterly Estimated Taxes?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Here is an example of someone who is required to make quarterly estimated tax payments:

The Freelance Writer: An individual left their corporate job in January to write full-time. They no longer have an employer withholding their taxes and expect to make $75,000 this year. Since they’ll owe approximately $15,000 in federal income tax plus self-employment tax, they need to make quarterly payments.

You might not need to pay if:

- You’re a W-2 employee with no side income

- You expect to owe less than $1,000 when you file

- Your employer withheld enough to cover at least 90% of your current year’s tax liability

- You have sufficient withholding to cover 100% of last year’s tax (or 110% if your income was over $150,000)

Note: Corporations that expect to owe $500 or more in tax must make estimated tax payments. If you’re operating as a C-corporation, the threshold is lower than for individuals.

Calculating Your First Estimated Payment

Let’s walk through the actual calculation process using Form 1040-ES, the worksheet the IRS provides.

- Estimate Your 2025 Adjusted Gross Income: Start with your expected income and subtract any deductions or insurance premiums.

- Calculate Your Deductions: Choose between standard and itemized deductions and subtract from your gross income. Make sure you include deductions like the home office deduction, if you qualify.

- Calculate Your Tax: Using tax tables or software, calculate income tax on your taxable income.

- Add Self-Employment Tax: If you’re self-employed, you’ll owe social security and Medicare tax on net earnings.

- Subtract Credits and Withholding: Subtract any credits you’ll claim, like the child tax credit, or income tax already being withheld from a W-2 job.

- Determine Your Quarterly Payment: Divide your total estimated tax liability by four to get your quarterly payment amount.

Need additional assistance with calculating your payments?

Tax Payment Questions That Lead to Mistakes

Over the years, small business owners make the same mistakes repeatedly because they don’t consult an accountant to clear up their misconceptions. Tax laws are subject to change each year, especially now after the One Big Beautiful Bill, so don’t rely on your previous knowledge when preparing for the upcoming tax season.

Let’s make sure you don’t fall into these traps.

Q: “Can I wait and pay it in April?”

If you skip quarterly payments and plan to pay everything when you file your return, you may not pay enough tax by the due date and be charged a penalty even if you’re due a refund when you file.

How to avoid: Set up automatic transfers to a separate account and transfer a percentage of your income each time you receive it. You’ll have the money ready for when you need to make your quarterly payments.

Q: “Why do I still have a penalty when I made quarterly payments?”

You likely estimated too low and didn’t pay enough throughout the year, even if you would pay the full amount by April.

How to avoid: Use the safe harbor method based on last year’s taxes. You’ll benefit from overpaying slightly and getting a refund rather than underpaying and facing penalties.

Q: “Why were my quarterly payments late?”

Marking “quarterly payments” on your calendar every three months doesn’t mean you’ll make the actual deadlines.

How to avoid: Set calendar reminders two weeks before each actual due date, the 15th of April, June, September, and January. You can also use the IRS payment system to schedule payments in advance, so you never miss a deadline.

Q: “Do I have to adjust my payments if my income changes?”

That huge contract you landed, or the major asset you sold, means your next quarterly payment may need to be adjusted. When your income increases, your payment increases, or you’ll realize a penalty.

How to avoid: Recalculate your payments immediately after any major income increase and review your tax situation each quarter. Consider refiguring your installments using the annualized income method to pay on time and avoid penalties.

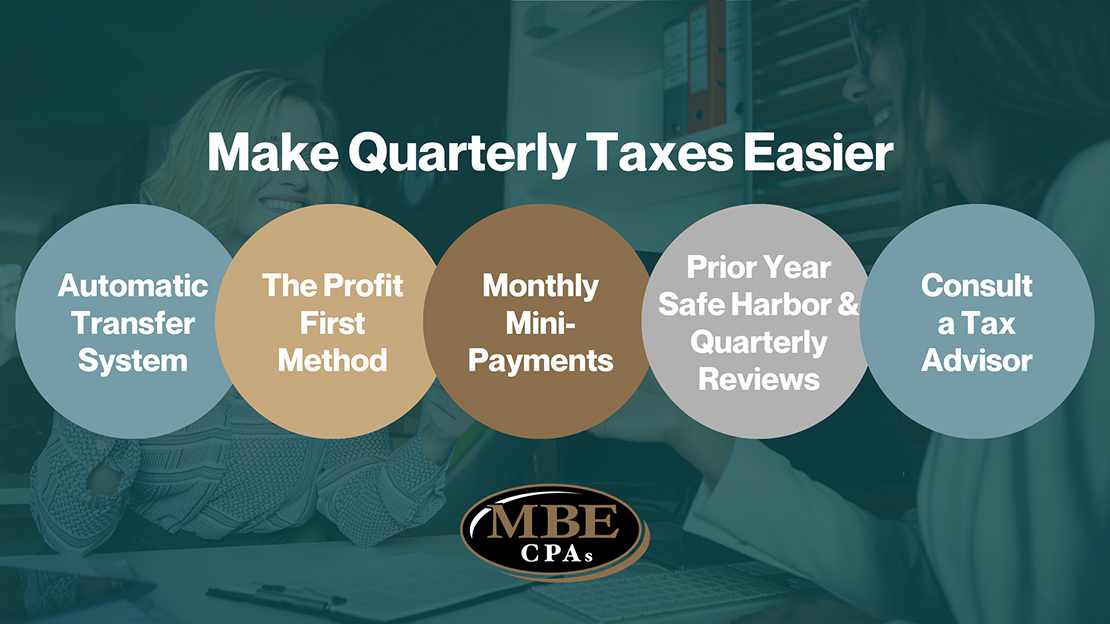

Make Quarterly Taxes Easier

It’s psychologically hard to pay taxes when that money feels like it’s “yours” already.

Here are some practical strategies that successful business owners use to stay on top of quarterly taxes without stress:

- Automatic Transfer System: Transfer a percentage of every deposit or gross sales immediately, so your money is ready to go.

- The Profit First Method: Set up separate bank accounts titled Income, Profit, Owner’s Pay, Taxes, and Operating Expenses. Split each deposit according to the set percentages, with 20% going to your tax account. Don’t touch your tax account except to pay quarterly taxes; this removes willpower from the equation.

- Monthly Mini-Payments: Rather than scrambling to come up with large quarterly amounts, make smaller monthly payments that add up to the right amount each quarter.

- Prior Year Safe Harbor & Quarterly Reviews: Calculate your safe harbor payments based on last year’s taxes, then review your actual income to begin making supplemental payments if needed.

- Consult a Tax Advisor: New business owners are often shocked by self-employment taxes. A quality CPA should calculate your quarterly estimated payments for you, provide a payment schedule, schedule quarterly check-ins, and help with tax planning to minimize your overall liability.

Even if you choose to manage your estimated payments on your own, consider having a CPA prepare your annual return. A quality tax advisor will often find deductions and credits that more than account for the consultation fees.

At MBE CPAs, our goal is to build a system so simple and automatic that quarterly estimated taxes become a non-event rather than a source of stress. Your business deserves your full attention and energy.