Secure Your Legacy Under New Tax Laws

Featured Topics:

- How Have Estate Tax Rules Changed?

- How Can You Maximize the 2025 Exemption Through Gifting?

- How Can You Use Trusts to Protect and Control Assets?

- How Should You Update Your Estate Plan for 2026 Compliance?

- How Can You Plan for Business Succession to Safeguard Value?

- Collaborate with MBE CPAs for Personalized Guidance

You’ve worked tirelessly to build a legacy. Whether it’s a thriving family business, a portfolio of cherished investments, or a vision for your family’s future, your wealth represents years of dedication and strategic planning.

At MBE CPAs, we see you not just as clients, but as partners in a community dedicated to your growth and success. As successful individuals, families, and business owners, you face a critical moment that could significantly impact your financial legacy. Our team is here to guide you through a comprehensive financial planning process. Below, we share actionable estate tax planning strategies to prepare for both the 2026 Estate Tax Sunset and the One Big Beautiful Bill Act.

How Have Estate Tax Rules Changed?

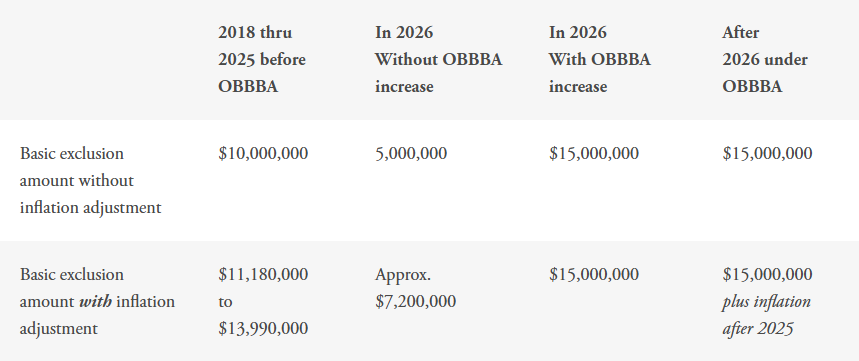

The Tax Cuts and Jobs Act (TCJA) of 2017 nearly doubled the federal estate and gift tax exemption, but those provisions were set to sunset on December 31, 2025. This threatened to shrink the federal estate tax exemption by nearly half. However, with the One Big Beautiful Bill Act (OBBBA) signed into law on July 4, 2025, the exemption rules have changed dramatically.

Key Update

Beginning January 1, 2026, OBBBA establishes a permanent estate, gift, and generation-skipping transfer (GST) tax exemption of $15 million per individual ($30 million for married couples), that are indexed for inflation starting in 2027. This change replaces the dramatic sunset with a more generous and permanent exemption.

- Example: Consider an estate valued at $20 million in 2026. Under the original TCJA sunset, if the exemption had dropped to roughly $7 million, $13 million would have been taxable at up to 40% (resulting in a $5.2 million tax bill).

- With OBBBA’s $15 million exemption: Only $5 million is taxable, resulting in $2 million in taxes. In comparison, under the $13.99 million exemption in 2025, the same estate would owe about $2.404 million in federal estate tax.

- Why It Matters: The OBBBA’s new exemption levels for 2026 create clear advantages for families. Instead of shrinking, the exemption is now permanently increased, making it easier to transfer more wealth to heirs or charitable causes with less concern about estate taxes and more room to construct a comprehensive financial plan.

- MBE Insight: Our CPAs can model your estate’s potential tax liability under both scenarios, providing a clear picture of what’s at stake and helping you plan proactively. This change highlights the need to establish a clear estate plan before the transition and consistent updates to your plan as legislation shifts.

How Can You Maximize the 2025 Exemption Through Gifting?

One of the most powerful estate tax techniques remains to take advantage of the maximum exemption before the transition. The IRS has clarified that gifts made under the increased exemption between 2018 and 2025 will not be subject to a “clawback,” even if the exemption changes. This anti-clawback rule, confirmed in IRS regulations on November 26, 2019, makes 2025 an important year for wealth transfers.

- Annual Gift Tax Exclusion: In 2025, you can gift up to $19,000 per recipient without reducing your lifetime exemption or triggering gift taxes. This allows you to transfer wealth to multiple recipients tax-free.

- Lifetime Exemption Gifts: You can gift up to $13.99 million per individual in 2025, increasing to $15 million in 2026 under OBBBA. For example, gifting $5 million to a trust in 2025 locks in the higher exemption, and OBBBA allows additional planning in 2026 and beyond.

- Gift vs. Inheritance Tax: Unlike inheritance taxes, which some states impose on beneficiaries, the federal gift tax is paid by the donor. Proactive gifting can minimize both gift and estate taxes.

- MBE Tip: Our team can help structure gifts to comply with IRS regulations so your transfers remain tax-efficient and aligned with your goals, while taking advantage of both current and future exemption levels.

By implementing a carefully structured gifting program, you can reduce your taxable estate and maximize your exemption usage, thereby protecting your wealth through the transition period.

How Can You Use Trusts to Protect and Control Assets?

Trusts are versatile tools for minimizing estate taxes and ensuring your assets are distributed according to your wishes. They can help you navigate the changes in the estate tax while providing flexibility and control over your legacy.

- Irrevocable Life Insurance Trust (ILIT): An ILIT removes life insurance proceeds from your taxable estate. For instance, a $5 million life insurance policy held in an ILIT could be excluded from your estate, potentially saving $2 million in taxes at a 40% rate.

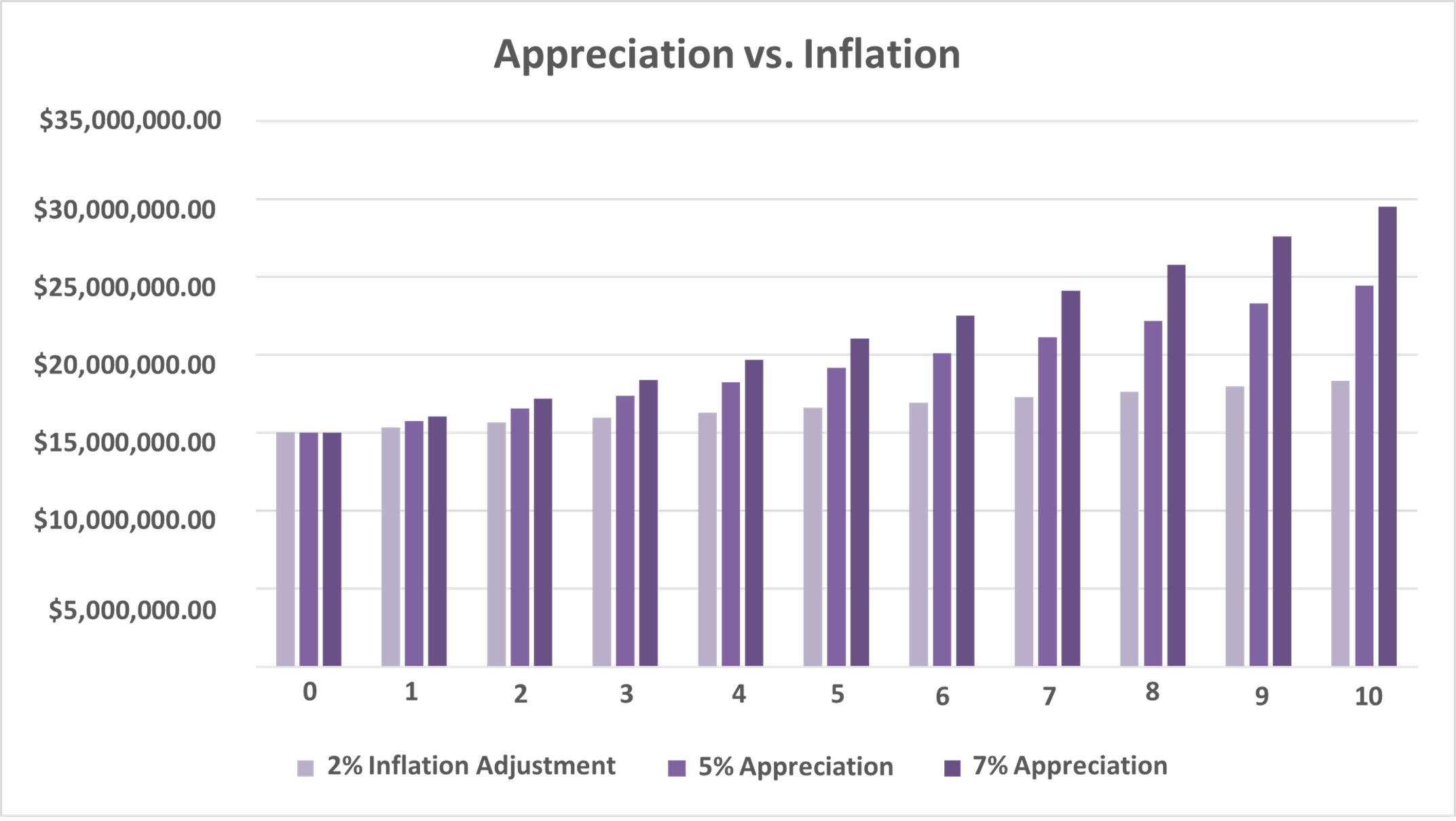

- Grantor Retained Annuity Trust (GRAT): A GRAT allows you to transfer appreciating assets to heirs while retaining income for a set period, reducing your taxable estate.

- Dynasty Trust: This trust can protect assets across multiple generations, shielding them from estate taxes and the claims of creditors.

- MBE Insight: With the OBBBA permanently setting a higher exemption, reviewing your trusts is important to help them capitalize on new thresholds and stay aligned with both your legacy goals and current law.

How Should You Update Your Estate Plan for 2026 Compliance?

An outdated estate plan can lead to unnecessary taxes, legal disputes, or unintended asset distribution, especially with the 2026 estate tax sunset and OBBBA. Regular reviews help your plan reflect current laws and your personal circumstances.

- Key Actions: Update your will, beneficiary designations, and powers of attorney to align with your goals and the latest tax regulations, including the OBBBA provisions.

- Portability After 2025: Portability allows a surviving spouse to use their deceased spouse’s unused exemption (DSUE). For example, if a spouse dies in 2025 with $8.99 million of unused exclusion (from a total of $13.99 million), their surviving spouse can add this $8.99 million to their own $13.99 million exclusion, for a total of $22.98 million, assuming a portability election is made.

- State Estate Taxes: Some states, such as Nebraska, impose their estate taxes at lower thresholds. Your plan should account for both federal and state tax obligations.

- MBE Tip: Our team can review your plan to maximize tax savings under both current law and the OBBBA framework, while minimizing potential disputes.

Regular updates are vital given the transition from TCJA to the OBBBA exemption structure and potential future legislative changes.

How Can You Plan for Business Succession to Safeguard Value?

For business owners, the 2026 estate tax transition could impact the transfer of your business to heirs or successors. While OBBBA’s higher exemption reduces the tax burden compared to the original sunset scenario, deliberate planning remains essential.

- Gifting Business Interests: Transferring business interests to heirs or a family limited partnership (FLP) in 2025 can use the current $13.99 million exemption. For example, gifting a $10 million business to an FLP could significantly reduce your taxable estate.

- Valuation Discounts: FLPs and other structures often allow valuation discounts, further reducing the taxable value of transferred assets.

- MBE Insight: Our business consulting team specializes in succession planning for industries like agribusiness, real estate, and manufacturing, helping your business legacy endure.

Proactive succession planning helps preserve your business’s value and facilitates a smooth transition to the next generation.

Collaborate with MBE CPAs for Personalized Guidance

Navigating the complexities of gift and inheritance tax rules, as well as the transition to OBBBA’s framework, requires professional support. At MBE CPAs, we combine comprehensive financial planning with a warm, community-focused approach to help you make informed decisions.

Schedule a consultation with our team to assess your assets, model tax scenarios under both current law and OBBBA provisions, and implement customized strategies, such as gifting or trusts.

Our multi-state presence allows us to provide comprehensive support that addresses the unique tax considerations and opportunities across different jurisdictions, both during the transition and under the new OBBBA framework.

Our team is dedicated to helping you understand and address the changes in estate tax so your plan stays effective, up-to-date, and prepared for the future.