The True Cost of Quality (COQ): Beyond Scrap Rates & Rework

Authored by: Glen Erdman — Director, EA | Date Published: September 3, 2025

When business owners think about the “cost of quality,” their minds often go straight to visible expenses like scrap materials or rework. But those are only part of the picture. The true Cost of Quality (COQ) digs deeper and reveals hidden financial impacts that can influence not only your bottom line, but also your customer relationships.

By investing in quality earlier in your processes, you can prevent expensive failures later, boost profitability, and strengthen customer loyalty. The challenge, of course, is knowing where and how to make those investments. Business owners find it easier said than done, but we’ve provided actionable insights that prove your business can improve.

Featured Topics:

Understanding the Cost of Quality

Quality doesn’t come free. Every business invests resources to prevent problems, monitor performance, or fix issues after they occur. These investments are what we call ‘Cost of Quality’ (COQ), which measures whether an organization is using its resources effectively to deliver reliable products and services while reducing failures.

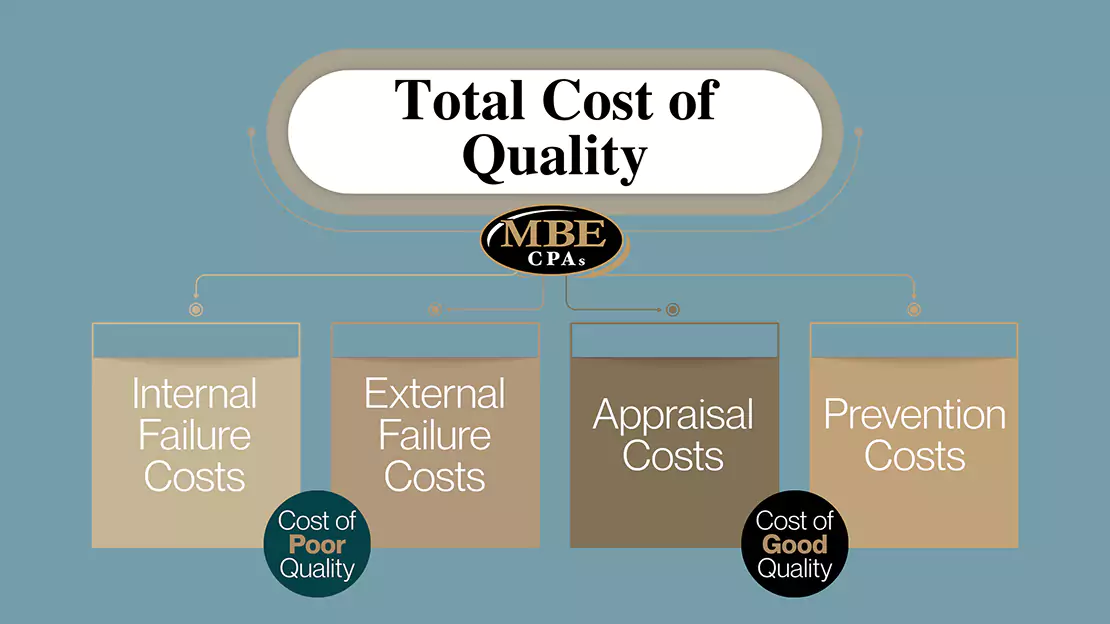

The Cost of Quality is made up of three types of costs: prevention, appraisal, and failure (both internal and external). Together, these represent the total cost of achieving and maintaining quality standards, as well as the price of not meeting them.

In this section we provide an overview of each category and why understanding them matters for your business.

What are Prevention Costs?

You know that dreaded feeling when a customer complains about a defective product and you realize it’ll cost you more to fix than it would have to prevent? Prevention costs are business expenses associated with the design, implementation, and maintenance of quality before operations begin. These proactive investments are made to prevent problems that could occur during production or operation.

Common risks that manufacturers face include the following:

- Supply chain disruptions

- Rapid technological changes and advancements

- Cybersecurity threats

- Workforce shortages and skill gaps

- Regulatory pressure and environmental fallout

To minimize these risks, you can implement these activities:

- Quality planning: Developing plans for reliability, operations, production, and inspection

- Quality assurance: Building and maintaining a consistent quality system

- Employee training and certification programs: Educating your staff and building skillsets that deliver quality at every step of the process

What Are Appraisal Costs?

You’re already behind schedule for shipping a large order when your gut tells you something about the product is off. Appraisal costs fall under the quality control category. These are expenses your business takes on to make sure products and services meet expectations and regulations. In other words, they are the costs of checking, testing, and reviewing to confirm that quality standards are being met, because it’s often less expensive to catch issues early than to fix them later.

Common examples include:

- Inspections: Hiring staff to check quality during production

- Field testing: Evaluating products or services under real conditions

- Secret shoppers: Assessing customer service and sales performance

- Audits: Reviewing standard operating procedures and compliance

While appraisal costs seem like added overhead, they play an important role in protecting your organization’s reputation. In today’s world, where customer feedback and social media visibility can make or break a brand, your business can’t afford to cut corners on quality control.

Understanding Internal and External Failure Costs

Every business has had to choose between eating the cost of fixing an internal problem or facing an angry customer who received a defective product. Failure costs are expenses related to product or service defects. Internal failure costs occur before the product or service reaches the customer; external failure costs happen after delivery and are discovered by the customer.

While catching issues internally is less damaging than having customers discover them, both failure costs can take a heavy toll on profitability.

- Internal failure costs: Anything from waste, scrap, rework, and low production efficiency. Correcting defective products writing off unsellable materials consumes both money and time.

- External failure costs: Replacements, complaints, recalls, and the handling of returned products. These not only generate direct expenses, but also harm customer satisfaction and loyalty.

These costs often hide in various expense categories, making them difficult to track and impact customer lifetime value.

Cost of Quality Scenarios for Companies

To understand the full picture of COQ and how your business could be impacted, here are two scenarios that show how your investments can reduce future costs.

Manufacturing Example

A mid-sized manufacturer invested $50,000 in employee training and process improvements. As a result, annual costs decreased significantly:

- Internal failures reduced by $150,000

- External failures reduced by $200,000

- Appraisal costs reduced by $25,000

Fewer warranty claims, reduced scrap and rework, and more efficient processes created lasting savings and stronger customer trust.

Here are more proactive measures to prevent additional costs in this industry.

Service Business Example

A professional services firm implemented a quality management system that costs $30,000 annually. This prevention cost led to:

- $80,000 in reduced external failure costs

- $150,000 in additional revenue from improved client retention

By maintaining a proactive approach to catching system failures in service delivery will build trust with your customers and reduce the cost of delivering less than expected quality.

Some business costs should be viewed as investments rather than expenses. Eliminating problems before they occur and taking action to improve the efficiency of your employees will make this expenditure the most strategic category in your quality budget.

2025 Tax Implications & Quality Costs

In 2025, businesses face rising costs and new tax rules that directly impact how they strategize operations. While prevention costs require upfront capital, they can provide a strong return on investment by helping organizations avoid much more expensive failures down the line.

The OBBBA Act made recent changes in tax regulations that affect how quality costs should be managed, creating opportunities for investments. Here are the shifts you should know:

Deductible Quality Expenses: Taxpayers can now deduct domestic research and experimental expenses in the year the expenses are incurred. In 2025, the following are fully deductible:

- Quality improvement R&D projects

- Employee training and certification programs

- Quality system implementation and software costs

- Process improvement consulting and analysis

- Quality audits and assessments

- Preventative maintenance programs

Capital Quality Investments: The OBBBA permanently extends 100% bonus depreciation for property acquired and placed into service. This creates significant advantages for quality equipment purchases. 100% deductible in year one includes:

- Quality testing and inspection equipment

- Manufacturing quality control machinery

- Quality management software systems

- Laboratory testing equipment

- Environmental monitoring systems

Read more about tax deductions your business should claim.

Understanding the tax implications allows business to improve overall ROI and strengthen cash flow management while making smarter quality investments.

For this year, the costs of doing business are also influenced by inflation, labor costs, and technology expenses. Here is a list of the major costs in 2025:

- Nonprofits were broken out into two groups: over and under $1 billion.

- Corporate funds broke out between total return and liability-driven plans and by size: over and under $1 billion.

- Public funds were broken out into three groups: over $10 billion, over $1 billion, and under $1 billion.

- Insurance pools were included for the first time.

Learning which costs can be cut and how prices can be adjusted can help mitigate these fluctuating challenges.

How MBE CPAs Help Prevent Additional Costs

Working with experienced CPAs can reduce your overall COQ through systematic approaches to financial management. MBE CPAs provides audit services that will put your business on the path to success.

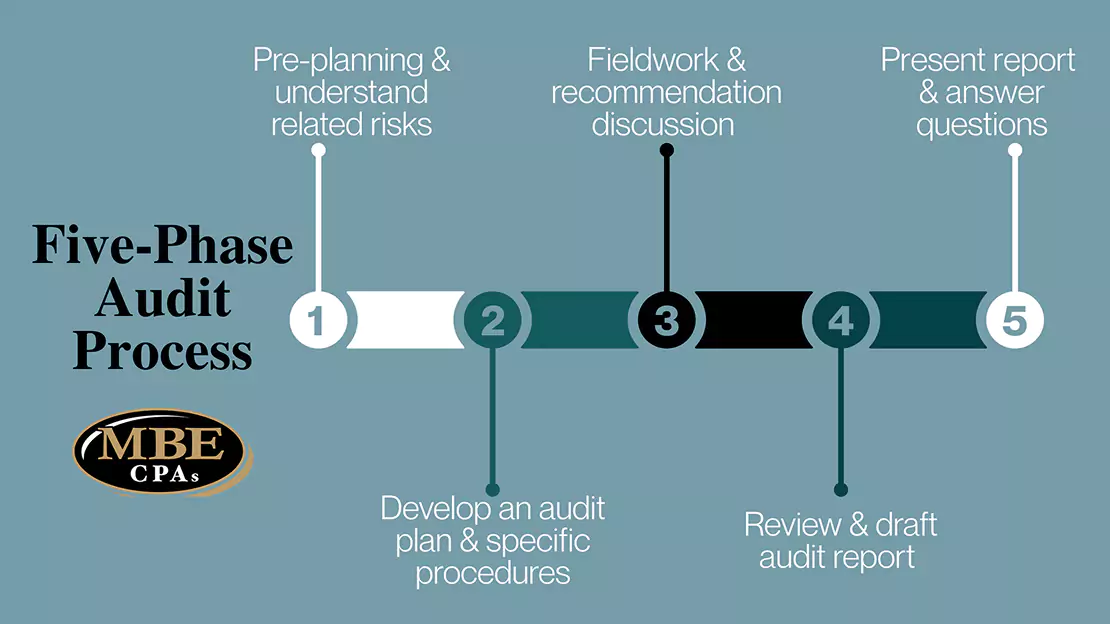

Here’s our five-phase audit process:

Phase 1: Pre-planning and gaining a better understanding of risks related to the audit areas

Phase 2: Develop an audit plan and specific procedures to be performed

Phase 3: Fieldwork & discussion of the results of our preliminary recommendations

Phase 4: Review and provide an audit report draft

Phase 5: Present the audit report and answer questions

Our team of professionals also suggests a deeper dive into analyzing costs and expenses. We provide accounting services that help you implement detailed cost tracking systems.

This is what a granular cost control analysis looks like:

- Utility management: Track usage patterns and negotiate better rates.

- Waste reduction programs: Monitor and minimize food waste by menu item.

- Maintenance scheduling: Prevent costly equipment breakdowns.

- Marketing spend analysis: Measure ROI for each advertising channel.

- Training cost tracking: Calculate ROI of employee development programs.

Ready to implement a Cost of Quality management system in your business?

Conclusion

The Cost of Quality isn’t just about avoiding defects but also about strategizing your financial management. By understanding COQ from an accounting perspective, you can improve your business’ profitability, reduce financial risk, and enhance your cash flow through reduced failure costs.

Whether you’re managing a business or your personal finances, utilizing proper accounting controls and professional guidance can turn quality management into your profit driver. Keeping the mindset that quality costs are not unavoidable expenses, but manageable investments will drive your business to long-term financial success.

Contact MBE CPAs today to learn how our audit services can help you identify hidden quality costs and improve your bottom line.