Why Farm Profits Are Under Threat Today

Authored by: Diane Payne — Partner, EA | Date Published: July 30, 2025

Featured Topics:

- What is the Agricultural Trade Deficit?

- Why This Matters to Your Operation

- What’s Driving the Agricultural Trade Deficit?

- How Different Sectors Are Affected

- What You Can Do: Building Resilience in Your Operation

- The Long-term Outlook

- Your Next Steps

- How MBE CPAs Can Support Your Operation During These Challenging Times

As grain prices continue to fall, the pressure on your business grows as competition from imports starts to take away your hard-earned market share, making it harder to stay profitable. Export markets that once provided reliable sales are now unpredictable due to changing demand, new trade rules, and shifting consumer tastes. This complicated situation makes it challenging to build strong partnerships and ensure consistent sales. Does this reflect the challenges you are currently facing?

If you’re noticing your profit margins shrink while imported products flood the markets you’ve served for years, you are witnessing the real impact of America’s growing agricultural trade deficit. This isn’t just an abstract economic concept; it’s happening in your fields, barns, and bank accounts right now. With the uncertainty created by the farm bill extension regarding future support programs, understanding these trade dynamics is crucial for the survival of your operation.

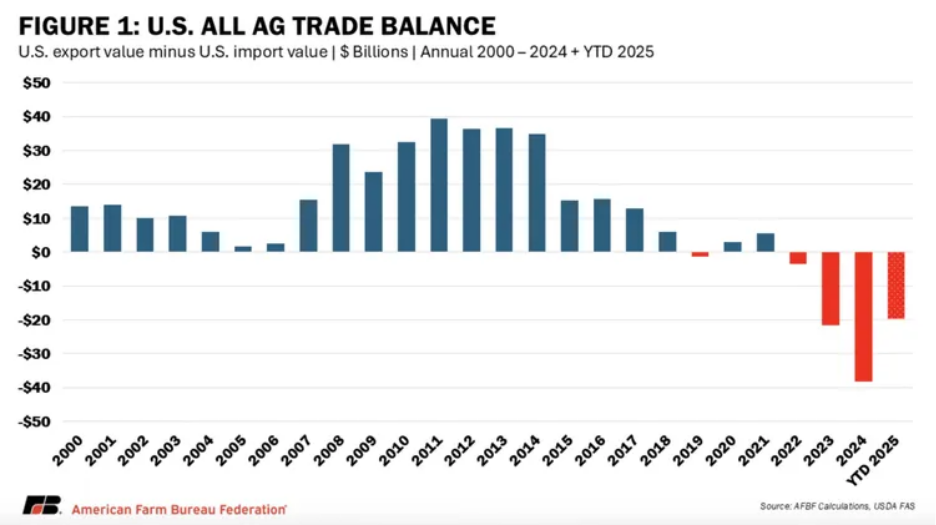

For the first time in decades, the United States is importing more agricultural products than it is exporting. In 2024 alone, this deficit reached a record $32 billion, and it is projected to exceed $45 billion in 2025. Every dollar of that deficit represents market share, pricing power, and profitability that’s shifting away from American producers like you.

Let’s break down what this trade deficit means for your farm and what you can do to position yourself for success.

What is the Agricultural Trade Deficit?

The agricultural trade deficit occurs when the United States imports more agricultural products than it exports. Simply put, we’re buying more food and farm products from other countries than we’re selling to them.

The current outlook for the agricultural trade sector reveals significant challenges ahead. For the fiscal year of 2024, the USDA’s Economic Research Service projects a record agricultural trade deficit of $32 billion. This figure is anticipated to rise to over $45 billion in fiscal year 2025.

To better understand the trend, consider the following figures:

- In 2023, the agricultural trade deficit stood at $16.7 billion.

- The deficit for 2024 reached $32 billion.

- Projections for 2025 indicate a deficit exceeding $45 billion.

These statistics highlight notable shifts in the markets where agricultural products are sold, underscoring the need for strategic adjustments in response to these evolving conditions.

Why This Matters to Your Operation

The growing trade deficit creates a ripple effect that impacts every aspect of your agricultural business. As imports flood domestic markets, you will find yourself competing not only with neighboring farms but also with producers from countries where labor costs are lower and regulatory standards may differ. This increased competition doesn’t just affect pricing, it fundamentally changes how you must approach your business strategy.

Your traditional export markets are becoming less reliable. Countries that used to buy American agricultural products are now looking at other suppliers or working to grow their own food. This decrease in demand for your exports means you depend more on domestic markets, which are facing pressure from cheaper imports. As a result, you are dealing with challenges on both sides. This situation is hurting your profits due to lower commodity prices and a shrinking market share.

What's Driving the Agricultural Trade Deficit?

1. Currency Strength Issues

Two key factors have led to the decline of U.S. exports since 2021: decreasing commodity prices and the strength of the U.S. dollar. When the dollar is strong:

- U.S. products become more expensive for foreign buyers.

- Imported products become cheaper for U.S. consumers.

As a result, a strong dollar makes our exports less competitive in international markets.

2. Changing Consumer Preferences

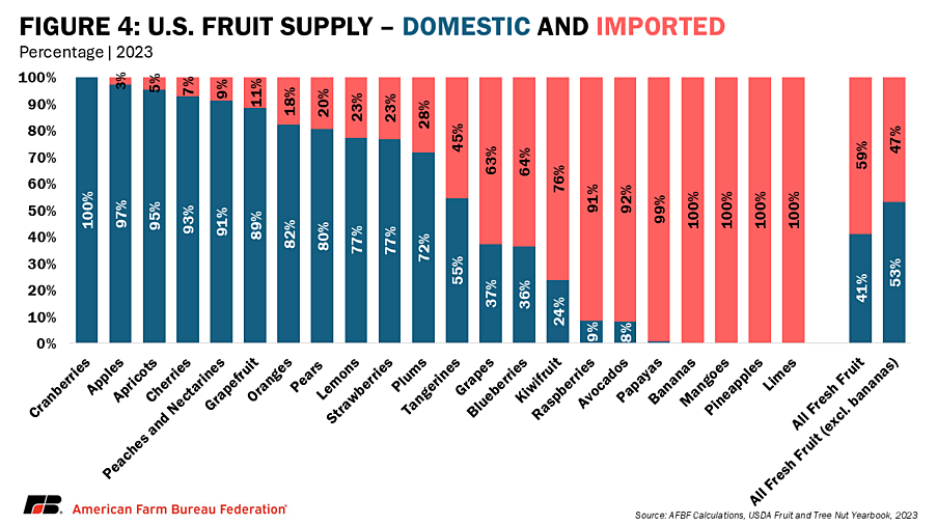

U.S. agricultural imports expanded steadily over the past 25 years, largely driven by growing domestic demand. These steady imports reflect a fundamental shift in American eating habits and expectations. Consumers now expect fresh strawberries in December, avocados year-round, and exotic fruits that can’t be grown economically in most U.S. climates.

The demand for different types of food throughout the year has opened up chances for countries with various growing seasons and lower production costs to gain a larger market share. While this variety is good for consumers, it makes it harder for local farmers. Farmers who grow seasonal crops now have to compete with imports during their usual harvest times.

3. Production Competitiveness

Some countries can produce certain agricultural products more cost-effectively than the United States, despite the superior quality of American produce. This advantage usually comes from lower labor costs, good weather, and government support that lowers production expenses. For example, tropical countries can grow crops like coffee and bananas all year long, which helps keep their prices low in the market.

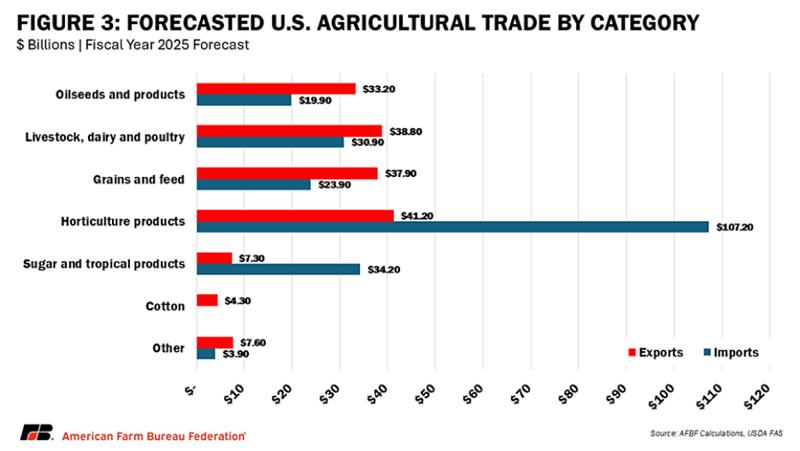

4. Import Categories Growing Fastest

In fiscal year 2025, the USDA expects horticultural products to make up about 49% of the total value of agricultural imports. The fastest-growing categories for imports include:

- Fresh fruits and vegetables

- Processed foods

- Specialty crops

- Organic products

How Different Sectors Are Affected

The agricultural trade deficit affects different farming sectors in various ways. Each type of farm faces its own challenges based on the products they grow, the markets they sell in, and their competition.

Grain Producers

Dairy Operations

Dairy operations face distinct challenges mainly due to imported dairy products that compete with local goods. Consumers increasingly prefer specialty and processed dairy items, which allows international competitors to thrive. At the same time, domestic producers deal with higher production costs and compliance expenses that do not impact imported products as much.

Meat Producers

Meat Producers continue to benefit from strong export demand for livestock products, but they’re dealing with increased processing costs and regulatory differences that affect their competitiveness. Competition from lower-cost international producers is intensifying, particularly in processed meat categories.

Specialty Crop Growers

Specialty Crop Growers face perhaps the most complex challenges. While tree nuts, fruits, and vegetables remain major U.S. exports, these producers must compete with year-round imports of fresh products, creating seasonal pricing pressures and forcing them to compete on quality and brand recognition rather than price alone.

What You Can Do: Building Resilience in Your Operation

Diversification Strategies

Product Diversification:

- Consider value-added products that are harder to import.

- Explore niche markets where you have competitive advantages.

- Develop direct-to-consumer channels.

Market Diversification:

- Don’t rely solely on export markets.

- Build strong local and regional customer bases.

- Develop relationships with processors and distributors.

Financial Management

Cash Flow Protection:

- Maintain stronger cash reserves during volatile periods.

- Consider forward contracting to lock in prices.

- Explore crop insurance options for price protection.

Cost Management:

- Focus on operational efficiency improvements.

- Invest in technology that reduces production costs.

- Negotiate better input prices through group purchasing.

Partnership and Collaboration

Industry Cooperation:

- Join producer organizations for collective bargaining power.

- Participate in marketing cooperatives.

- Share resources with neighboring operations.

Using diversification strategies, strong financial management, and industry collaboration is key to long-term growth. Exploring new products and markets helps businesses reduce risks and take advantage of opportunities. Improving financial practices increases stability, and working together with others allows for resource sharing and better decision-making.

The Long-term Outlook

The agricultural sector has demonstrated remarkable resilience and adaptability throughout history. Several factors suggest potential pathways for recovery and growth, even amid current market pressures.

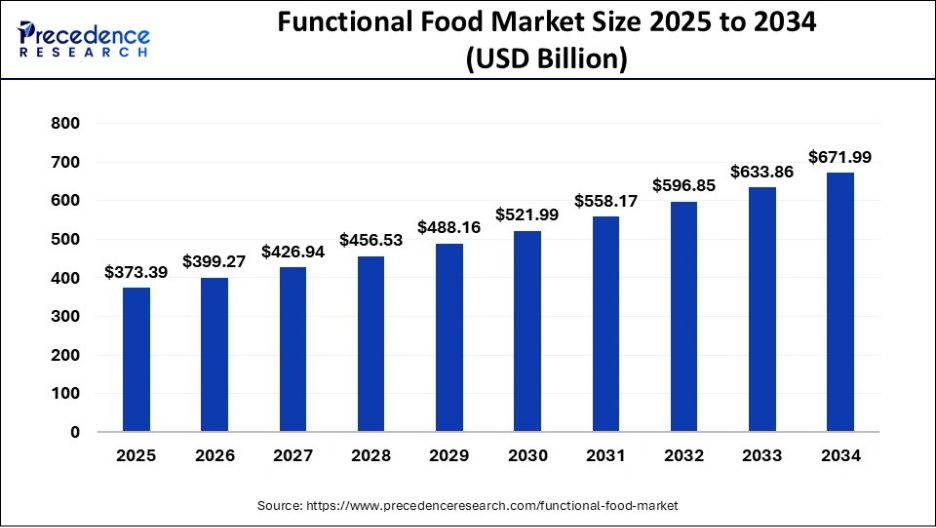

The global population is growing, and this will increase the demand for food. Technological advancements, such as precision agriculture and improved supply chain management, can help U.S. farmers compete. Additionally, changing policies at both the federal and international levels could help resolve some currency and trade issues that contribute to this problem.

The farms and agribusinesses that will do well are those that can adapt quickly to changing market conditions while maintaining financial flexibility. Success will increasingly depend on the ability to focus on quality and differentiation to unlock market potential, while building strong relationships throughout the supply chain that provide stability during volatile periods.

Your Next Steps

- Assess your current exposure to export markets and import competition.

- Develop contingency plans for different market scenarios.

- Build financial reserves to weather volatile periods.

- Explore new opportunities for diversification and growth.

- Connect with professionals who understand agricultural trade impacts.

The agricultural trade deficit is a real challenge affecting your operation, but with the correct information, planning, and support, you can adapt and continue to grow. Your skills, dedication, and the quality of what you produce remain your greatest assets.

How MBE CPAs Can Support Your Operation During These Challenging Times

At MBE CPAs, we don’t just handle numbers. We help farmers like you adjust and succeed in changing markets. Every agricultural statistic represents a real family working hard to feed America and the world. Our team has strong accounting skills and understands how farms operate. We are not just your accountants; we are your partners in building a stronger and more profitable venture.

Our Agricultural Knowledge Includes:

Financial Planning & Analysis:

- Cash flow forecasting during volatile market periods.

- Profitability analysis to identify your most resilient revenue streams.

- Tax planning strategies that account for trade-related market changes.

- Agriculture accounting proficiency to track import/export impacts on your bottom line.

Risk Management Support:

- Guidance on forward contracting and hedging strategies.

- Insurance evaluation to protect against trade-related losses.

- Scenario planning for different market conditions.

Growth Strategy Development:

- Diversification planning to reduce export dependency.

- Value-added product development financial modeling.

- Investment analysis for operational improvements.