2025 Ends the Clean Energy Tax Credits

Authored by: Brett Leibfried — Partner, CPA | Date Published: September 16, 2025

Imagine you have been considering solar panels for your home, purchasing an electric vehicle, or upgrading to energy-efficient appliances. A few months ago, you could save on these investments with various tax credits that support your switch to clean energy. Now, thousands of dollars in potential tax savings are disappearing, and many Americans don’t even realize what they’re losing.

Lawmakers are looking to repeal the Clean Energy Tax credits by the end of 2025 to pay for the expiring Tax Cuts and Jobs Act.

In this guide, we’ll break down exactly what these tax credits were, why they’re being eliminated, and most importantly, what you need to do before it’s too late to benefit from them.

Featured Topics:

What Are Clean Energy Credits? A Beginner’s Guide

Whether you’re a longtime advocate for renewable energy or simply someone who wants to reduce their tax burden, understanding what these changes are targeting is important for your financial planning.

In 2022, the Inflation Reduction Act (IRA) passed clean energy investments aimed at making energy bills more affordable. This was made possible with clean energy credits, which are financial incentives that lower a person’s or company’s tax bill for using renewable energy sources.

What else the Clean Energy Credits created:

- Millions of jobs for working Americans

- Advanced manufacturing tax credits

Learn more about the original goals of the Clean Energy Tax Credits that are now set to expire by the end of 2025.

Why are Clean Energy Credits Being Repealed?

When the One Big Beautiful Bill, OBBBA, was enacted on July 4, 2025, many of the clean energy tax credits originally established by the Inflation Reduction Act (IRA) were significantly cut back.

The major tax and budget legislation passed by the House of Representatives on May 22 made deep cuts. Almost every clean energy provision is reduced due to early terminations and new, unworkable restrictions.

Arguably, repealing the EV and clean energy credits raises almost $200 billion over the next decade. It may seem complicated, but OBBBA’s approach to these credits addresses issues that argue that the credits were never fair to begin with.

Several arguments behind the federal policy change:

- Cost Concerns: Consumers were benefiting from the commercial EV credit even when their vehicles did not comply with the credit restrictions, benefiting drivers who would have purchased an electric vehicle regardless.

- Economic Efficiency: The comparison between the cost for the credit and the CO2 reductions proves to not be as effective, and many of the recipients would have purchased clean energy without the subsidy.

- Skewed Income Distribution: Residential and EV credits disproportionately benefit higher-income households.

- Limited availability of Credits: The credits were only available if certain labor requirements were met or if located in specific areas.

Clean energy tax credits are not the only provisions being made that may impact how you plan for tax season. With the extension of the Trump-era tax cuts, there are many other changes to consider.

The Extension of the Trump-era Tax Cuts

The One Big Beautiful Bil Act extends and makes permanent many provisions of the Tax Cuts and Jobs Act. The TCJA temporarily lowered income taxes for individuals and corporations, but they will no longer expire at the end of 2025.

Here are the key Trump-era tax cuts in 2025:

- Permanent corporate tax cut

- Zero penalty for individual health coverage mandate

- Repealed Roth recharacterization

- Reduced individual income tax rates

- State and local tax deduction cap exemption for tip and overtime pay

- Elimination of EV and clean energy tax credits

Taxpayers who don’t qualify for the deductions or credits of Trump’s new tax plan may see fewer advantages.

The Phases of the Clean Energy Credit Repeal

The Repeal of Clean Energy Credits follows a phased approach to individual clean energy credits (electric vehicle, residential solar) after 2025, impacting eco-conscious clients. Missing these dates means missing out on potentially thousands in tax savings.

Here are the various termination dates:

- September 30, 2025: The Clean Vehicle Credit for all new, used, commercial, and non-commercial electric vehicle credits will expire for any vehicle acquired after September 30, 2025 (originally set to last until 2032).

- December 31, 2025:

- Expiring tax credit for homeowner installation of solar panels, geothermal heat pumps made after December 31, 2025 (Residential Clean Energy Credit).

- Qualifying home improvement upgrades like windows, doors, insulation, heat pumps, biomass stoves will end. (Energy Efficient Home Improvement Credit)

- New Energy-Efficient Home Credit for home building contractors

- June 30, 2026: EV charging stations in low-income or rural areas (Alternative Fuel Vehicle Refueling Property Credit). This includes home installation of EV chargers.

The One Big Beautiful Bill officially sets the expiration date on the Clean Energy Tax Credits, leaving you with only a few months to take action. Whether you’re a longtime advocate for renewable energy or simply someone who wants to reduce your tax burden, understanding these changes is critical for financial planning.

Immediate Impacts of Clean Energy Credit Repeal

The elimination of clean energy tax credits by the end of 2025 threatens to create affordability challenges for American consumers, among many other changes.

Here are emerging risks to consider following the clean energy credit repeal:

- Higher electricity bills

- Reduced energy security

- Threats to manufacturing, jobs, and economic growth

- Higher-emissions fuels

These financial implications must be taken into consideration when understanding your current situation. Given the complexity of these credits and the tight timelines, working with a qualified tax advisor can help you maximize your savings and avoid costly mistakes.

How the Clean Energy Repeal Impacts You

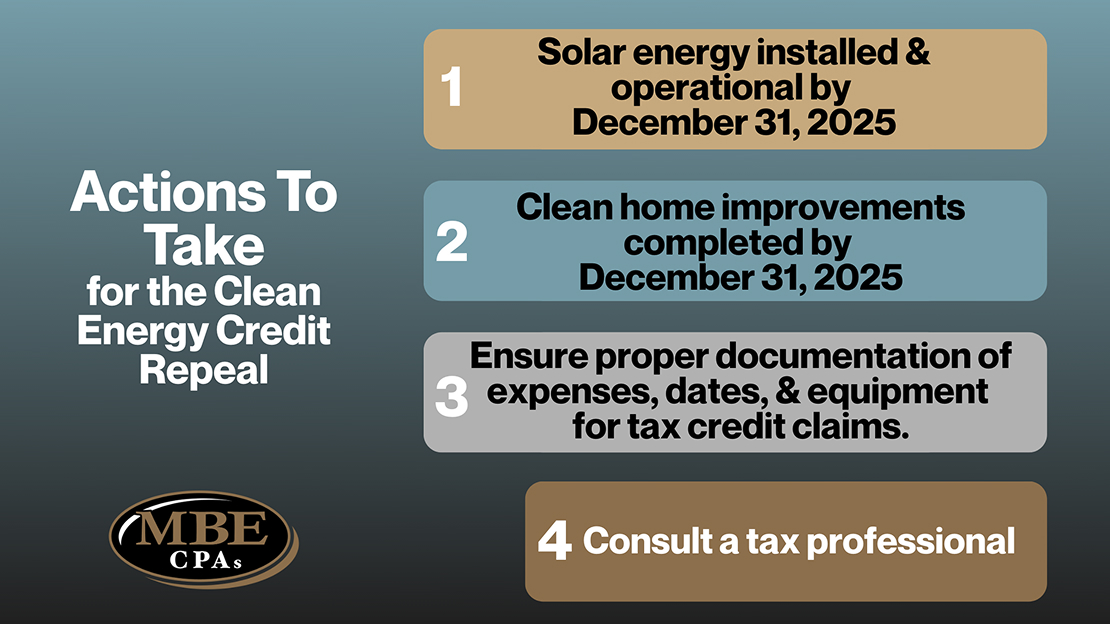

If you are planning to purchase a clean vehicle or install residential clean energy equipment, you must complete these purchases and place the property in service by the specified deadlines to still qualify for the credits.

Let’s look at a few credit examples:

If you were planning a $25,000 solar installation, you’re losing $7,500 in federal tax credits (30% of the cost). For a $50,000 electric vehicle, you could be missing out on up to $7,500 in savings.

When budgeting your expenses or planning for taxes, consider these changes:

- Loss of Direct Credits: Citizens lose up to 30% tax credits on solar installations, wind, geothermal, fuel cells, and battery storage technology that were previously available

- Higher Energy Bills: Incentives for new energy-efficient appliances and heat pumps will end, along with financial assistance for technologies that reduce monthly utility costs. This causes higher costs for energy-efficient appliances and raises energy bills.

- Accelerated Installation Timeline: Individuals must complete installations before the urgent cutoff of December 31, 2025, leading to scheduling delays, contractor shortages, and potentially compromised installation quality as the industry struggles to meet compressed timelines.

- Increased Demand & Prices for EV: Eliminating EV tax credits creates a market rush to purchase electric vehicles before losing the incentive opportunities. This is driving up EV prices and creating supply shortages.

The savings you preserve today could significantly impact your financial position for years to come.

How MBE CPAs Can Help

With tax season approaching, make sure you’re accounting for all tax credits and deductions available to you. With many changes to keep track of, it’s easy to get lost in a pile of tax legislation, regulations, and IRS guidelines.

At MBE CPAs, our knowledge and experience working across various industries make us qualified to help you identify tax-saving opportunities that are specific to you. We stay up to date on the latest tax changes, closely following the recent repeal and accelerated timeline, so you don’t have to worry about what you could be missing.

The elimination of clean energy tax credits represents a change in federal tax policy that creates a sudden sense of urgency. With the residential credits, energy efficiency improvements, and clean energy credits nearing expiration, this means taxpayers could potentially lose thousands of dollars in tax savings that were available just months ago.

Your opportunities may be changing, but with proper planning and guidance, you can still optimize your tax strategy for the years ahead.