2025 Is the Future Without Paper Checks

Authored by: Diane Payne — Partner, EA | Date Published: September 15, 2025

Remember learning to write your first check in grade school? That careful practice of writing in perfect cursive, for many Americans, has continued to be a trusted method for decades. Maybe you’re still that person who confidently pulls out your checkbook at the grocery store while younger shoppers tap their phones to pay.

If you’re one of the approximately five million Americans who still receive your tax refund as a paper check in the mail, it’s time for some important, and rather disappointing, news. Those familiar transactions with the IRS are about to become a thing of the past.

Featured Topics:

What's Behind the Decline of Paper Checks?

While direct deposit has become the standard for receiving tax refunds, a significant number of taxpayers still choose to get a paper check. During the 2025 filing season, for example, about five million people opted to receive their refund by mail. This trend, which might seem surprising in our increasingly digital world, shows that a notable portion of the population still relies on traditional banking methods, whether by choice or necessity.

Those days have come to an end, and though it might cause some challenges for checkbook writers, this is what sparked the change:

- Risk: Paper checks are 16 times more likely to get lost, stolen, altered, or delayed.

- Speed: Electronic payments are safer, allow quicker access to funds, and have less risk of fraud, where paper refund checks can take several weeks to be delivered.

- Cost: Taxpayers will save money on printing and mailing.

We understand. You’ve used paper checks for as long as you can remember, and learning how to adopt electronic payment methods is more challenging than sticking with your routine.

However, starting September 30, 2025, the federal government will stop issuing paper checks for federal payments. That means that it’s time you switch to a new method. This change stems from a March 2025 executive order requiring the U.S. Treasury to move to an all-electronic system for federal payments, including IRS tax refunds.

Regardless of the benefits of switching to electronic direct deposit, the IRS is trying to understand why five million people still opt for paper checks. That’s six percent of taxpayers when you break it down.

Here’s how you may be affected by the switch to an all-electronic system:

- A bank account will be required

- Reduced delays due to the mail

- Elimination of risk of lost or stolen checks

- New Requirement: You’ll need a secure method to make tax payments electronically

Changing the way that millions of taxpayers receive their refunds could cause wide-scale confusion, but you don’t have to be one of them. Understanding what you can do to take proactive measures now will save you the headache in the upcoming months.

Who Needs to Take Action?

The transition impacts several groups of people, and you might recognize yourself in one of these positions.

- Taxpayers without bank accounts: Maybe you’ve always been paid in cash or want to avoid the fees of a bank. You’ll need to open an account to be able to use direct deposit.

- US citizens abroad: The paper check system once allowed you to receive your tax refund via international mail while living abroad, but now you must explore the US-based banking solutions for international transfers.

- Estates, trusts, & special cases: Whether you’re a senior managing family finances or an individual handling these affairs for someone else’s estate, learning a new digital system is required.

Don’t wait until September 29th to figure this out. Before you lose your trusted system, familiarize yourself with the new way of receiving and sending electronic payments. By consulting a qualified advisor, your affairs can be sorted before time runs out.

What Steps Should Taxpayers Take to Prepare for the Elimination of Paper Checks?

It’s November 2025. You meant to get around to setting up direct deposit but are now frantically calling the IRS because your refund is stuck in limbo. If you had started your process earlier, you would already be planning how to use your refund because it arrived safely in your account right on schedule.

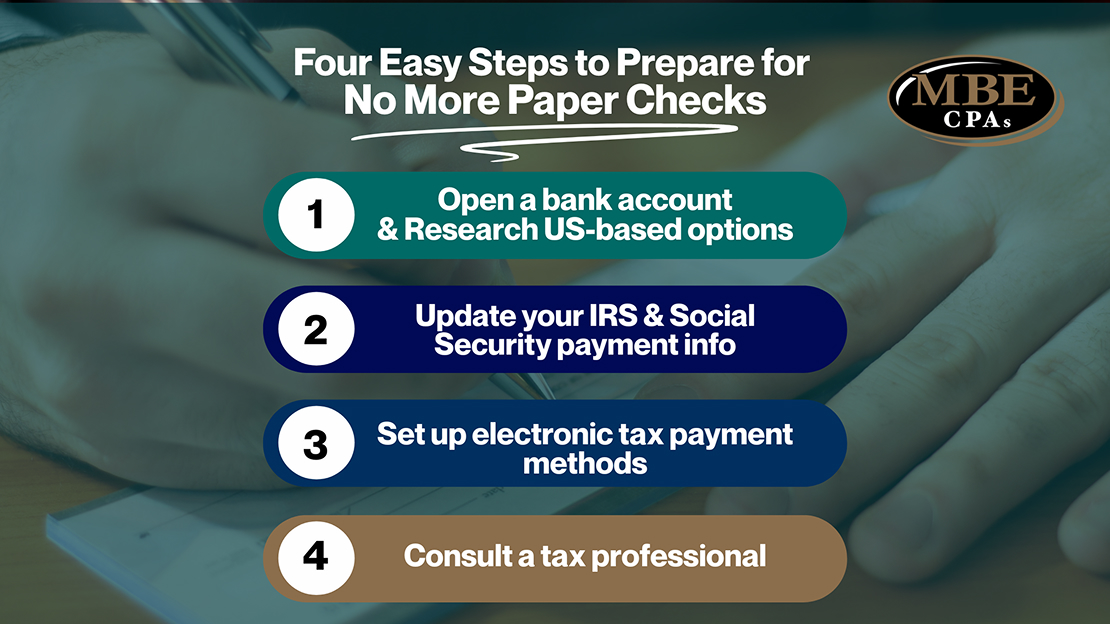

Here are the four easy steps to take now to make your life easier:

- Open a bank account (if you don’t already have one).

- Research US-based banking options.

- Update your IRS & Social Security payment information.

- You can do so by signing into your account online.

- Set up electronic tax payment methods.

- Consider secure platforms that can automate your tax payments

- Consult a tax professional to prepare accordingly, based on your tax account.

While tricky at first, electronic payments eliminate the anxiety of checking your mailbox every day, the frustration of dealing with lost checks, and the risk of identity theft from stolen mail.

How Does MBE CPAs Offer Transition Support?

At MBE CPAs, we’re helping clients navigate this transition. We understand that what seems like a simple switch to electronic payments can feel overwhelming when you’re dealing with real life, whether that’s caring for aging parents, managing a business, or simply preferring the familiar comfort of paper.

Our transition support:

- Client Onboarding: A step-by-step guide to set up secure electronic payment accounts and submit your first digital payments

- Remitian Partnership: We’ve partnered with Remitian, a secure platform that simplifies tax payments for our clients. This solution is a portal that allows you to do the following:

- Automate federal and state tax payments

- Handle Wisconsin tax client needs

- Estimates payments for IRS individual & business income tax

- Eliminates the need for manual logins to multiple portals

- Client Communication Support: We’re providing email templates and guidance to help you understand the IRS policy shift. You can trust our digital payment methods, and we will help you learn and move forward with confidence.

Before Remitian, you wrote checks, worried about mail delivery, tracked payments manually, and logged into multiple government websites. Now, your tax filing data flows directly into automated payment scheduling, and you have more time for tax planning and strategic financial decisions.

With our targeted communication, you can have peace of mind that your taxes are handled securely and on time.

Conclusion

It’s time to get ready for the switch. Change is never easy, especially when it involves something as personal as how you receive your money. But this transition, while mandatory, offers faster access to your funds, better security, and less stress about lost mail. You’ll benefit in the long run, so let us help you take the next step.

The September 30th deadline isn’t negotiable, but who you choose to consult is. At MBE CPAs, we provide industry-leading tax guidance and ongoing support to help you minimize your tax liability and maximize financial success.

Your checkbook might be headed for the drawer, but your financial security doesn’t have to suffer. Embrace the electronic age and let your future self relax when your refund arrives quickly and safely, without any trips to the mailbox.