ATS and Payroll Support for Restaurants

Authored by: Doug Gross — Partner, CPA, CGMA & Kim Wegner — Partner, CPA, CVA, CGMA | Date Published: September 19, 2025

It’s another busy morning, and you’re reviewing yesterday’s sales reports when your phone buzzes with yet another text. “Can’t work my shift tonight, family emergency,” it reads. You glance at the schedule board, mentally calculating coverage, overtime implications, and the domino effect on everyone else’s hours.

Then your manager pops their head in. “The new hire from last week is asking about their paycheck again,” they say. “Something about their tips not being calculated correctly.” they say. You feel that familiar knot in your stomach, not because you don’t care about your team, but because you know how tricky these calculations can get.

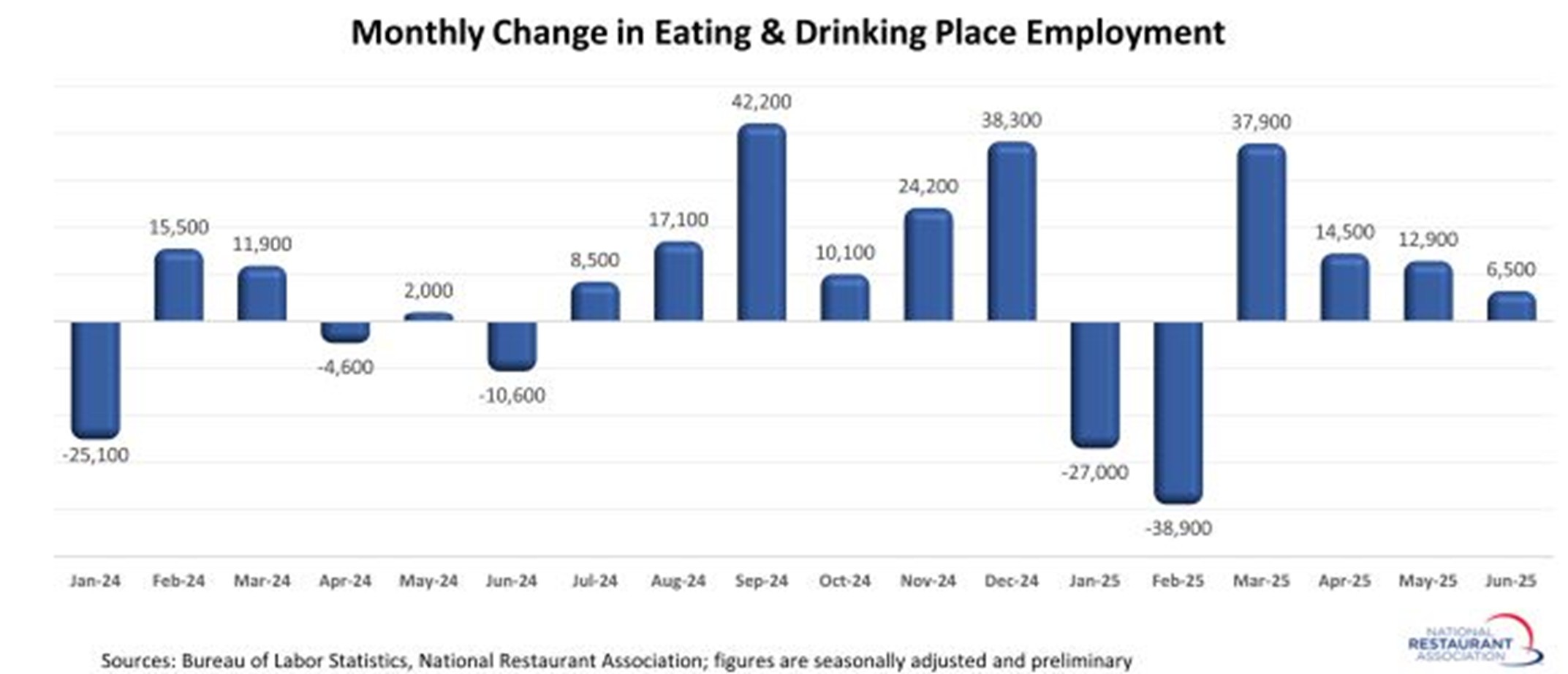

You’re not alone in this struggle. Industry sales are expected to grow more than four percent this year, with employment projected to reach 15.9 million jobs by the end of 2025. Yet eight out of ten restaurant owners currently have job openings that they say are hard to fill. The mathematics of success in today’s restaurant industry is not just about food costs and profit margins. It’s also about building systems that support your most valuable asset: your people.

Here’s the truth: Your passion for hospitality brought customers through the door, but it’s your operational excellence that keeps them coming back and your team engaged.

Featured Topics:

- What Are the Hidden Costs of Payroll Problems?

- What Is the Case for Payroll Outsourcing?

- How Can Restaurants Win the Talent War with Modern Hiring Strategies?

- How Can ATS Become Your Secret Weapon for Hiring?

- What Are the Differences Between Quick-Serve vs. Full-Serve ATS?

- Your Partner in Restaurant Success

What Are the Hidden Costs of Payroll Problems?

Restaurant payroll isn’t just about cutting checks. It’s about managing a tangled web of regulations, varying pay structures, and employee expectations that can make or break your business culture.

What Are the Core Challenges Facing Both Full-Serve and

Quick-Serve Establishments?

- Tip Reporting Issues: Managing multiple pay rates for different roles. Chefs might be salaried while servers work hourly with variable tip income each month.

- Overtime Calculations: Managing fluctuating schedules while staying compliant with federal and state overtime laws.

- Labor Cost Fluctuations: With industry sales projected to reach $1.5 trillion, operators face challenges in recruitment, labor costs, and food price inflation.

- Compliance Pressure: Staying current with ever-changing labor laws across different jurisdictions.

When payroll goes wrong, it doesn’t just affect your bottom line, it affects your people. A single error can damage employee trust and morale, create legal compliance issues, lead to costly penalties and back-pay calculations, increase turnover in an already competitive market, and consume valuable time that should be spent on customer service.

Manual payroll processing in today’s restaurant operations is like trying to run a full kitchen with one burner. Smart operators know that investing in proper payroll for restaurants is not merely an expense, but rather insurance for your most important relationships.

What Is the Case for Payroll Outsourcing?

Professional payroll outsourcing isn’t just about convenience. It’s about protection, accuracy, and freedom. After working with countless restaurant owners over the years, we’ve seen firsthand how the proper payroll solution can transform operations.

- Reduced Administrative Burden

- Minimized Risk of Errors

- Cost Savings That Add Up

- Integration with Your Existing Systems

How Can Restaurants Win the Talent War with Modern Hiring Strategies?

Although the restaurant industry is projected to grow significantly, over 75% of restaurant leaders report that recruiting and retaining employees are a “significant” challenge to their business. QSR industry trends indicate that the most successful operators are those who have moved beyond traditional hiring methods to adopt technology-driven solutions.

Finding and retaining great people has become increasingly challenging. However, successful restaurants are discovering that the solution lies not in simply offering higher wages, but in creating effective systems to attract, identify, and retain the right talent.

Before you post your next job listing, ask yourself: What makes working at your restaurant special?

Your employer brand is how potential employees perceive your workplace, and it’s just as important as your customer brand.

How Can ATS Become Your Secret Weapon for Hiring?

Applicant tracking systems (ATS) are software tools that help manage the recruiting process, from job posting to candidate screening to onboarding. They cut out time-consuming tasks like sifting through resumes. Think of an ATS as your hiring command center: a single platform that manages every aspect of your recruitment process from start to finish.

What Are the Benefits of ATS for Restaurants?

- Centralized Applicant Management: All applications, resumes, and candidate communications in one organized system. No more lost emails or misplaced applications.

- Automated Screening and Communication: Set up automatic responses to applicants, schedule interviews, and send follow-up communications without lifting a finger. Many systems now include applicant testing services to evaluate skills before the interview stage.

- Improved Process and Reduced Time-to-Hire: Recent studies indicate that an effective Applicant Tracking System (ATS) can decrease the average hiring cycle by as much as 60%. When using an ATS, the turnover rate of new hires is approximately 40% lower than that of those without one.

- Compliance Protection: Built-in tools help maintain equal opportunity hiring practices and keep records for compliance purposes.

What Are the Differences Between

Quick-Serve vs. Full-Serve ATS?

Quick-serve restaurants face challenges such as high turnover rates, large part-time workforces, and the need for rapid onboarding. ATS improves QSR hiring with high-volume capabilities, mobile applications, quick screening, and batch processing.

Full-service restaurants prioritize diverse skills among servers, bartenders, kitchen staff, and management, along with detailed tip reporting and higher skill requirements. ATS solutions offer skill-based matching, portfolio management, reference checking, and cultural fit assessment.

Your Partner in Restaurant Success

At MBE CPAs, we understand that restaurant success requires more than just number-crunching. It requires partnership, specialized knowledge, and reliable systems.

- MBE CPA’s Affiliate, Payroll Solutions feature integrated tip reporting and allocation, automated overtime calculations, direct deposit, reporting and analytics, and 24/7 online access for both managers and employees.

- MBE CPA’s Affiliate, Workforce Solutions goes beyond basic payroll with benefits administration and enrollment, workers’ compensation management, HR compliance and documentation, and performance management tools.

- Workforce Solutions’ Application Tracking System (ATS) includes industry-specific job templates, a mobile-friendly application process, automated screening and communication, compliance-focused record-keeping, and integration with payroll and HR systems.

Our team doesn’t just process your payroll; we help you understand and manage your labor costs through labor cost analysis, forecasting models, budgeting support, and performance metrics. We provide key restaurant data that you can use to make smarter business decisions.

Contact MBE CPAs today to learn how Payroll Solutions and Workforce Solutions can transform your restaurant operations.