Fuel Excise Tax Refunds Your Business Needs

Authored by: Greg Patel — Partner, CPA | Date Published: October 24, 2025

If you’re employed in farming, construction, aviation, or marine operations, here’s a question worth thousands: Are you paying fuel taxes you don’t owe? If you’re also stuck wondering, you may be about to discover you’ve been overpaying the government for years.

Every time you fill up at the pump, the federal government collects excise taxes. However, when that fuel powers equipment that never touches public roads, like bulldozers, boats, or tractors, there is an offered refund.

The problem? Most businesses don’t know these refunds exist, let alone how to claim them. If you’re operating these types of equipment, you’ll want to read this guide to learn everything you need to know about the Federal Fuel Excise Tax and what to do about it this quarter.

Featured Topics:

Understanding the Federal Fuel Excise Tax

For America’s highways, the Federal Fuel Excise Tax can be thought of as a toll system. This user fee is paid at the pump, rather than when passing through on the interstate.

What’s the tax’s purpose? The funding generated at the pump finances the construction and maintenance of federal highways, bridges, and transportation infrastructure.

However, the roads are not the only beneficiary. This tax is designed as a “benefits received” tax. Not everyone drives on highways, especially those who fill up tractors that never leave fields or generators at a construction site. Those individuals shouldn’t have to pay a tax for a benefit they’re not receiving, which is why Congress created a refund system.

That’s where Form 8849 allows you to claim a refund from excise taxes.

Remember: You must put in the work to get your money back; the IRS won’t automatically send it to you.

Who Qualifies for Fuel Refunds?

If your fuel doesn’t power a vehicle on public highways, you likely qualify for a refund. Most of us have never seen a tractor or any aircraft on the highway (at least we hope not), so stop paying taxes like you’re operating any other motor vehicle.

Let’s break down the major qualifiers for Form 8849:

- Farming & Agriculture: Running tractors and other farm machinery for farming purposes.

- Construction & Landscaping: Any equipment and machinery on private property or construction sites, like generators, tractors, bulldozers, and forklifts.

- Commercial Fishing & Marine Operations: Fuel used in boats for commercial fishing operations.

- Aviation: Certain helicopter and fixed-wing aircraft uses qualify, as well as military aircraft.

For further clarification, let’s say you are a taxpayer using gasoline to power a lawnmower in your own yard. This does not qualify as off-highway business use. However, using a lawn mower in your landscaping business services for customers qualifies the used gasoline as an off-highway business fuel.

The main takeaway is that any engine that doesn’t propel a vehicle, such as backup generators, pumps, or compressors, can qualify for the refund. But even if your equipment qualifies, the fuel you use to drive into town is not refund eligible, so make sure you’re properly making distinctions.

How to Calculate & Claim Your Potential Refund

When filling up at the tank, we all think about what we could’ve spent that money on. You’re one of the lucky ones who can actually get your money back. Understanding your potential recovery helps justify the administrative effort, so we’ll help you with a quick calculation.

Your Annual Refund = (Gallons Used Off-Highway per Year) × (Tax Rate per Gallon)

Here’s an example: If you used 5,000 gallons of diesel fuel off highway this year, and your state’s excise tax rate is $0.24 per gallon, your potential refund would be: 5,000 × $0.24 = $1,200.

To claim the refund, you must follow a refund computation schedule. Before you begin, gather all fuel purchase invoices for the claim period. Ensure each invoice clearly shows the date, vendor name, fuel type, quantity purchased, and price per gallon (including tax).

We’ll walk you through it:

- Complete the Fuel Purchase Schedule listing each invoice being claimed. Price per gallon, column (e), should include tax.

- Attach additional sheets instead of the standard purchase schedule if necessary. The alternative spreadsheet must contain the same information, in the same order as requested on the purchase schedule. For Wisconsin, it’s the MF001 purchase schedule. Check which schedule is correct for your state.

- List purchases in date order (oldest first) by fuel type. Provide a total on the last line of the schedule.

- Do not include copies of your fuel purchase receipts with the claim; the department will request copies of any receipts if required. However, it is still important to maintain these invoices for your records.

There are additional details to consider when checking if you qualify for a refund. Take a look at these qualifications below:

- For off-road agricultural and non-agricultural claims, indicate the number of gallons that were used in licensed vehicles. A vehicle is licensed when it has been issued a license plate for traveling on public roads.

- For taxicab refund claims: indicate the number of gallons entered in column (b) that were not used in a taxicab for transporting passengers.

- Separate purchase when possible: Some fuel suppliers can provide red-dyed fuel for off-road use, which is sold tax-free. This eliminates the need for refund claims.

If you’re unsure if you qualify or simply don’t know where to start, consider consulting with a trusted advisor.

Addressing Mistakes & Staying Informed

You have concluded that the fuel you use qualifies for a refund. What’s next? With accuracy, consistency, some groundwork, and a little guidance, you can start putting dollars back in your pocket.

Here are the best practices that ensure your refund claim is accepted:

- Track Your Fuel Usage

- Determine Your Filing Schedule

- Complete Form 8849

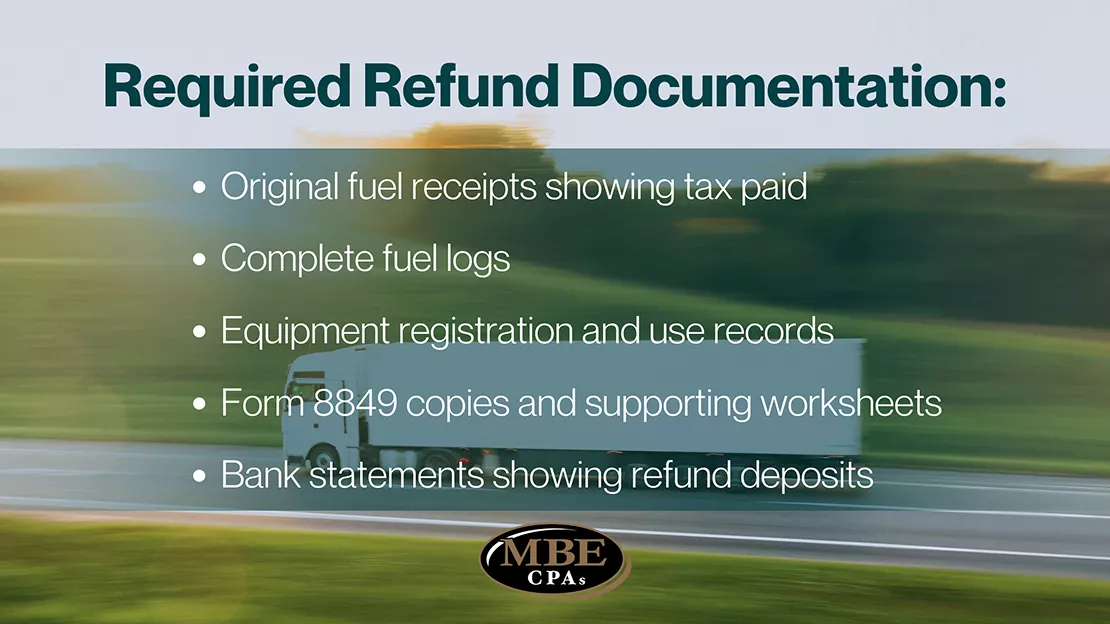

- Submit & Maintain Records: Keep records of vehicles and equipment used, including proof of ownership. Hold on to copies of invoices or receipts for the fuel purchases.

In this industry, many businesses unknowingly miss out on fuel tax refunds just from being unaware. The good news is that most state revenue departments have agricultural or off-highway fuel tax information. To check if you’re fully optimizing your agriculture business, read our recent news and updates.

To learn from others’ errors and claim what’s yours, let’s look at an example:

A Nebraska family operates a 1,200-acre grain farm. When the third generation took over management in 2023, they implemented modern accounting practices.

When reviewing expenses, they realized they’d never claimed fuel tax refunds despite operating six tractors, three combines, and multiple irrigation pumps. They retroactively filed for 2023 and implemented quarterly filing for 2024.

The Results:

- 2023 recovery: $8,400

- 2024 refunds: $11,200

- 2025 projected: $12,800 (projected through October)

- Total three-year recovery: $32,400

That money, which they had already spent, may have funded their precision agriculture GPS upgrade in the future, and they almost missed the opportunity to get it back and put it toward better use.

The key takeaway? Stay informed, keep records clean, and review your tax strategy regularly. The Fuel excise tax refunds made possible by Form 8849 are often overlooked, not because they’re inaccessible, but because they fall through the cracks of outdated accounting habits or limited awareness.