Dodge 5 Tax Audit Traps with Ease

Authored by: Michelle Sainio — Partner, CPA | Date Published: December 4, 2025

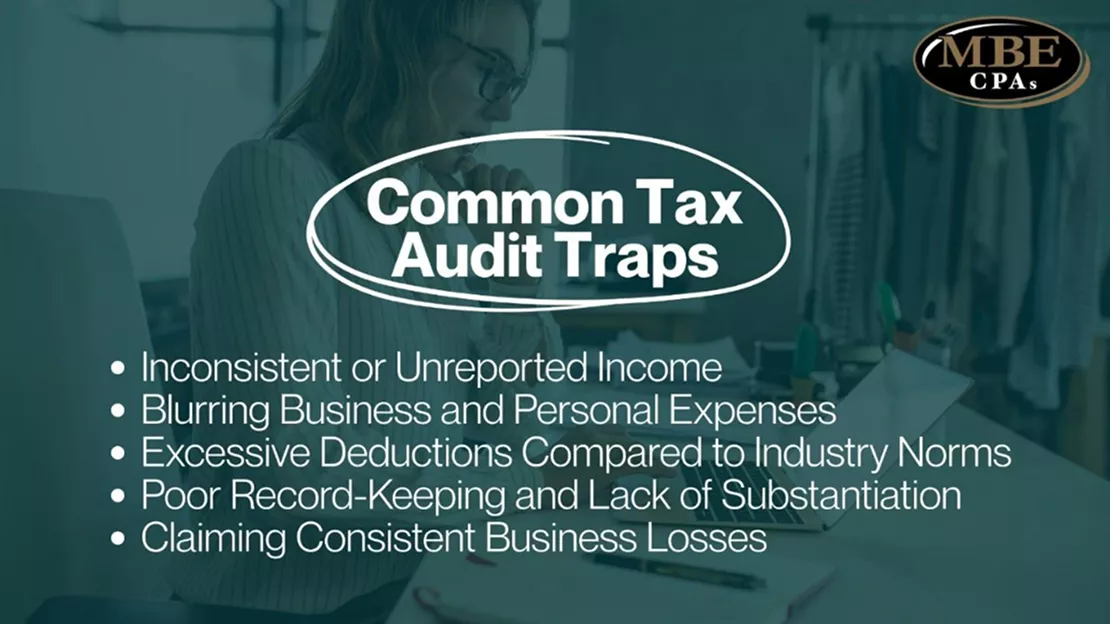

The thought of an IRS tax audit can be daunting for any small business owner. While the majority of returns are never flagged, a few common mistakes consistently draw IRS scrutiny. The good news is that these audit triggers are entirely manageable. By addressing five frequent errors, you can significantly minimize your risk, keep more of your hard-earned money, and file your taxes with greater confidence.

In this blog, we’ll go over five common tax audit traps for small businesses and provide actionable strategies to help you avoid them.

Featured Topics:

- What is Inconsistent or Unreported Income?

- How Can I Avoid Blurring Business and Personal Expenses?

- What is Considered an Excessive Deduction Compared to Industry Norms?

- How Poor Record-Keeping and Lack of Substantiation Affects Your Business

- How Claiming Consistent Business Losses Can Hurt Your Business

- Build Audit Confidence with Professional Support

What is Inconsistent or Unreported Income?

The IRS employs advanced software to cross-check the income reported on your tax return with data submitted by third parties—such as banks, clients, and payment processors that issue Forms 1099-NEC or 1099-K. Any discrepancies between reported and third-party income immediately trigger a high-priority red flag. This most frequently occurs due to cash transactions, overlooked side-gig earnings, or missing 1099 forms amid the busy tax season.

Actionable Strategy: Reconcile and Report Everything

- Perform an Annual Income Reconciliation: Before filing, cross-reference every 1099-NEC, 1099-K, 1099-INT, and W-2 you receive with the total revenue recorded in your business’s accounting software or ledger.

- Report All Income: If you receive a payment in cash or from a source that doesn’t issue a 1099 (like smaller freelance gigs), you are still legally required to report it. Every dollar counts.

- Use Separate Accounts: Keep dedicated business bank accounts and credit cards so that all business income flows through a clearly tracked channel.

How Can I Avoid Blurring Business and Personal Expenses?

Attempting to deduct a personal expense like a family vacation, daily commute, or personal services as a business cost is a typical audit mistake. This practice, known as co-mingling, not only complicates your financial records but also signals to the IRS that you may be bending the rules.

The IRS expects a clear separation between business and personal finances. If an auditor discovers personal purchases like groceries paid from your business account, it may prompt them to scrutinize all your other deductions.

Actionable Strategy: Maintain Financial Separation

- Establish Separate Accounts: This is non-negotiable. Use dedicated checking accounts and credit cards only for business transactions.

- Document Reimbursements: If you must use a personal card for a business expense, record the purchase, promptly reimburse yourself, and maintain a detailed paper trail.

- Focus on “Ordinary and Necessary”: Only deduct expenses that are ordinary (common and accepted in your industry) and necessary (helpful and appropriate for your business).

What is Considered an Excessive Deduction Compared to Industry Norms?

The IRS routinely compares your tax return to the averages of similar businesses within your industry and revenue bracket. If your deductions for categories such as travel, meals, or advertising are notably higher than those of your peers, your return may attract extra scrutiny.

Actionable Strategy: Justify the Outliers

- Benchmark Against Your Industry: While you don’t have to match industry averages exactly, be aware if your figures are outliers.

- Super-Document Outlier Deductions: If you have valid reasons for high expenses (e.g., a large equipment purchase this year, or a significant one-time business trip), make sure your documentation is strong.

How Poor Record-Keeping and Lack of Substantiation Affects Your Business

The most frequent reason a valid deduction is denied during an audit is inadequate documentation. For example, if an auditor asks for proof of a $500 business dinner and you only provide a credit card statement labeled “Restaurant,” the expense will be disallowed. The burden of proof is always on the taxpayer.

Actionable Strategy: Document Everything, Instantly

- Go Digital: Use accounting software or mobile apps to capture photos of receipts immediately.

- Record Details for Meals/Travel: For business meals, the receipt alone is not enough. You must also record:

- The business purpose of the discussion.

- The date and location.

- The names of the people who attended.

- Keep Records for 3 to 7 Years: Keep all supporting documentation for at least three years from your filing date and longer for certain items like business assets.

How Claiming Consistent Business Losses Can Hurt Your Business

It’s normal for new businesses to experience losses in their early years. However, if your business consistently reports net losses year after year, the IRS may reclassify your activity as a “hobby” rather than a legitimate business.

If the IRS deems your business a hobby, you may only deduct expenses up to the amount of income earned. As a result, significant losses will be disallowed, leaving you responsible for back taxes and potential penalties.

Actionable Strategy: Establish and Prove a Profit Motive

- Show Profit in 3 of 5 Years: The IRS generally presumes you are in business to make a profit if you show a net profit in at least three of the past five tax years.

- Document Business Intent: If you are still in a loss phase, ensure you have documentation that proves your intent to make money. This includes:

- A formal business plan.

- Evidence of marketing, advertising, and changes in operational methods to improve profitability.

- Separate business records and licenses.

Build Audit Confidence with Professional Support

While understanding these five common audit traps is your first line of defense, implementing proper bookkeeping practices consistently requires time, experience, and attention to detail that many business owners simply don’t have. That’s where professional help makes all the difference.

At MBE CPAs, our experienced team specializes in helping small businesses maintain accurate, compliant financial records that stand up to IRS scrutiny. Our accounting and bookkeeping services help your finances stay audit-ready year-round. Don’t wait until you receive an audit notice to get your records in order. Contact us today to learn how our personalized bookkeeping solutions can give you peace of mind and freedom to focus on growing your business with confidence.