Turn Great Hires into Great Tax Credits

Authored by: Brett Leibfried — Partner, CPA | Date Published: January 20, 2026

Every time you bring on a new employee, you’re investing in your business. You’re paying for job postings, spending hours in interviews, covering onboarding costs, and adding another name to payroll. It adds up quickly. What if I told you that some of those hires could actually reduce your federal tax bill by thousands of dollars per person?

Many employers are unaware that they qualify for a tax credit that rewards hiring qualified candidates. In my experience at MBE CPAs, I have seen numerous companies miss this opportunity due to a lack of awareness. The Work Opportunity Tax Credit (WOTC) is a well-established federal program that provides substantial financial benefits as you grow your team.

Featured Topics:

What Is the Work Opportunity Tax Credit (WOTC)?

The Work Opportunity Tax Credit is a federal tax credit available to employers for hiring individuals from certain targeted groups who have faced barriers to employment. Think of it as the government saying “thank you” for giving someone a second chance or helping a veteran transition back into civilian work.

This tax credit applies to wages paid to eligible individuals who start work on or before December 31, 2025. Businesses can receive credits of $1,200 to $9,600 per qualified hire.

Who Qualifies for This Tax Credit?

This is where it gets interesting. You might already be hiring people who qualify without even realizing it. The program includes 10 targeted groups, and you’d be surprised how many of your potential hires fall into one of them.

Veterans and Military Families

- Those who’ve served our country and may be receiving SNAP benefits

- Veterans with service-connected disabilities

- Veterans who have been unemployed for extended periods

Individuals Receiving Government Assistance

- SNAP recipients between 18 and 40 years old

- TANF recipients working to get back on their feet

- SSI recipients receiving Supplemental Security Income benefits

- Recipients of long-term family assistance (LTFA) who have received benefits for at least 18 months or whose eligibility has recently expired.

People Facing Employment Barriers

- Ex-felons hired within a year of their conviction or release

- Long-term unemployed individuals who’ve been out of work for 27 weeks or more

- Vocational rehabilitation referrals for individuals with disabilities who have completed or are completing rehabilitation programs

Youth and Community Programs

- Summer youth employees ages 16-17 living in designated areas, working during the summer months

- Designated community residents living in empowerment zones or rural renewal counties

What Are the Credit Amounts You Can Receive?

The credit is typically 40% of up to $6,000 in wages paid to certified individuals, with a maximum of $2,400 per employee who works at least 400 hours. For employees working between 120 and 399 hours, a 25% credit applies.

Here’s where the tax benefits for hiring veterans become even more substantial. Up to $24,000 in wages may be considered in determining the WOTC for certain qualified veteran-targeted groups. That means you could receive up to $9,600 for hiring an eligible veteran.

There is no limit to the number of qualified employees you can hire. As your team grows, these credits can accumulate substantially.

How Do You Claim This Credit?

I know what you’re thinking. “This sounds great, but is it going to be a paperwork nightmare?” I hear you, and I’m happy to say it’s more straightforward than you might expect.

Here’s your simple roadmap for the application process.

Have your job applicant complete Form 8850 on or before their first day of work.

- Form 8850 (Pre-Screening Notice and Certification Request) helps determine if they’re part of a qualifying group.

- Completing this form early means you can submit it within the required 28-day window.

Within 28 days of your new employee's start date

- Submit the completed form to your state workforce agency (not the IRS).

- You may need additional forms depending on the targeted group.

- Your state agency will review and certify eligibility.

After receiving certification

- Keep that certification document safe with your tax records.

- When filing your business tax return, complete Form 5884 (Work Opportunity Credit)

- The credit reduces your federal tax liability dollar-for-dollar

While those steps seem clear, many of our clients find that managing them themselves raises concerns. To get these credits, you have to ask for very personal information. If you handle this in-house, you are forced to collect sensitive HR data that is usually best left private.

We often suggest hiring a vendor to handle the details for you, so you do not have to be involved in that part of the process. We recommend a company like HireTech, or you can reach out to us for a referral. Using a third party acts as a helpful buffer. It keeps the sensitive details away from your hiring team and makes sure you do not miss those tight deadlines.

What Mistakes Should You Avoid?

After helping countless businesses with WOTC claims, I’ve seen a few common stumbling blocks. Let me save you some headaches:

- Missing the 28-day deadline: This is the biggest mistake I see. The window closes fast, so build this step into your hiring process from day one.

- Handling the data yourself: As previously mentioned, it is often better to use a vendor so you are not personally reviewing sensitive background info.

- Forgetting to track hours: You need documentation showing your employee worked the required hours. Your payroll system should already track this, but double-check.

- Rehiring former employees: The credit applies only to new hires, not to people returning to your company.

- Skipping the pre-screening: Don’t wait until after someone’s been hired to consider WOTC. Start the conversation during the application process.

- Not keeping proper documentation: Keep all forms, certifications, and supporting documents. If the IRS comes knocking, you’ll want everything organized and ready.

Is Pursuing This Credit a Good Investment?

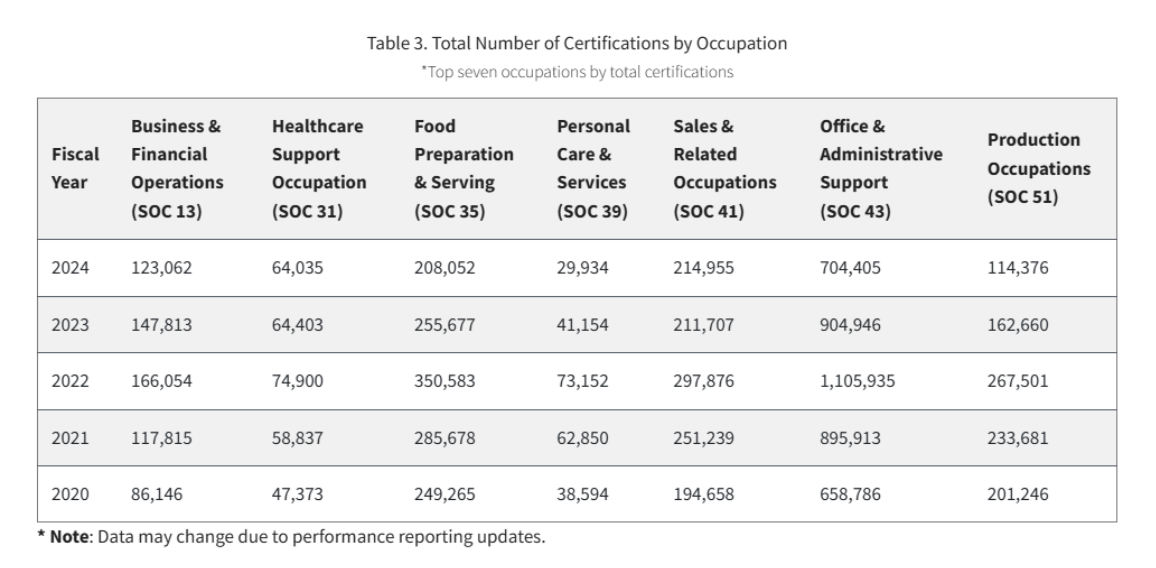

We understand that running a business is demanding. However, if you are hiring, it makes sense to use available credits. Consider the sheer magnitude of the program: the U.S. Department of Labor (DOL) certified 1,577,683 WOTC-eligible hires nationwide during Fiscal Year 2024 alone.

This is a massive federal incentive that demonstrates a significant opportunity for tax savings.

Let’s say you hire 10 people this year, and just two of them qualify for the full $2,400 credit. That’s $4,800 back in your pocket. For many small businesses, that’s meaningful money that can go toward equipment, marketing, or even hiring another employee.

The Bottom Line

The Work Opportunity Tax Credit isn’t just about saving money on taxes. It’s about opening doors for people who face real barriers to employment. It’s about building diverse, resilient teams. And it’s about taking advantage of programs designed to help businesses like yours succeed.

The Work Opportunity Tax Credit program is currently authorized through December 31, 2025, so now is the time to make sure you’re not leaving money on the table. Review your hiring processes, train your HR team on the pre-screening forms, and build WOTC into your standard procedures.

Got questions about how WOTC might work for your specific situation? Want help making sure you’re capturing every credit you’re entitled to? That’s exactly what we’re here for at MBE CPAs. Give us a call, shoot us an email, or stop by. We’d be happy to walk through your hiring plans to see where you might benefit.

The tax-savings strategy you put into action is the one that delivers results. Don’t miss out on available opportunities.