Boost Freelancer Tax Savings Now

Authored by: Diane Payne — Partner, EA | Date Published: December 15, 2025

If you’re a freelancer, independent contractor, or sole proprietor, running a business means you’re wearing the apron while also signing the checks. The bright side of operating as your own CFO, tax strategist, and compliance officer is that the tax code offers significant advantages to the self-employed. Of course, these savings don’t come automatically. You need to know where to look.

We’ve outlined how freelancers, like you, can better understand your taxes and prepare for this season with money set aside. By claiming the deductions that were created for you and setting up ways to start earning money on your income, tax season will look less like the most stressful time of your year.

Featured Topics:

Understanding Your Tax Reality

Before we dive into deductions, let’s talk about what makes your tax situation unique.

When you work for yourself as a sole proprietor, you:

- Report your business income and expenses on Schedule C.

- Get taxed at your individual income tax rates.

- Are subject to self-employment tax which covers Social Security and Medicare.

Essentially, your business is an extension of you, not a separate tax entity. This simplicity is one reason many freelancers start as sole proprietors but then forget to properly track and deduct legitimate business expenses.

When you were an employee, your employer paid half of your Social Security and Medicare taxes, and you covered the other half through payroll deductions. Now that you’re paying both halves of your taxes, your net self-employment income will benefit from finding deductions you qualify for.

If you find yourself asking, “What if I properly tracked and deducted business expenses throughout the year,” then it’s time we re-evaluate your tax season plan.

Build Your Foundation with Deductions

Every business needs tools, and yours is no exception. The beauty of deductions is their breadth. Many essential aspects of owning a business allow you to qualify for money saving.

Here are deductions to investigate:

- Home Office: If your home office space is regularly and exclusively used for business purposes, you qualify for the deduction.

- Equipment & Supply: Thanks to Section 179, you can deduct the full cost of qualifying equipment purchases, such as computers, machinery, and vehicles, in the year you buy them.

- Qualified Business Income: A provision of the 2017 Tax Cuts and Jobs Act many freelancers miss is that self-employed individuals can deduct up to 20% off their qualified business income. This puts sole proprietors on a more equal footing with C corporations.

- Health Insurance Benefit: On Schedule 1 of your Form 1040, you can deduct medical, dental, and vision insurance premiums if you’re paying for them yourself. You get the deduction even if you take the standard instead of itemizing.

Let’s look at a realistic example:

A freelance photographer has built a successful business specializing in product photography for small e-commerce brands. A problem began to brew when their growing collection of props, backdrops, and styling materials was taking over their apartment. After consulting with a CPA, they realized that storing inventory in your home qualifies for the home office deduction even if that space doesn’t meet the ‘exclusive use’ test. And if you’re using the regular method, you can deduct the business percentage of actual expenses.

Freelancers can significantly benefit from the home office deduction. You can read more about the benefits of claiming the business space in your home.

Your job is to know the rules, play by them, and take every legitimate advantage available. Document everything and never claim something that isn’t truly business-related. Within the boundaries of what a freelancer qualifies for, be adamant about identifying and claiming every deduction you’re entitled to.

Save on Taxes with Retirement Contributions

One of the biggest mistakes freelancers make is neglecting retirement savings. Even without an employer 401(k), the self-employed still have access to powerful retirement savings.

Here are options to consider:

- Simplified Employee Pension IRA: SEPs can generate a significant source of income at retirement without the start-up and operating costs of a conventional retirement plan. It’s a great option if cash flow is an issue in your case and is available to all business sizes.

- Solo 401(k): This plan offers the highest contribution potential by allowing you to contribute as both employee and employer. Some solo 401(k)s also allow Roth contributions and loans.

- Simple IRA: If you plan to hire employees, this is the best option. Even with lower contributions, it’s easier to administer, reduces your taxable income, and builds your wealth. A conservative percentage over time can grow to thousands of dollars.

Treat your money as if it’s already gone. Choosing to start saving for retirement must also be paired with proper tax planning. You can’t make contributions if all your savings go to taxes.

Common Tax Mistakes that Cost Freelancers

Many freelancers fall into the trap of spending every dollar you earn because “investing” in your company is what helps it grow, right? Wrong.

While investing in business development is important, the critical mistake is forgetting to set aside money for taxes. When April rolls around, you’ll face a sneaky surprise when you owe thousands of dollars that you didn’t save. Many freelancers also overpay by missing legitimate deductions hiding in plain sight.

Ask yourself: “Does this help me run my business or improve my professional capabilities?” If yes, it’s likely at least partially deductible.

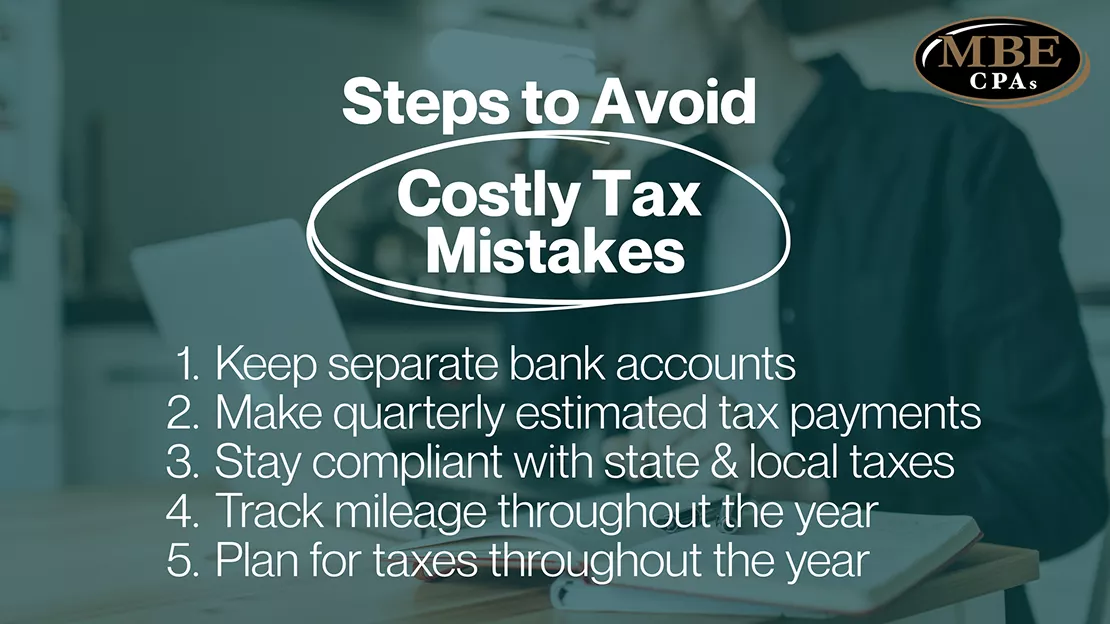

Here’s what you can do to avoid costing your business more money than it has:

- Separate your personal & business expenses: Opening a separate account for your business makes it easier to track business income and expenses, which is crucial for accurate bookkeeping and tax returns

- Make quarterly estimated tax payments: Self-employed individuals don’t have their income withheld, so instead of attempting to set aside enough money throughout the year, divide your total estimated tax liability by four to get your quarterly payment amount.

- Stay compliant with state & local tax obligations: As a freelancer, you are responsible for paying federal, state, and local taxes. These include income and self-employment taxes which are typically paid quarterly.

- Track your mileage throughout the year: Expenses incurred while traveling for business purposes, like fuel and tolls, are deductible.

- Plan for taxes throughout the year: Set aside money, track all income and expenses, and maximize deductions.

Learn more about mistakes that you should avoid this tax season.

After implementing these steps into your yearly practices, you:

- Already paid most of your estimated taxes by November

- Covered any outstanding business expenses by December

- Finalized all allocated retirement contributions by January

- Filed your return by April

Remember: Just because you can file your own taxes doesn’t mean you should. Consider working with a quality CPA that will help proactively plan for taxes year-round on top of preparing your return during tax season.

Start Investing in Your Skills

Here’s the real secret successful freelancers understand: the tax code provides you with monetary rewards, but the most powerful improvement is focusing on your professional skills. If your further education maintains or enhances abilities that are required in your current business, then it’s another deduction to take.

The tax code is designed to encourage business investment and growth. Reducing your tax bill is important, but increasing your skills and earning potential will keep your business in solid standing for the future. Depending on your point of view, deductions are only tricks if you’re not willing to take the risks and find new ways to receive incentives for self-employment.

Start today:

- Open a separate business account

- Choose an expense-tracking system and use it consistently

- Set aside money for quarterly estimated taxes

- Review your home office setup

- Schedule time to research retirement plan options

- Find a tax professional

You’ve taken the risk of self-employment, putting in long hours and building something from nothing. Just because you don’t know what to look for doesn’t mean you don’t qualify. That’s where MBE CPAs can step in.

Focusing on understanding your unique needs, our team at MBE CPAs creates customized tax strategies to improve your tax position while keeping your goals and objectives in mind. Start implementing systems to capture the benefits of the tax code.