Building Your Next Culver’s With Tax Savings

Authored by: Kim Wegner — Partner, CPA, CVA, CGMA | Date Published: January 23, 2026

That moment when you realize you’ve built one successful Culver’s location tells you something important: your systems work. Your team knows what they’re doing. Your guests keep coming back for fresh burgers and custard. Naturally, you start thinking about what comes next.

Opening a second location sounds exciting until you look at the numbers. The build-out costs add up faster than you expected. Equipment alone can run into six figures. Then there’s the real estate, construction delays, and the months before that new location starts turning a profit. You need capital, and you need it without putting unnecessary strain on your first location’s cash flow.

But what if I told you that tax planning could help you pay for your next build? Not through tricky loopholes or risky moves, but through a method restaurant owners have used for years to free up cash when they need it most. One approach that makes this possible is a cost segregation study, which allows you to recover certain costs faster by reclassifying parts of your building for quicker depreciation.

Featured Topics:

- Why Does Tax Planning Matter More as You Grow?

- What Is Cost Segregation and How Does It Work?

- How Does Recent Tax Legislation Affect This Strategy?

- Can You Use Cost Segregation on Existing Properties?

- What Steps Should You Take Before Your Next Build?

- How Do You Connect Cost Segregation to Your Overall Growth Plan?

- What Makes Working with Someone Who Understands Restaurants Different?

- What Comes Next?

Why Does Tax Planning Matter More as You Grow?

Most Culver’s owners know their tax accountant handles their annual return and quarterly estimates. That relationship works fine when you’re running one location. Your accountant files the paperwork, you pay what you owe, and you move on to the next day’s operations.

Growth changes everything. When you plan your second location, the financial questions get more detailed:

- How do you structure the new entity?

- What happens to your tax bill when both locations are profitable?

- Which deductions can you take, and when should you take them?

This shift is why planning matters more than just following the rules. Tax preparation looks back at last year, whereas tax planning looks ahead to what you want to build and helps you keep more cash available.

The real value often shows up after the return is filed. That line might surprise you, but it reflects what happens when owners take time to sit down with someone who understands both restaurant operations and tax law. You discover opportunities you didn’t know existed.

What Is Cost Segregation and How Does It Work?

The concept of cost segregation is straightforward. Generally, the IRS requires you to depreciate a commercial building over 39 years. If you spend $1.5 million on a new Culver’s, you might only write off about $38,000 each year. For an owner looking to grow quickly, waiting four decades to recover those costs does not help with today’s expansion needs.

A cost segregation study looks at the specific parts of your restaurant. A Culver’s is more than just a shell of a building. It includes:

- Walk-in coolers and specialized freezer units

- Kitchen ventilation and dedicated plumbing lines

- Decorative lighting and custom flooring

- Parking lot improvements and outdoor signage

By identifying these items, a study reclassifies them into 5, 7, or 15-year depreciation periods. If you spend $500,000 on a build-out, a study might find that $200,000 of those costs can be written off much faster. This results in larger deductions in the first few years, when you need cash the most to cover opening costs.

How Does Recent Tax Legislation Affect This Strategy?

Tax rules change, and those changes can work in your favor when you time things well. The One Big Beautiful Bill Act (OBBBA), signed into law in July 2025, adjusted provisions that restaurant owners should understand.

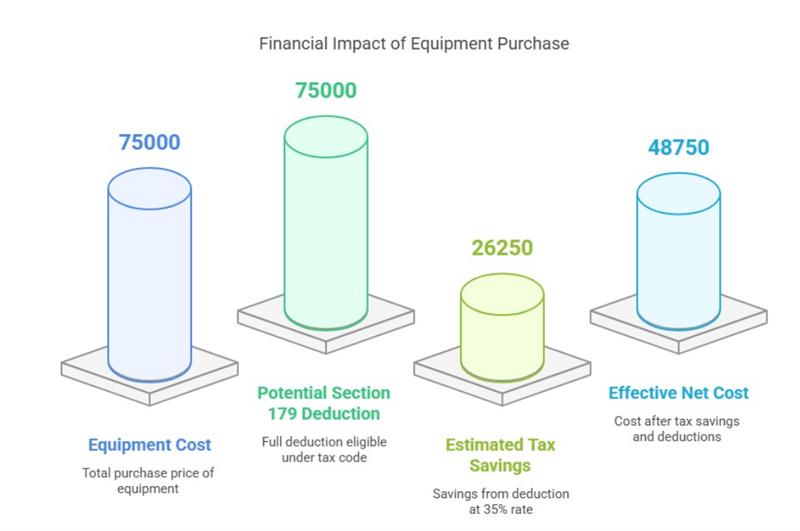

Under the OBBBA, 100% bonus depreciation for qualified property placed in service after January 19, 2025, has been reinstated. The law also increased the Section 179 expensing limit to $2.5 million for 2025. So, what does this mean for your next Culver’s build? Instead of spreading out those reclassified assets over 5, 7, or 15 years, you can now write off the full amount in the first year your new place opens. For most restaurant projects, first-year tax savings often go beyond $300,000 when you use cost segregation and these depreciation rules together.

Think about what that money could do for your business. You might:

- Build a stronger reserve fund for the new location’s ramp-up period.

- Cover unexpected construction overruns without touching your operating line.

- Make additional equipment purchases for your existing location.

- Start planning for location number three sooner than expected.

The timing matters here. Properties placed in service after January 19, 2025, qualify for the full benefit. If you’ve been thinking about starting your next build, now is the time to move forward with your planning.

Can You Use Cost Segregation on Existing Properties?

You don’t need to wait until your next build to benefit from cost segregation. If you’ve purchased or renovated an existing Culver’s location in the past several years, you can still take advantage of this planning tool through what’s called a lookback study.

A lookback study goes back and analyzes what you should have been depreciating differently all along. You don’t have to amend previous returns. Instead, you use a “catch-up” adjustment that lets you claim all those missed deductions in the current year.

This approach works particularly well if you:

- Purchased your current location within the last 15 years.

- Completed a major renovation or remodel recently.

- Added new equipment or expanded your dining area.

- Made significant improvements to your parking lot or outdoor areas.

The catch-up amount can be substantial, particularly if you’ve owned the property for several years. That one-time adjustment to your current year return can free up cash you didn’t know was available.

What Steps Should You Take Before Your Next Build?

Planning is the most important part of the process. You should consider cost segregation before you break ground, as your construction contracts and architectural plans provide the data needed for a strong study.

The first step is a conversation with your CPA about your expansion timeline. Sharing your budget early allows your accountant to estimate the tax savings. Once you decide to move forward, you work with a firm that specializes in these studies. They will review your detailed cost breakdowns to confirm the study meets IRS standards.

After the study is finished, the results are integrated into your tax filing. Your depreciation schedules are updated, and the increased deductions appear on your return for the year the property was placed in service. This keeps your records organized and prepares you for future growth.

How Do You Connect Cost Segregation to Your Overall Growth Plan?

Cost segregation is most powerful when it is part of a larger discussion about your future. We focus on where your business is going over the next three to five years. We want to know whether you plan to open one store per year or expand into a new state.

Research from the Tax Foundation in 2025 indicates that allowing businesses to recover investment costs quickly through accelerated depreciation leads to a measurable increase in capital investment and higher long-term wages. At MBE CPAs, we align these tax moves with your growth goals. If you are in a heavy growth phase, we front-load your deductions. If you plan to slow down, we can spread the benefits out to match your needs.

We also look for other opportunities, such as payroll tax credits. When you combine these credits with cost segregation and the right business structure, you can often fund a large part of your next build through tax savings alone.

What Makes Working with Someone Who Understands Restaurants Different?

General tax advice often falls short for Culver’s owners. Your business has specific equipment requirements and margin pressures that a retail store does not face. You need a partner who understands how your average unit volume affects your ability to borrow money for expansion.

At MBE CPAs, we’ve walked alongside Culver’s owners through the entire growth journey. We know the Culver’s brand and what it takes to grow from a single location to a multi-unit portfolio. We understand why your labor costs might be higher due to your commitment to fresh food and why the timing of your build matters so much.

When you work with a team that respects your individuality and your goals, the advice you receive fits your actual life. You avoid the mistakes that happen when a firm treats you like just another number on a spreadsheet. We are here to support your progress and celebrate your success as you build your legacy.

What Comes Next?

If you are ready to grow, cost segregation should be a part of your financial plan. The current tax laws, combined with the specific nature of restaurant buildings, create a unique window of opportunity. The savings are substantial, and the process is well-established.

Growth should be a rewarding experience that makes your business more stable. By planning ahead and using these tax moves, you can expand with the certainty that you have the financial foundation to succeed. Your next Culver’s build is an opportunity to bring the brand to a new neighborhood, and we want to help you fund it the right way.