How Asset Tracking Improves Sustainable Growth for Your Farm

Authored by: Kevin Block — Partner, CPA | Date Published: November 25, 2025

The sun hasn’t yet burned off the morning mist as you check bin levels at your main grain storage. Texts from farm managers roll in, detailing overnight cattle counts and supply shortages across four counties. Your accountant’s quarterly report is due, but the figures on your clipboard don’t match your computer system. This common scene on large scale farming operations in the United States shows why some agribusinesses consistently perform better financially while others struggle with cash flow. The key difference is a fundamental practice: they know precisely what they own, where it is, and its value at any moment.

My work with Midwestern agricultural producers shows that those who build century farming legacies manage farm inventory well early on, while others face frequent monetary shocks. With net farm income projected to increase by $48.8 billion in 2025, large farming operations have a significant opportunity. Succeeding means practicing fiscal oversight that goes beyond pen and paper. This guide details why inventory tracking and valuation are essential for capitalizing on this growth.

Featured Topics:

- Why Does Inventory Management Matter for Large Operations?

- What Are the Best Practices for Tracking and Valuing Your Agricultural Assets?

- How Does Inventory Management Impact Your Financial Reporting and Tax Obligations?

- What Technology Solutions Can Transform Your Inventory Tracking?

- When Should You Use Cash vs Accrual Accounting for Your Large-Scale Operation?

- Building Your Farm Inventory Management Foundation for Sustainable Growth

Why Does Inventory Management Matter for Large Operations?

Farms in the United States face unique stock control challenges that smaller operations don’t. When you’re managing thousands of head of cattle, storing grain across multiple facilities, or maintaining equipment fleets worth millions, every miscount or valuation error multiplies across your entire enterprise.

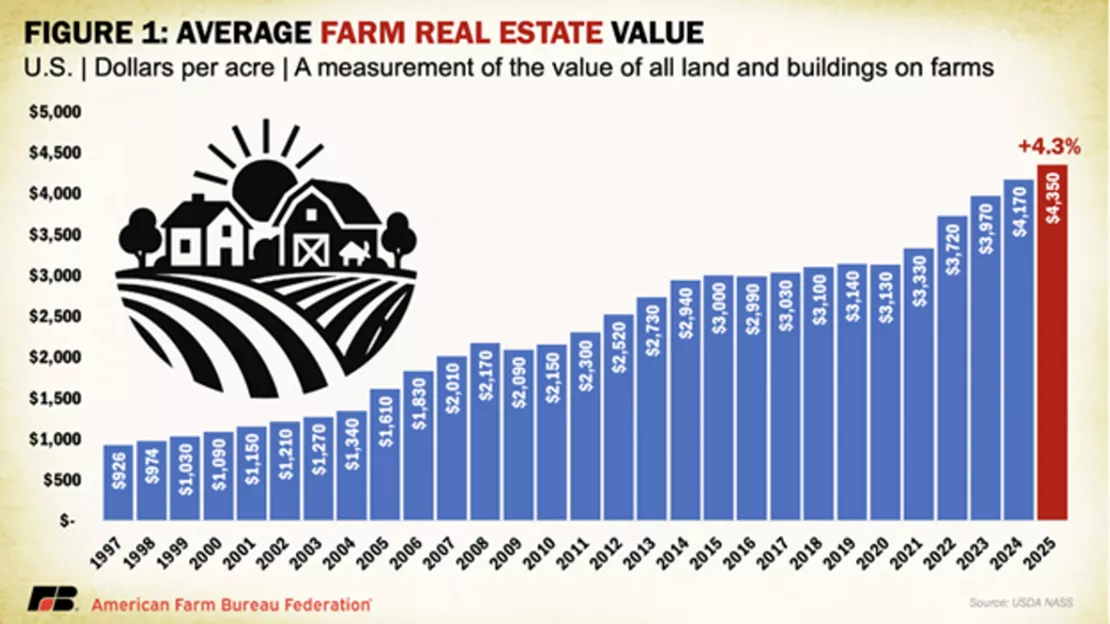

The stakes have never been higher. While this marks the fifth consecutive annual increase, the pace of growth is slowing compared to previous years, indicating a maturing market. Your land assets alone require reliable tracking and management. Add livestock, stored grain, equipment, and supplies to the equation, and you’re looking at asset values that can easily reach tens of millions of dollars.

The most successful operations share these characteristics:

- Treat asset management as a profit center, not just a compliance requirement.

- Invest in systems that provide real-time visibility across all locations.

- Understand that exact holding data drives better decision-making at every level.

What Are the Best Practices for Tracking and Valuing Your Agricultural Assets?

When it comes to monitoring holdings across thousands of acres, systematic approaches make all the difference. The methods that consistently work for large operations focus on physical measurement protocols and proper valuation techniques.

Crop Inventory Management

Your stored grain and growing crops are among your most valuable resources, yet they’re often the hardest to track accurately. For cash crop farming ventures, implementing comprehensive tracking systems is essential:

- Conduct weekly grain bin measurements during storage season.

- Map crop progress by specific parcels using GPS-enabled field mapping.

- Record detailed quality grades and moisture content data.

- Apply lower-of-cost-or-market valuation for stored commodities.

- Update market values monthly or more frequently during periods of market volatility.

Livestock Inventory Systems

Livestock presents unusual challenges because your capital goods literally move around. Enterprises that excel at livestock tracking focus on identification and verifiable valuation:

- Install electronic identification (EID) tags for all breeding stock.

- Conduct monthly physical counts with two-person teams for verification.

- Record birth and death data in real-time systems.

- Apply the unit livestock price method for breeding stock.

- Adjust values quarterly based on market conditions and animal performance.

Equipment and Supply Management

Your machinery and supply inventory often total millions. The best approach uses systematic equipment records with cost, purchase, and depreciation details, location-based supply tracking, high-value item check-out, and quarterly inventories.

How Does Inventory Management Impact Your Financial Reporting and Tax Obligations?

Maintaining an accurate inventory directly affects your bottom line in ways that might surprise you. When reviewing financial statements with farm clients, supply adjustments often represent the largest single impact on net income.

Your inventory values are reflected in your balance sheet and income statement. A farm’s balance sheet provides a comprehensive snapshot of assets and liabilities, underscoring the importance of inventory accounting.

Proper asset management delivers measurable financial benefits:

- Improve debt-to-asset ratios and working capital position through reliable valuations.

- Demonstrate true profitability by aligning costs with revenues through precise adjustments.

- Meet bank requirements for loan decisions and covenant compliance.

- Provide family members and partners with accurate data for informed decision-making.

Resource management also offers significant tax planning opportunities. Year-end inventory adjustments can shift income between tax years, proper crop inventory valuation can defer income recognition, and livestock inventory changes can accelerate or delay tax obligations.

What Technology Solutions Can Transform Your Inventory Tracking?

The agricultural technology market has expanded significantly with solutions designed specifically for large-scale operations. Modern Agri-tech tools provide comprehensive stock control capabilities:

- Collect real-time data through mobile apps that allow field crews to update inventory instantly.

- Manage multiple locations through cloud-based systems, providing visibility across all farm sites.

- Monitor grain bins automatically for measurement and condition data.

- Track livestock location and health using RFID and GPS technology.

Advanced analytics turn this inventory data into actionable insights by forecasting demand based on historical patterns, comparing costs across operational units, identifying price and weather risks, and generating recommendations for buying, selling, and timing storage.

When Should You Use Cash vs Accrual Accounting for Your Large-Scale Operation?

Choosing between cash and accrual accounting has a significant impact on how you manage inventory and affects your tax obligation and financial reporting. The cash method recognizes income and expenses when received and paid; the accrual method recognizes them when earned and incurred.

Different agricultural operations benefit from different accounting approaches:

- Family operations with average annual gross receipts under $31 million can use the cash method.

- Operations with minimal inventory storage benefit from the simplicity of the cash method.

- Partnerships and S and C corporations with gross receipts exceeding $31 million are required to use the accrual method of accounting.

- Operations seeking bank financing or external investment typically need to use the accrual method.

Many large agricultural enterprises use hybrid methods that combine cash accounting for certain items and accrual accounting for others, offering tax flexibility and meeting regulatory requirements.

For example, a large farm might use cash accounting to handle day-to-day operational expenses and smaller, miscellaneous purchases, enabling more immediate tracking and management of cash flow. Meanwhile, the accrual method can be applied to major capital investments, such as significant equipment purchases or land acquisitions, facilitating precise allocation of expenses over time and stable financial forecasting.

Building Your Farm Inventory Management Foundation for Sustainable Growth

The path forward requires commitment to systematic approaches and modern tools, but the payoff extends far beyond compliance requirements. A well-structured succession plan that includes your assets as a foundational part can help secure the longevity of your farming legacy. The agricultural community grows stronger when we share knowledge and support each other’s success.

Whether you’re implementing new inventory systems, evaluating accounting method changes, or improving existing processes, having experienced advisors makes the difference between struggling with inventory management and mastering it as a competitive advantage.