Tax Funding Benefits for Franchise Growth

Authored by: Kim Wegner — Partner, CPA, CVA, CGMA | Date Published: September 30, 2025

Featured Topics:

- How Can Tax Planning Fund Your Next Location?

- What Entity Setup Works Best for Multi-Unit Owners?

- When Should You Buy or Lease Equipment?

- How Do You Manage Multi-State Franchise Taxes?

- What is the Best Way to Build Cash Reserves That Minimize Your Tax Burden?

- Advanced Tax Methods for Serious Expansion

- How Can You Create an Expansion Tax Strategy Timeline?

- Your Next Steps Toward Tax-Funded Expansion

For many franchise owners, tax season feels like a roadblock to growth. You put everything into your business, yet a significant portion of profits is lost each year. Even dedicated owners feel they’re missing out on tax strategies that could fuel growth.

But what if your approach to finances could become the turning point? Across the country, franchise operators are discovering creative ways to use planning as a launchpad for new locations. With the right plan, you can turn tax season from a source of stress into the engine for your next step.

This community of growth-minded franchise owners views tax preparation as a year-round funding mechanism. Let’s explore how you can join their ranks.

How Can Tax Planning Fund Your Next Location?

Thoughtful financial planning is key to generating the immediate cash flow that can make your goals a reality. When you save $50,000 to $75,000 annually through the right approach, you have essentially created a down payment for your next location. This proactive method can serve as a strong alternative to traditional franchise finance methods.

Here’s a few tax strategies that can help you build expansion capital:

- Section 199A QBI Deduction: This allows eligible businesses to deduct 20% of their qualified business income (QBI), resulting in substantial savings.

- Equipment Depreciation Timing: Recent legislation allows for the immediate expensing of 100% of the cost for qualifying equipment, which significantly increases cash flow by accelerating deductions.

- Multi-State Filing: Careful preparation can prevent double taxation as you grow across state lines.

Consider how these approaches could help your company. By applying the Section 199A deduction, using accelerated depreciation, and managing multi-state tax obligations, you could save between $50,000 and $75,000 annually. These can provide an alternative to loans. This lets you reinvest in your next location on your own terms.

What Entity Setup Works Best for Multi-Unit Owners?

The structure you choose for growth can greatly impact your savings and long-term financial flexibility across locations. Most successful multi-unit operators use separate LLCs for each site, often paired with a holding company.

Benefits of a Multi-Entity Structure:

- Asset Protection: This structure isolates the financial and legal risks of each location. An issue at one site will not affect your entire business.

- Tax Freedom: Different entities can elect different tax treatments, which lets you improve your tax position as you grow.

- Estate & Succession Planning: This makes the process simpler for transferring or selling individual locations, simplifying ownership transitions for heirs and new buyers.

- State Tax Benefits: This allows you to take advantage of specific tax benefits or favorable regulations for certain types of entities in different states, such as a state’s pass-through entity tax provision that helps business owners deduct state and local taxes on their federal returns.

This method works well in industries with major liability concerns. When income flows through properly set up entities, you can maximize your QBI deduction while protecting your assets. The key is in the timing. Creating the right entities before expansion begins allows you to capture the most tax benefits from the very start.

When Should You Buy or Lease Equipment?

Before deciding whether to buy or lease equipment, it’s important to understand how each option impacts your franchise’s growth and finances. The benefits of equipment purchases go beyond ownership. They affect your cash flow, tax liability, and future expansion opportunities.

Buying Your Equipment

Here are key advantages of purchasing equipment for your restaurant:

- Immediate Depreciation: Section 179 allows up to $2,500,000 in immediate deductions for equipment, vehicles, and technology purchases.

- Bonus Depreciation: The One Big Beautiful Bill Act (OBBBA) permanently reinstates 100% bonus depreciation for qualified property acquired and put into service after January 19, 2025. This allows businesses to write off the full cost of equipment in the year of purchase, which significantly increases cash flow.

- Asset Building: Building equity in your equipment creates valuable collateral for future bank loans. This provides you with more options for financing your next location, eliminating the need for external financing.

- Control: Owning your equipment gives you full control over maintenance, upgrades, and replacement timing. This helps protect the value of the asset and its depreciation benefits.

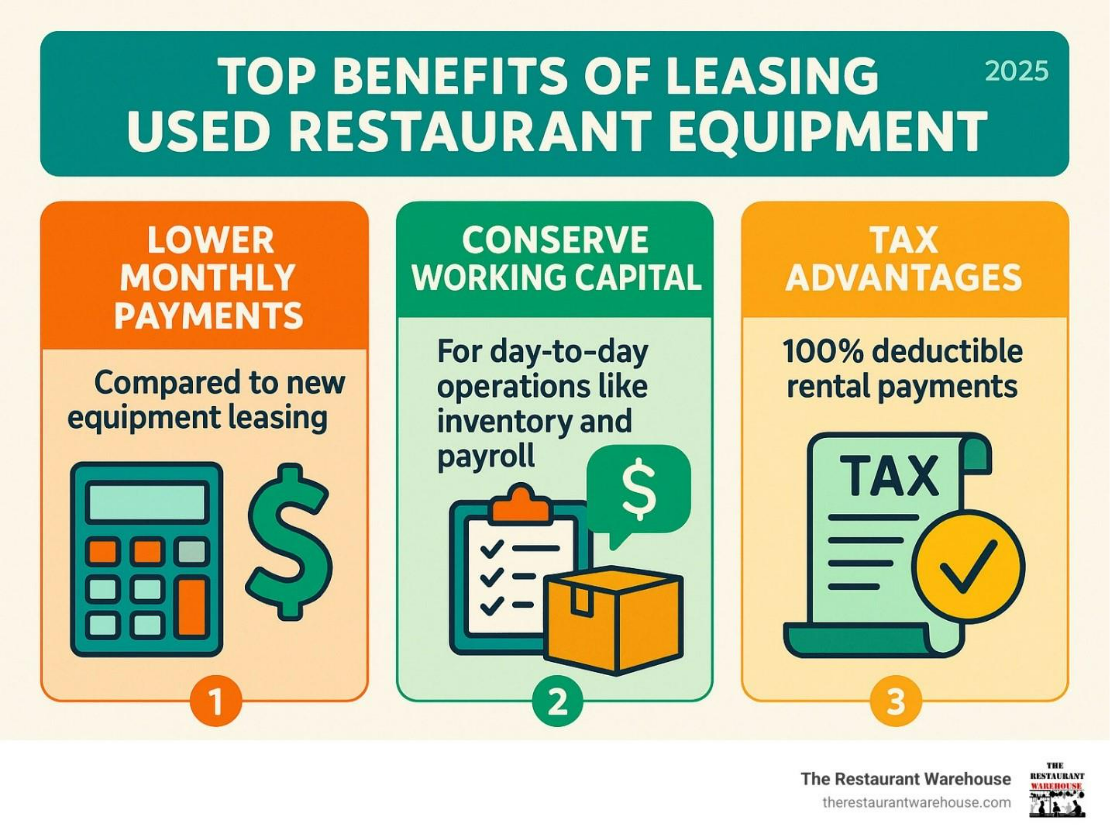

When Leasing Makes Sense

The benefits of leasing equipment go beyond cash flow:

- Cash Flow Preservation: A lower initial payment than a purchase, keeping your capital available for other needs like hiring, marketing, or opening a new location. You can obtain the necessary equipment without incurring a major upfront expense.

- Technology Updates: This option can provide a simple way to access the latest POS and kitchen technology. Many leases include the ability to upgrade your equipment regularly, preventing you from being stuck with outdated machines.

- Maintenance & Service: Many lease agreements include maintenance and repair services. This can save you money and time, as the responsibility for upkeep often falls to the leasing company, reducing your operational headaches.

The choice often depends on your available capital and the timeline for expansion. When you are expanding quickly, leasing can preserve your cash. Once you have a stable business, purchasing equipment can provide long-term tax advantages for your locations.

How Do You Manage Multi-State Franchise Taxes?

Expanding across state lines brings new challenges, but with the right planning, you can turn them into opportunities. Each state has its own franchise tax rules, income tax rates, and business incentives that impact your expansion strategy.

Multi-State Tax Considerations:

- Nexus Rules: This refers to the legal term for when a business activity creates a tax obligation in a new state. Understanding these rules is essential to knowing where to file and pay taxes.

- Apportionment: This refers to the method states use to divide your company’s income among the states where you operate. This determines how much of your profit is taxed in each state.

- State Incentives: Many states offer tax credits or other incentives to encourage new business development. Researching these early can lead to significant savings.

Starting your multi-state structure before signing an out-of-state lease prevents costly restructuring later. Some states offer incentives for franchise growth, like Texas’s lack of state income tax. Additionally, cost segregation studies can identify assets with shorter depreciation periods, resulting in savings in high-tax states.

What is the Best Way to Build Cash Reserves That Minimize Your Tax Burden?

Cash reserves fuel expansion opportunities. Building these reserves with a tax-advantaged approach can accelerate growth and provide financial security. While these strategies are for personal wealth and not direct business funds, they free up other capital for your franchise.

- SEP-IRA Contributions: Contribute up to 25% of compensation annually, reducing current taxes while building retirement security.

- Solo 401(k) Plans: For owner-operators, these plans allow larger contributions than traditional IRAs.

- Health Savings Accounts: Triple tax advantage for covering medical expenses.

- Life Insurance: Properly structured policies provide tax-free growth and access to funds.

The feedback from successful franchise owners consistently points to one truth: regular, systematic contributions to tax-advantaged accounts create both immediate tax savings and long-term capital for expansion.

Advanced Tax Methods for Serious Expansion

Successful franchise owners who consistently expand use sophisticated strategies that maximize every available benefit. This approach extends beyond basic tax planning to accelerate capital generation for growth.

Cost Segregation Studies for Restaurant Buildouts

A cost segregation study accelerates depreciation on restaurant buildout costs, generating immediate cash flow. Instead of depreciating the entire building over 39 years, a study can identify components that qualify for shorter depreciation periods. This is a powerful tool to address the depreciation of commercial property in a way that provides immediate benefits.

For example, a cost segregation study for a $500,000 restaurant buildout might reclassify $200,000 of that cost into assets with a much shorter lifespan:

- Kitchen Equipment: 5-7 years

- Specialized Plumbing and Electrical: 5 years

- Decorative Finishes and Millwork: 15 years

By accelerating the depreciation on these assets, you could generate immediate tax savings of $50,000 to $75,000 in the first year alone, providing a substantial down payment for your next franchise location.

Like-Kind Exchanges for Real Estate

A Section 1031 exchange allows you to defer capital gains taxes when you replace business assets. This means you can sell your old real property and allocate all the proceeds toward purchasing new property. This allows for a full reinvestment of capital without incurring an immediate tax burden. This tactic works particularly well for:

- Selling an existing franchise location’s real estate to acquire a new, larger building.

- Upgrading a corporate office building and reinvesting the proceeds into a new, more suitable space.

- Exchanging land to secure a more favorable location for a new buildout.

State Incentive Programs for Franchise Development

Many states actively court franchise development through incentives that reduce the investment required. Research these programs before choosing expansion locations. The right incentives can lower your actual investment by 20-30%. These include corporate incentives, which can provide direct tax credits or grants for job creation or capital investment.

- Job Creation Credits: You may receive a tax credit for each full-time position you create.

- Equipment Purchase Credits: Some states offer a percentage of your equipment costs as a credit against state taxes.

- Property Tax Abatements: These programs reduce or eliminate your property taxes for a set number of years.

- Training Credits: Some states offer reimbursement for employee training programs, which helps with onboarding new staff.

How Can You Create an Expansion Tax Strategy Timeline?

Year One: Foundation Building

- Establish proper entity structures.

- Implement Section 199A.

- Begin systematic reserve building.

- Research target expansion markets.

Year Two: Pre-Expansion Preparation

- Complete cost segregation studies on existing locations

- Maximize equipment depreciation benefits.

- Investigate state incentive programs.

- Build relationships with lenders familiar with franchise operations.

Year Three and Beyond: Expansion Execution

- Deploy saved capital for down payments at the new location.

- Implement multi-state tax planning.

- Apply successful methods across all locations.

Your Next Steps Toward Tax-Funded Expansion

These tactics have helped countless franchise owners accelerate their expansion by creating immediate cash flow. Your success begins by implementing these proven approaches, which are particularly powerful for franchise businesses due to their standardized models.

Rather than dealing with difficult tax laws on your own, work with a tax advisor who understands the financial dynamics of your franchise. By collaborating throughout the year, you can access powerful ways to generate immediate cash flow, fuel your expansion, and achieve your growth goals.