Unravel Sales vs. Use Tax Now

Authored by: Doug Gross — Partner, CPA, CGMA | Date Published: December 12, 2025

If the thought of a state tax audit makes you uneasy, you’re not alone. Many small businesses unintentionally increase their risk by overlooking the important difference between sales tax and use tax. Confusing these concepts can lead to unexpected audits and fines. To stay compliant and protect your business, you need to know exactly when you act as the collector and when you act as the taxpayer.

In this blog, we’ll clearly define these two taxes and provide the practical steps to manage compliance with confidence and protect your business’s financial well-being.

Featured Topics:

What’s the Difference Between Sales Tax and Use Tax?

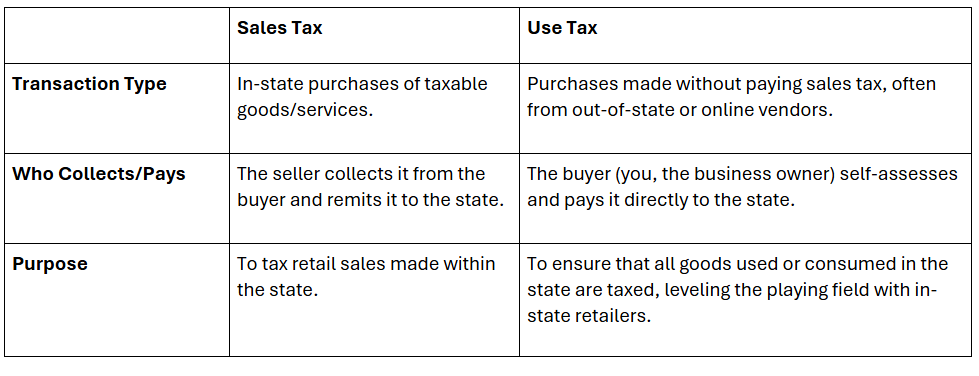

While both sales tax and use tax are consumption taxes, the main difference lies in who collects the tax and when it is collected.

- Sales Tax is what a business charges you when you make a purchase.

- Use Tax is the tax you owe the state when the seller doesn’t charge you sales tax, and you use the taxable item in your state.

When Does Use Tax Apply to Your Business?

Use tax is most commonly applied when a small business makes a purchase from an out-of-state or online vendor that doesn’t have a significant presence in your state and therefore doesn’t collect sales tax from you.

For example, say your Wisconsin-based company purchases a new, expensive piece of equipment online from a manufacturer in Montana (which has no state sales tax). The manufacturer does not charge you Wisconsin sales tax. The machinery is being used in Wisconsin. You, the buyer, are now responsible for calculating, reporting, and remitting the equivalent Wisconsin use tax to the state.

The same rule applies to many other business expenses, such as supplies purchased tax-free from an online retailer, digital items purchased from an out-of-state provider that doesn’t collect tax on the transaction, and more.

Common Mistakes and Why Compliance Matters

Failing to properly report use tax is one of the most common mistakes small businesses make, and it can be a big audit trigger.

- Ignoring Out-of-State Purchases: Many business owners think that if they weren’t charged tax, no tax is due. Auditors frequently look for this discrepancy in your purchase records.

- Incorrect Tax Rates: Use tax rates are typically the same as the sales tax rate in your location, which can include state, county, and local components. Using the wrong rate or forgetting the local portion can lead to underpayment and fines.

- Poor Record-Keeping: You must be able to prove that sales tax was paid or accurately track what use tax is owed. Missing invoices or a failure to flag tax-exempt purchases that were later used internally can raise a red flag.

The interest and fines for uncollected or under-reported taxes can be severe, especially for a growing small business.

How Can I Make My Reporting More Accurate?

To protect your business, you need a proactive strategy for sales and use tax compliance.

Automate Tracking: Implement a software system that can flag purchases where sales tax was not paid. Your team should be trained to identify these transactions and collect the correct use tax right away.

Centralize Rates: Keep an up-to-date schedule of your applicable local sales and use tax rates.

Regular Reconciliation: Regularly review your purchase invoices and general ledger accounts to ensure any missing sales tax has been correctly recorded as a use tax liability.

Partner with Trusted Professionals

Understanding the significant differences between sales tax and use tax is necessary for your small business’s financial health and compliance. With proactive strategies such as automated tracking, centralized rate schedules, and regular reconciliation, you can accurately manage your business’s essential tax obligations.

Don’t let sales and use tax compliance become a barrier to your business’s success. For customized support with implementing accurate tracking systems, navigating tax rates, or maintaining strong records, contact MBE CPAs. Our experienced advisors offer the guidance you need to stay compliant and concentrate on growing your business with confidence.