Welcome to Delicious Growth Scaling Alongside You

Authored by: Kim Wegner — Partner, CPA, CVA, CGMA | Date Published: January 14, 2026

The Culver’s origin story began in Sauk City, Wisconsin, when Craig Culver and his parents, George and Ruth, along with his wife, Lea, reimagined their family’s former A&W property as a new kind of gathering place. On July 18, 1984, they brought something different to the table: fresh, never-frozen beef seared only after you order it, and fresh frozen custard made in small batches throughout the day. These were not just menu items; they were commitments to quality that required attention and care at every turn.

That same commitment is what makes running a Culver’s so rewarding. It also makes growth both exciting and a bit of a challenge. When you manage one location, you know every detail.

You know which equipment needs watching and which crew members shine at which stations. You know exactly how your numbers should look at the end of each week. But when you start thinking about opening your second or third location, everything that felt manageable suddenly shifts. More revenue means more accounts to track. More employees mean more payroll considerations. If you are crossing state lines to open in one of those markets where Culver’s is expanding rapidly, you are adding layers of financial requirements you may not have encountered before.

Featured Topics:

- When Does Growth Become More Than Just More Revenue?

- What Financial Considerations Come with Expanding into New Markets?

- How Do You Build Financial Systems That Support Multiple Locations?

- What Makes Culver’s Growth Different from Other Franchises?

- Why Does a Personalized Financial Partnership Matter During Expansion?

- What Comes Next for Growing Culver’s Operators?

When Does Growth Become More Than Just More Revenue?

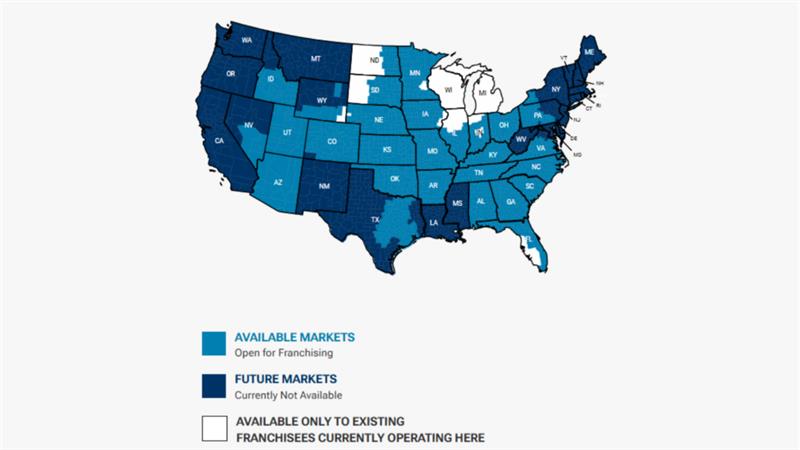

The transition from a single location to multiple units often occurs faster than owners anticipate. Over the last several years, Culver’s has maintained a remarkably steady pace of expansion, reaching a milestone of 1,046 locations across 26 states by late 2025. This trajectory has historically averaged about 50 to 55 new restaurant openings annually.

For current franchisees, this consistent growth represents both opportunity and questions. If the brand continues to expand at this pace, what does that mean for your own timeline? How do you prepare financially when you see other owners successfully adding second, third, or even fourth locations to their portfolios?

Here is what changes when you add that second location:

- Each restaurant needs its own profit and loss statement.

- You face multiple state tax filings if you cross state borders.

- Lenders want consolidated financials that tell a clear story.

- Managing cash flow gets more involved as you add locations.

- Depreciation tracking multiplies for each new building.

This change in your role is why having some backup matters. You should not be left to handle all these financial details on your own. Having someone keep your books organized frees you up to focus on the parts of the business you enjoy most.

What Financial Considerations Come with Expanding into New Markets?

The rapid expansion into states like Florida presents both excitement and unknowns for owners. Florida has seen growth from 81 restaurants in 2021 to 119 currently. This kind of market penetration creates opportunities for established owners to expand their footprint, but it also means entering new financial territory.

According to the 2025 Franchise Economic Outlook from the International Franchise Association, multi-unit operators are facing new local regulations and rising labor costs. Opening in a different state involves more than finding a good site and following your operational model. It means:

- Understanding new state tax codes and filing requirements.

- Managing payroll across different state wages and hour laws.

- Dealing with varying property tax assessments and local fees.

- Adapting to different cost structures for labor and supplies.

- Building relationships with new banking institutions.

The financial unknowns can seem like a lot to take on. What if the cost of doing business in that new state eats into margins more than you planned? What if hiring timelines differ and you burn through more cash during the opening phase? What if local regulations require modifications, you did not account for in your initial budget?

Many owners have successfully managed these hurdles. Getting advice from someone who has been through this before can help you spot issues early and make better decisions for your business. Franchisees who maintain strong relationships with their advisors report higher confidence in their expansion decisions and better preparation for market changes.

How Do You Build Financial Systems That Support Multiple Locations?

When you run one Culver’s, your financial system can be relatively straightforward. You track sales, manage food and labor costs, pay your bills, and file taxes annually. When you run three Culver’s across two states, that simplicity disappears.

Making fresh custard throughout the day takes more labor than using pre-made desserts. Cooking beef to order rather than batch-cooking also adds time and increases costs. These choices shape your expenses differently from those in other restaurants. You need systems that can:

- Consolidate reporting across all locations while maintaining individual unit tracking.

- Handle different state tax deadlines and requirements without issues.

- Monitor cash reserves needed to cover slower periods at multiple sites.

- Compare performance metrics across locations to identify opportunities.

- Meet what lenders ask for when it comes to getting a loan.

Talking through your finances regularly can help you keep things on track as you grow. It helps to have someone who can tell you if your plans look realistic or if it might be better to wait a bit before adding another location. This kind of partnership looks different from traditional accounting services. Rather than meeting just once a year, it helps to have quarterly conversations about:

- Whether your cash reserves are enough for the number of units you operate.

- How to structure compensation for location managers to help profitability.

- When buying new equipment makes sense versus leasing it.

- Which tax deductions specific to restaurant operations you might be missing.

- How your numbers compare to similar Culver’s operators with more than one location.

What Makes Culver’s Growth Different from Other Franchises?

Part of what makes Culver’s expansion noteworthy is its consistency. While many restaurant chains experienced volatility recently, Culver’s has maintained steady growth. According to the 2025 industry analysis from the Restaurant Finance Monitor, the brand’s predictability matters to owners as they consider their Culver’s expansion plans.

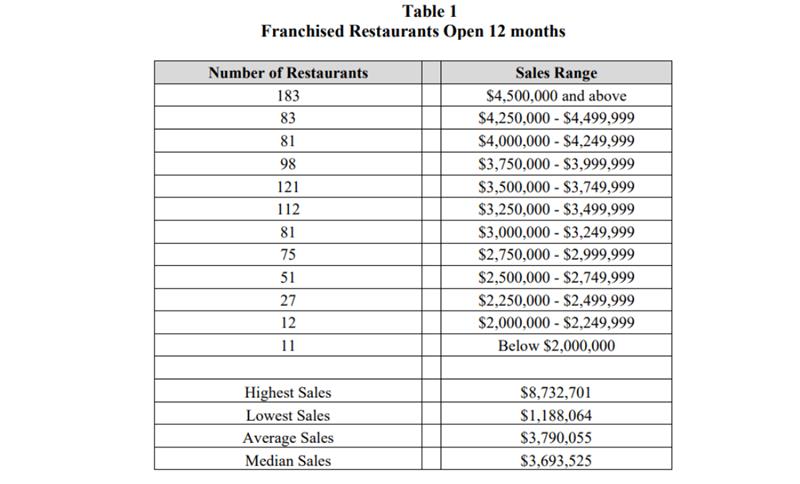

The average unit volume in 2025 is about $4.2 million, putting Culver’s among the top quick-service brands in the country. This average unit volume is a key benchmark for anyone interested in a Culver’s restaurant franchise. Labor and equipment costs may be higher than in other restaurants and understanding the royalty and marketing fee structure helps you plan your cash needs.

These shifts require someone who understands franchise restaurant finances specifically. The difference matters when it comes to cost segregation studies, which can provide significant tax benefits for restaurant properties. It also matters when structuring manager compensation to align with your goals across different locations.

Why Does a Personalized Financial Partnership Matter During Expansion?

Every Culver’s owner has a different story and different goals. Some want to build a portfolio of five or more locations. Others want two well-run restaurants that provide financial security. Some come from restaurant backgrounds and know operations inside and out but need financial guidance. Others come from different industries and need support with both operational and financial planning.

Advice should match your situation and goals, not a standard checklist. When someone understands your business and your needs, the suggestions you get are more practical. You may learn if your growth plans fit your life, or if it is better to focus on what you have now. You can discover tax credits or other options you might not have known about.

The benefits show up in your daily work. You will get advice year-round, not just at tax time. You will know what lenders need before you apply for a loan. You will have benchmarks to compare your business to others. Building this kind of working relationship takes time. It comes from regular check-ins with someone who gets to know your business and sticks with you through changes.

What Comes Next for Growing Culver’s Operators?

If you’re running one successful Culver’s and thinking about the next step, or you’re already leading several locations, now is the time to build a stronger financial foundation. The brand’s ongoing growth offers new possibilities, but those are best realized by owners who feel ready for what expansion brings.

Any good conversation starts with honest questions about where you are now, and where you want to go:

- What does your ideal operation look like in three years?

- What financial questions are on your mind right now?

- What feels like it’s standing in the way of opening your next location?

- How clearly do you see your current financial picture across all your restaurants?

Growing your business should be satisfying. When you have clarity around your numbers, it’s easier to make decisions and feel ready for what’s ahead. If you’d like to talk through your options, MBE CPAs is here to have that conversation with you.