Manufacturers Are Embracing Automation to Beat Tariffs

Authored by: Glen Erdman — Director, EA | Date Published: May 2, 2025

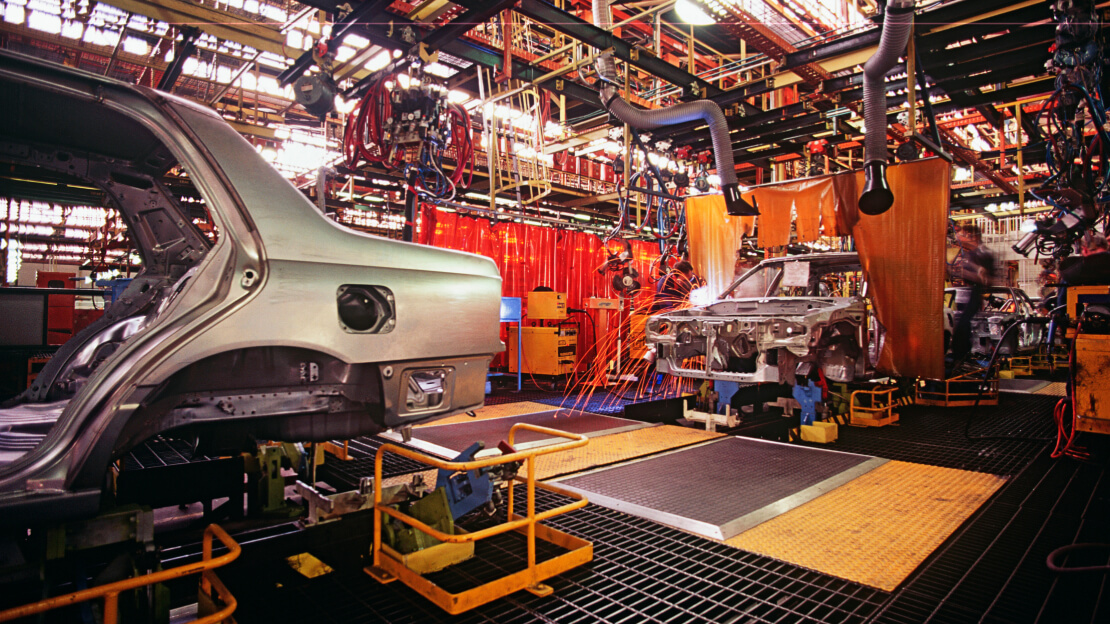

In an industry built on precision, how do you respond to unpredictable pressure? Recent changes in U.S. trade policy, including a new 25% tariff on imported vehicles and key components, have sparked a major shift in the manufacturing industry. With overseas parts becoming more expensive, many U.S. manufacturers are turning to automation as a way to cut costs and protect margins. In fact, Business Insider reports that automation providers like Formic are seeing a noticeable increase in demand across industries like food production, packaging, and light assembly.

But while robots can boost output, they come with significant financial questions. Ones that every manufacturer should be addressing before making a move.

Featured Topics:

Tariffs and the Cost of Doing Business

Tariffs are more than just a trade policy headline because they directly impact your financial planning. Imagine you’ve been sourcing a key part from overseas for years. Pricing is steady, production runs smoothly, and everything is predictable. Then, overnight, a 25% tariff takes effect, and suddenly that same part costs much more. Now your margins are shrinking, and you’re left figuring out whether to eat the cost, raise prices, or rethink your entire supply chain. For manufacturers already working with tight budgets, these shifts can’t be ignored.

Many manufacturers are turning to robotics and automated systems as a potential solution. While robotics and smart systems require a significant upfront investment, they offer a way to reduce labor costs, increase efficiency, and better control expenses over time. When evaluated strategically, these new technologies can help offset the financial strain caused by tariffs and even create opportunities to gain a competitive edge.

The Financial Realities Behind Automation

Automation Is a Big Investment

Automated systems often come with high upfront costs. Sometimes reaching six or even seven figures when you factor in installation, software, and training. For example, a single industrial robot can cost between $50,000 and $80,000, not including the systems needed to integrate it into your existing line. That kind of spending can put a serious dent in your cash flow if not planned properly.

These are long-term assets that impact your financials well beyond the initial price tag, affecting everything from depreciation schedules to tax exposure.

Navigating these changes requires a strategic approach. MBE CPAs can help manufacturers assess whether buying or leasing makes more sense based on their financial goals. We also create custom models that project return on investment and help you see the full financial picture before you commit.

Asset Tracking Matters More Than Ever

New equipment should be treated as long-term business assets. That means tracking their value, applying proper depreciation, and staying audit-ready. This is especially important when financing is involved or if you plan to scale up operations later.

We help you set up clean, accurate systems for tracking and reporting on your assets, keeping you in compliance and prepared for whatever comes next.

Tax Opportunities and Cost Shifts You Shouldn’t Overlook

Many manufacturers miss out on valuable tax savings when they invest in new technology. Not because the incentives aren’t available, but because they’re often overlooked during the implementation process. Equipment gets installed, operations move forward, and by the time tax season arrives, key deductions and credits are left unclaimed simply because they weren’t identified early enough.

Section 179 allows you to deduct the full cost of qualifying equipment in the year it’s placed into service. There’s also bonus depreciation and potential eligibility for R&D tax credits, even if you’re not creating new products. If your modernization effort involves improving processes or experimenting with production changes, you may qualify.

Beyond taxes, upgrading your operations changes how your business spends money. Labor costs may drop, but fixed expenses like maintenance, licensing, and tech support often rise. We work with you to update your cost structure, revise pricing, and keep margins where they need to be as your operations evolve.

How MBE CPAs Helps Manufacturing Businesses Move Forward

Let’s Future-Proof Your Operation

As advanced manufacturing technologies become more common, so do the financial risks of jumping in without a plan.

These decisions are far from one-size-fits-all, and that’s why many manufacturers turn to MBE CPAs for manufacturing accounting guidance. We support manufacturers with financial planning, tax strategy, and reporting so they can make confident decisions as they invest in new systems and technology.

Before you invest in equipment, restructure your operations, or update your pricing, talk to someone who understands the numbers behind manufacturing. Schedule a free consultation with an MBE CPAs trusted advisor, and let’s talk about how to make your next move a smart one.