A Simple System for Tracking and Categorizing Business Spending

Authored by: Ryan Weber — Partner, CPA, CVA | Date Published: September 8, 2025

If you’ve ever wondered why you’re holding on to old receipts, we’ll tell you why it may be the most important thing you do for your business. Managing business expenses can feel like solving a puzzle with only half the pieces, but by establishing the right bookkeeping practices, it doesn’t have to be so overwhelming.

The good news is that there are various methods for you to choose from that’ll best suit your business. However, choosing a confusing method may lead to missed opportunities and major business losses. Having control over your expenses is one of the smartest investments you can make in your business’s future.

Featured Topics:

- Why Are Business Expense Reports So Difficult to Manage?

- What Business Expenses Can I Deduct on My Taxes?

- How Should I Categorize My Business Expenses for Better Organization?

- What’s the Best Way to Track Business Expenses Daily?

- Common Expense Reporting Questions

- Simple Five-Step System for Streamlined Expense Management

- Take Control of Your Business Expenses Today

Why Are Business Expense Reports So Difficult to Manage?

Running your own business is not easy, and owners face all these challenges while trying to stay competitive in the evolving market. External pressures can cause these problems, but so can poor leadership and outdated systems.

By identifying pain points, businesses can focus on which areas to improve.

- Cash Flow Management

- Customer Acquisition & Retention

- Product/Service Quality

- Inefficient Processes

- Poor Culture

By failing to improve these vulnerabilities, businesses can face hidden costs, including time, money, and compliance issues. Businesses must develop proper expense management and understand where money is coming from and where it’s going. Without properly tracking your expenses, your cash flow and tax planning will be negatively impacted.

At first, it may feel painful when you recognize your business is headed in the wrong direction. However, approaching the experience as an opportunity to grow will allow your business to learn from past mistakes and better prepare for risk in the future.

What Business Expenses Can I Deduct on My Taxes?

Your business incurs ordinary costs that are subtracted from revenue and establish the taxable net income. An expense that is considered necessary for business purposes is tax-deductible, meaning it can lower the amount of taxes that you owe.

Here is a list of deductible business expenses:

- Business Expenses (Theft, Casualties, Disasters)

- Employee Pay

- Rent Expense

- Interest

- Taxes & Insurance

- Advertising & Marketing Expenses

- Amortization & Depletion

- Travel, Gift, and Car Expenses

Keeping track of these expenses, such as holding on to receipts, is essential if you want to prove that each expense is qualified as a business deduction. The burden of proof is on the taxpayer.

For most general expenses, you should keep:

- Proof of payment

- Invoices and paid bills

- Bank and credit card statements

- The amount, purpose, and date of payment

Depending on the nature of the transaction, certain expenses can raise red flags that attract IRS scrutiny. Be careful not to blur the line between personal and business use, and only claim expenses that were exclusively used for work. Taking advantage of tax deductions does not mean claiming excessive amounts.

Staying updated on what tax laws and deductions apply to you creates the potential to save your business thousands of dollars.

Read more about what you could be missing.

How Should I Categorize My Business Expenses for Better Organization?

Staying organized may not be one of your top priorities, but it should be if your business could save thousands. By having a strict record-keeping organization, you’re less likely to raise red flags with the IRS and be able to claim the deductions you qualify for.

Essential expense categories every business needs:

- People & Operations

- Marketing & Sales

- Professional & External Services

- Travel & Miscellaneous

A standard approach for record keeping is to set up a chart of accounts. To do so, define your business’s specific needs, then categorize accounts into five main types: assets, liabilities, equity, revenue, and expenses. Implement this chart into accounting software and review periodically to adjust as your business needs.

It’s also recommended to receive training on this type of software so you can learn how to easily navigate and handle these everyday tasks.

Learn more recordkeeping tips here.

What's the Best Way to Track Business Expenses Daily?

Accounting software makes tracking your finances more manageable and helps keep everything organized, especially during tax season. Choosing which method best suits your business’s needs will help you handle your bookkeeping or may point you toward consulting a tax accountant. We’ll help you explore the various methods you can use.

Digital tools vs. traditional methods

The choice between digital and traditional expense tracking comes down to how tech-savvy you are and how complex your business is.

Digital tools offer increased efficiency, real-time data access, and reduced long-term costs. By using software, you can automate tasks and store data in the cloud, providing a secure solution for businesses.

Using QuickBooks or a trusted app can provide on-the-go account access and simplified communication that is user-friendly and helps you troubleshoot.

On the other hand, traditional methods have a lower initial cost but have a higher risk of human error. Where you aren’t required to have technical skills, you will need accounting skills to use physical ledgers and spreadsheets for recording financial transactions.

Why fix a method that isn’t broken? If your current system works and you’re staying compliant, stick with it. But if you’re spending hours each month on manual data entry or struggling to find receipts, it’s time to consider an upgrade.

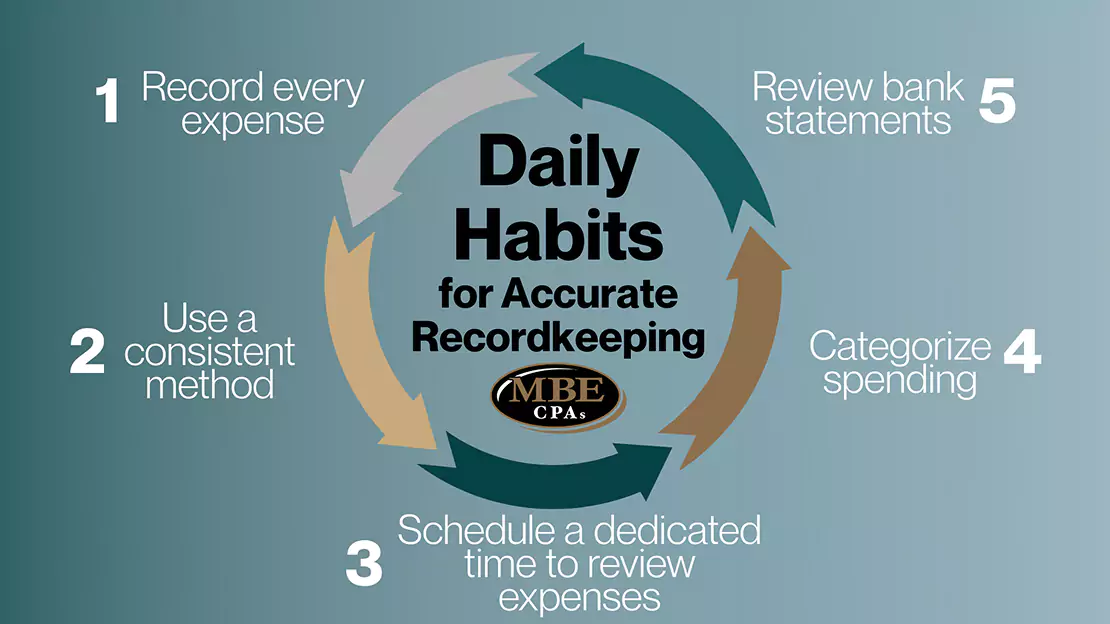

Success with expense tracking comes down to consistency, not just the tools you use. Make sure you incorporate these daily and weekly habits to track expenses:

- Record every expense

- Use a consistent method

- Review bank statements

- Categorize spending

- Schedule a dedicated time to review expenses

Regularly checking your spending against your budget will help you meet your financial goals. These habits will keep you on top of your finances, whether you’re using the latest app or a spreadsheet.

Common Expense Reporting Questions

Making sure you include the right information and categorize your expenses correctly can be difficult. Here are answers to questions we hear most from business owners when it comes to expense reporting.

How Do I Handle Employee Expense Reimbursements Properly?

As you expect to be reimbursed for your business expenses, employees will expect the same for any personal funds expended for business. An expense report allows employees to document each business expense, provide a corresponding receipt, and get reimbursed from company funds.

A standard expense report often includes the following fields:

- Employee name

- Total expense reimbursement amount

- Advances received

- Subtotal

- Your own coding

- Amount of each expense

- Date each expense was incurred

- Description of each expense

By standardizing this system, employees can get reimbursed quickly while you maintain proper documentation for tax purposes.

How Can I Automate My Expense Reporting Process?

Submitting and approving expense reports shouldn’t drain your time or your company’s budget. Choosing the right system will improve your accuracy and help you maintain policy compliance.

Here are the steps to implement automated expense reporting:

- Select expense management software

- Upload and configure your expense policy

- Integrate corporate cards

- Build automated approval workflows

- Sync with accounting systems

- Train your employees

The upfront effort that goes into automating your reporting pays off in hours saved every month.

Avoid These Common Expense Reporting Mistakes

- Personal vs. business expense mixing

- Missing or inadequate documentation

- Incorrect categorization error

- Timing issues (cash vs. accrual accounting

To prevent legal, financial, and operational risks, establish a clear structure for your expense reporting. Without accurate information, management cannot make informed strategic decisions, which can lead to financial losses and missed opportunities.

Simple Five-Step System for Streamlined Expense Management

Sometimes, the best method to stay in control of your expenses means removing all steps where human intervention can occur.

Here is a five-step system for streamlining your expenses:

Step 1: Set Up Your Categories and Chart of Accounts

Step 2: Choose and Implement Your Tracking Tools

Step 3: Establish Daily Capture Habits

Step 4: Create Weekly Review Routines

Step 5: Monthly Reconciliation and Analysis

Take Control of Your Business Expenses Today

Taking control of your business isn’t just about being organized but empowering yourself to make informed decisions. Having a clear picture of where your money is going can identify where your business can cut costs, invest in growth, and maximize tax deductions.

At MBE CPAs, we understand that implementing new expense tracking and recordkeeping systems can feel overwhelming, especially when you’re already wearing multiple hats in your business. Our team specializes in helping business owners like you establish efficient, compliant expense management processes that save time and money. From setting up your chart of accounts to training you on the latest accounting software, we’re here to guide you through every step of creating a system that works for your unique business needs.

Here are the services we offer that your business can benefit from:

- Accounting and Bookkeeping

- Audit and Assurance

- Business Consulting

- Tax Services

Don’t let poor expense management hold your business back – let us help you build the financial foundation your company deserves.