Tips for Your 2026 Sustainable Business Model

Authored by: Brett Leibfried — Partner, CPA | Date Published: October 9, 2025

Over half of small business owners plan to retire within the next decade, but a majority of them have no concrete succession plan. Are you one of them?

Employee ownership represents a powerful yet overlooked force for business sustainability. The people who run daily operations determine your business’s personality, rapport, and sales. When it’s time for you to step down, why not leave the keys to them?

Discover the benefits of incorporating your employees into decision-making early and what it can mean for your business when you’re ready to retire.

Featured Topics:

Understanding Employee Ownership

You’ve built your business from the ground up, facing many economic storms and market changes along the way, and now it’s nearing the time of your retirement. But what happens to your business?

A solution to this dilemma can be employee ownership. This succession plan is exactly what it sounds like. Employees become actual owners of the business through sharing the company’s value. From simple grants of shares to highly structured plans, employee ownership can keep your business operating without the risk of complete transformation.

Common reasons companies become employee-owned:

- The current owner is leaving. In many cases, owners who want to gradually exit their position without leaving the business to private equity look toward employee ownership.

- Attraction and Retention of Employees. Employee ownership provides employees with long-term wealth building, creating a better workplace for potential hires.

- Your current succession plan is failing. Maybe your family members aren’t interested in taking over or your qualified employees don’t have the capital to buy the business outright. Many succession plans don’t address your reality, especially if you’re trying to avoid losing everything you built by selling to an external buyer.

Employee ownership does not mean you’re giving away your business, rather, you’re restructuring ownership to create value for everyone. If you’re considering this transition, here are the associated benefits:

- Supports a high-involvement work culture

- Protects the business’s character

- Improves corporate performance

Understanding how employee ownership fits in your business starts with knowing which type will be the most beneficial.

Four Main Types of Employee Ownership

Many businesses choose to transition to employee ownership through an ESOP, but other forms can similarly protect the legacy of the owner’s business.

Explore the forms of employee ownership:

- Employee Stock Ownership Plans (ESOPs): Think of ESOPs as a retirement plan that buys your company, providing a tax deduction for the value of shares. The company’s contributions to pay back the loan are tax-deductible, so your business can finance its own purchase, allowing you to get paid and your employees to become the new owners.

- A downside to ESOPs is the cost to administer, making them a better fit for larger organizations. For smaller organizations, we often see multi-stage EO incorporation. Equity begins to be built, making EO a great employee retention tool. Non-voting units are often deployed, and the original owner doesn’t have to pay tax on stage one of the deal.

- Equity Compensation Plans: For small businesses looking to grow, using grants provides incentives to selected workers for paying capital gains taxes on the increase in value. Each grant has its own vesting schedule, and the company receives a deduction when the employee recognizes income.

- Worker Co-operatives: Employees in co-operatives have equal say in business decisions, meaning that managers can become voting owners while founding partners maintain their investment. Over time, partners gradually reduce their operational involvement, and this option is a lower-cost way to set up an employee ownership plan.

- Employee Ownership Trusts (EOTs): The middle ground between ESOPs and co-operatives, EOTs offer flexibility by holding company shares for all employees. The trustees of the EOT are required to exercise their control of the company for the benefit of all the employees.

Each one of these plans provides differing benefits, highlighting the importance of understanding all tax implications before selecting the best-fit strategy for your business.

Tax Benefits & Financial Incentives to Know

Here’s where employee ownership gets interesting from an accounting standpoint. Congress created tax incentives to promote the creation of ESOPs, which are currently the most common form of employee ownership in the U.S.

- Capital Gains Tax Deferral: The 1042 election allows a selling shareholder to defer up to 100% of capital gains taxes realized from the sale to an ESOP, potentially a permanent avoidance if structured correctly. Learn more about capital gains.

- Deductible Contributions: For both S and C corporations, cash or stock can be contributed to the ESOP trust and deducted from their taxable income. The maximum deductible amount is 25% of the total eligible payroll.

Let’s see how this realistically impacts your business:

- Your manufacturing business is valued at $3 million.

- You pay 20% capital gains tax, plus state taxes.

- With the ESOP sale, you can defer all capital gains taxes by reinvesting in qualified securities. 100% ESOP ownership can eliminate the annual $200,000 your business pays in corporate taxes.

Employee ownership produces better cash flow, reduced tax burden, and more resources available for your business’s operations.

Addressing Employee Ownership Concerns

Your business is not just your job, it’s your life. We understand that. Concerns are bound to rise about this transition, so we are here to address the questions you have about whether adopting EO is right for you.

Will I actually get paid?

In an ESOP transaction, you’re typically paid through a combination of initial cash payment, promissory notes, or seller financing.

What if my employees aren’t ready to be owners?

Proper education can take a year or more, along with a gradual transfer of ownership. Maintaining professional management during transition will help your employees prepare for the change.

How do I maintain control during the transition?

Start with an initial 30-50% ownership with the option to buy more over time, stage your transition over multiple years, and retain voting control throughout the transition.

Is employee ownership right for my business?

If you have loyal, long-term employees, offering the right training could be all you need to implement EO. With stable cash flow, reasonable debt levels, and core values for employee development, consider EO.

Is employee ownership promising?

Here’s a list of how employee ownership has been changing throughout the years:

- EO is combating the fluctuating housing market that impacts American workers. As housing costs continue to rise, employee ownership has built more equity and strengthened local economies, creating a better outlook for the working class.

- Worker co-operatives may create a union to ensure fair wages and better benefits.

- The Silver Tsunami is driving adoption of EO as a means to prepare. In the next decade, one quarter of the US labor force is predicted to be 55 years of age or older, meaning that these retirees will take the knowledge, skills, and experience with them.

- EO usage in private equity is expanding from the increasing visibility in the media, attracting more players to grow the industry.

How to Begin Implementation in Your Business

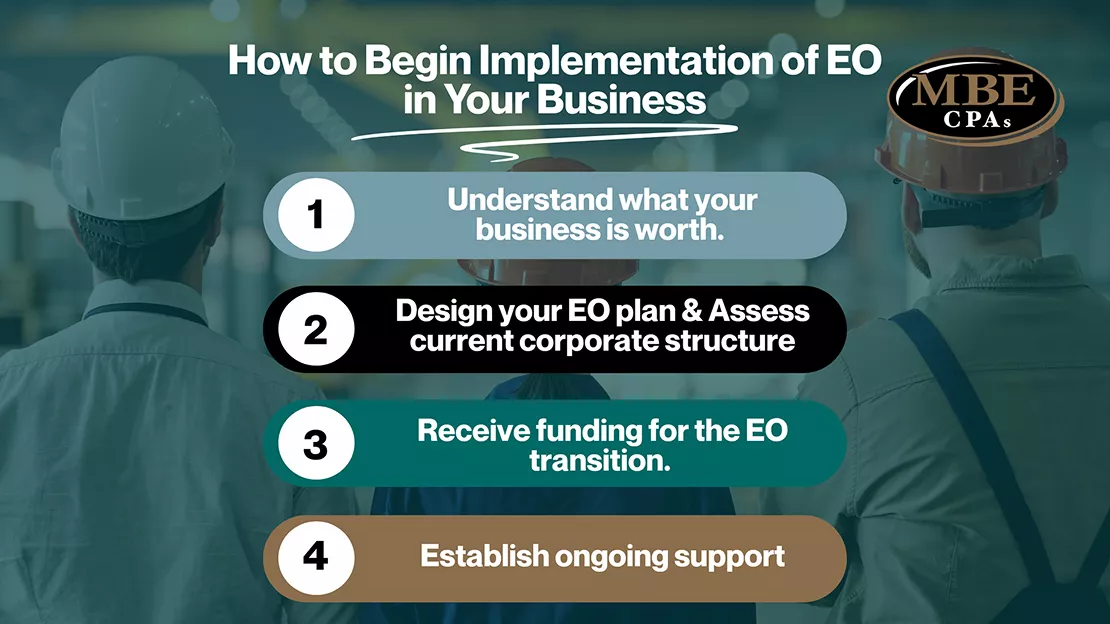

If employee ownership resonates with your situation and values, here’s a guide for how to transition ownership of your business:

- Understand what your business is worth. Over-or undervaluing your business creates financial strain or unfair transactions. Complete your business valuation with multiple methods and cash flow projections. Learn more about business valuation.

- Design your EO plan and operations. Assess your current corporate structure and choose between ESOP, cooperative, or EOT based on your goals. Investing in education and creating mentorship programs creates a proactive transition approach.

- Receive funding for the EO transition. Complete initial ownership transfer and financing, and execute all transaction documents. To avoid inadequate cash flow projections, utilize financial modeling with multiple scenario planning and adequate cash reserves.

- Establish ongoing support. Implement systems for continued education and development for the new owners, including employee communication systems. Having a solid governance structure and activation will help employees shift to the owner mindset.

The conversation starts with understanding your specific situation, goals, and concerns.

Conclusion

Employee ownership addresses the question that many business owners face: What happens to everything they’ve built when they’re ready to step back? With the shift in how Americans think about work, ownership, and economic participation, employee ownership addresses these expectations while solving practical business problems.

Your legacy matters. Your employees matter. Your financial security matters. Employee ownership might be the solution that addresses all three. Consider receiving guidance for your ownership transition.

Contact MBE CPAs for a long-term partner in making employee ownership successful for everyone involved.