How the One Big Beautiful Bill Act Impacts Manufacturing

There has been significant movement on a pivotal piece of legislation, now officially known as the “One Big Beautiful Bill Act.” This package, enacted into law on July 4, 2025, aims to significantly boost the nation’s economy and profoundly impacts numerous sectors. For manufacturers across the country, understanding this new law is essential for maintaining competitiveness and securing a successful future.

Featured Topics:

What is the One Big Beautiful Bill Act?

The overarching purpose of the “One Big Beautiful Bill Act” (OBBBA), or H.R. 1, is to stimulate the American economy through a combination of tax cuts, spending reductions, and measures aimed at boosting domestic industries. The bill was passed by the Senate on July 1, 2025, and subsequently by the House on July 3, before being signed into law by President Trump on July 4, 2025. A primary goal of the law is to create a more favorable environment for businesses, particularly within the manufacturing sector, leading to job creation and increased economic output.

Tax Provisions

The OBBBA includes a suite of tax changes designed to benefit manufacturers.

- Qualified Business Income Deduction (up to 20%): While the House proposed up to 23%, the enacted law maintains the existing 20% deduction for qualified business income, allowing qualifying pass-through businesses to deduct a significant portion of their income, effectively reducing their tax burden.

- Enhanced Expensing for Equipment and Machinery: The law increases Section 179 expensing limits, allowing businesses to immediately deduct the full cost of eligible new and used equipment and machinery in the year it is placed in service. It also includes 100% expensing for “qualified production property” including certain commercial real property.

- Immediate R&D Expensing: Businesses can fully deduct their R&D costs in the year incurred, encouraging innovation and technological advancement.

- Eased Interest Deduction Limits: Relaxing limitations on how much interest businesses can deduct from financed purchases makes it more affordable for manufacturers to borrow money for expansion, equipment upgrades, and other investments.

- New Tax Breaks: OBBBA introduces specific tax incentives designed to encourage companies to move or expand manufacturing operations within the United States.

How Does the OBBBA Use Investment Incentives?

Beyond direct tax cuts, the OBBBA aims to strengthen domestic manufacturing by incentivizing companies to produce goods and retain intellectual property within the U.S. This includes potential investments and incentives for critical industries like defense manufacturing and broader industrial infrastructure.

What Are the Supply Chain Changes in the Act?

The act addresses national security and economic resilience by focusing on supply chains. It aims to reduce reliance on foreign supply by incentivizing onshoring and developing stronger domestic networks. This may include restricting business with “prohibited foreign entities” to protect critical industries and reduce risk.

What Are the Potential Benefits of the OBBBA?

Through strategic tax incentives, the OBBB Act aims to free up capital, enabling businesses to increase investment in new equipment, technology, and modern facilities. This encourages automation and advanced manufacturing techniques, hoping to bring the U.S. to the forefront of industrial innovation and grow global competitiveness.

By lowering tax burdens, American-made products become more attractive in international markets. This focus on domestic production is expected to have a positive impact on job creation within the manufacturing sector, stimulating the broader economy. It also offers greater certainty and predictability for manufacturers by establishing various tax provisions, which allow for long-term planning and less uncertainty around significant capital investments.

What Are the Risks and Considerations in the OBBBA?

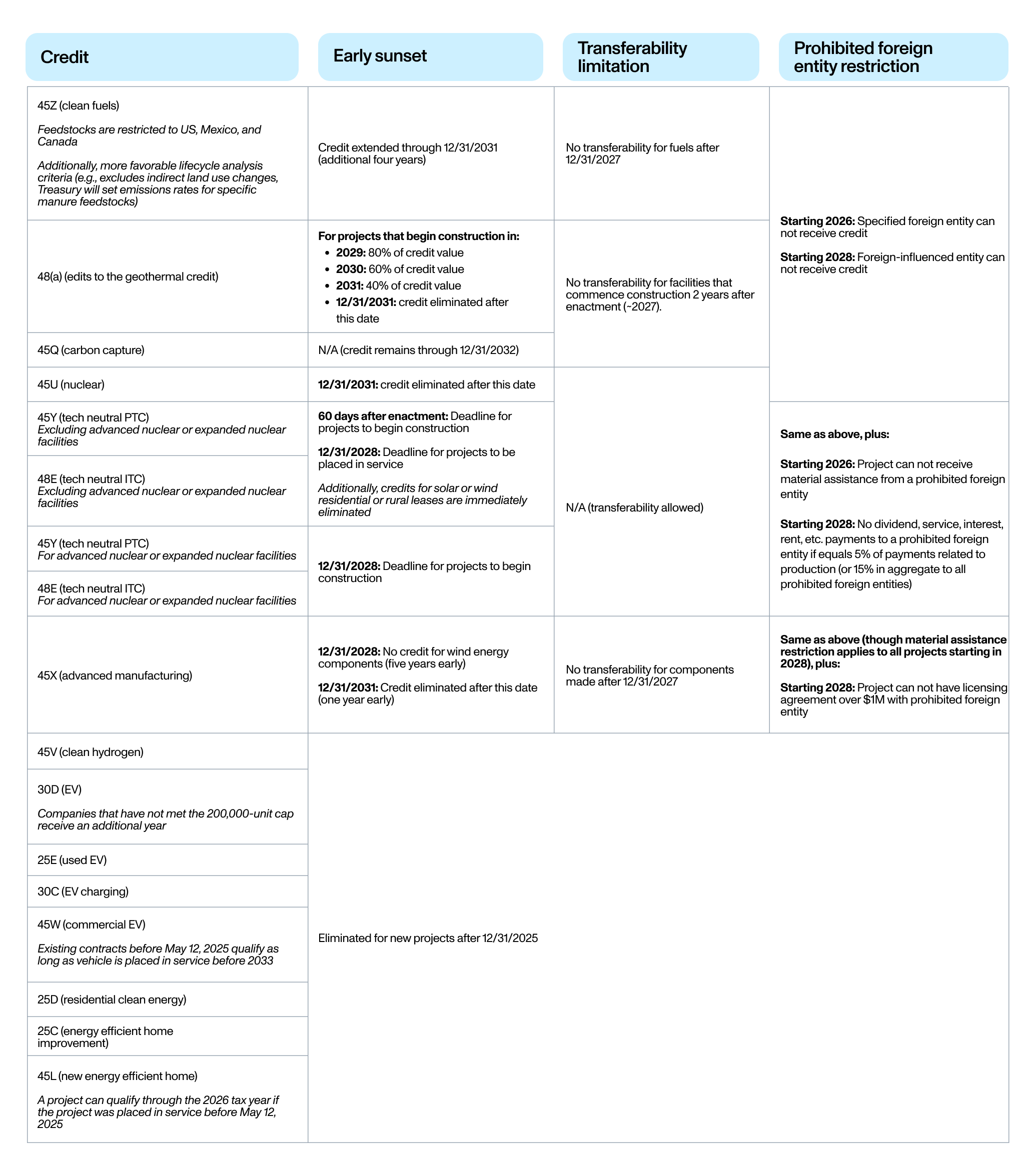

While this act offers potential benefits, it also carries implications, particularly for clean energy manufacturing and the broader economic environment. A controversial aspect is the accelerated restrictions on clean energy tax, which could lead to higher electricity costs and lower investment in clean energy technologies.

Concerns are growing about limits on “prohibited foreign entities.” These limits could disrupt clean tech supply chains. They may impose strict compliance rules and disqualify projects based on where components come from or who owns them. This could also lead to higher electricity bills for businesses and risk job losses and reduced investments if clean energy incentives are cut.

Source: Crux Climate

How Can Manufacturers Prepare for the One Big Beautiful Bill Act?

To proactively prepare for the enacted OBBBA, manufacturers should implement a comprehensive strategy. This begins with a thorough review of financial strategies, including a consultation to fully understand the specific implications for their business, and a re-evaluation of capital expenditure plans. Given the restrictions on “prohibited foreign entities,” it is important to assess supply chains immediately to identify vulnerabilities and risks.

Manufacturers should also engage with industry associations and policymakers while monitoring any further guidance or regulations that may be issued, as the implementation of the law unfolds.

Finally, it is important to invest in innovation for long-term success. Manufacturers can utilize the permanent R&D tax expensing to improve products and processes and adopt new technologies to increase competitiveness, regardless of how specific provisions of the OBBBA affect their operations.

Final Thoughts

The “One Big Beautiful Bill Act,” now law, has the potential to transform U.S. manufacturing by providing major funding for modernization and global competitiveness through significant tax incentives. However, with these opportunities come considerable challenges and complexities.

As you stay informed about the latest updates and how they may impact your production, turn to MBE CPAs for guidance. Our team specializes in providing personalized accounting and financial solutions for the manufacturing industry. Reach out to learn more about how we can help you take advantage of these potential changes.