Effortlessly Submit Your Individual Tax Documents Online

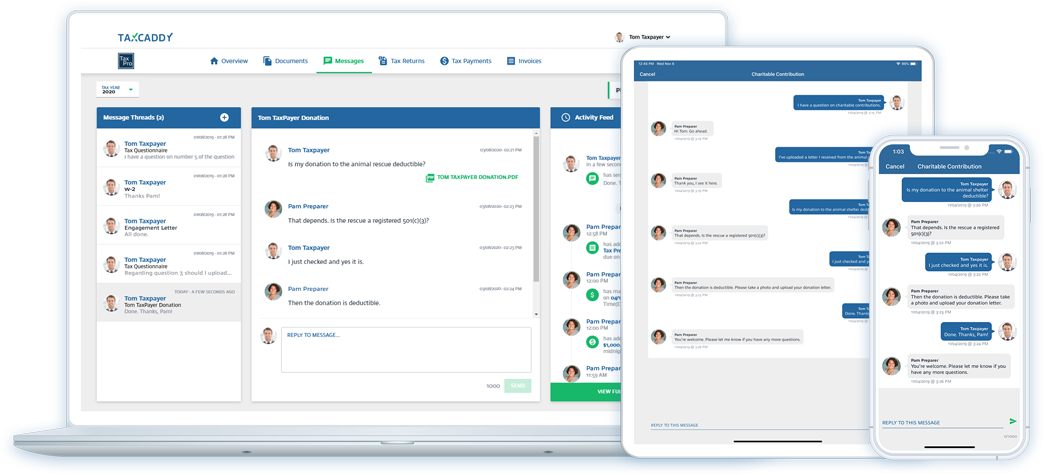

TaxCaddy makes gathering tax documents and sharing them with your tax professional a breeze. Let TaxCaddy retrieve your 1099s, 1098s, and W-2s automatically. Upload or snap photos of your tax documents year-round and store them with bank vault security. Make your Federal and State tax payments right from TaxCaddy.

- No more office visits.

- No more paper organizers.

- Simplify tax time with TaxCaddy.

Experience the Convenience of TaxCaddy

Accordion FAQ

MBE CPAs will send you an invitation link via email to set up your account. If you already have an account, please use the provided link in the email to associate your account with MBE CPAs. If you did not receive the email invite, please contact us here.

You can download the iOS app on your iPhone or paid app on your Android Phone or Tablet through the Google Play Store here. You may also log in online here.

To provide access to your spouse or others, click your name in the top right corner, and then click Settings. Click Additional User Account, and enter their information. They will receive an invitation email to create a linked account with the same steps you have already completed.

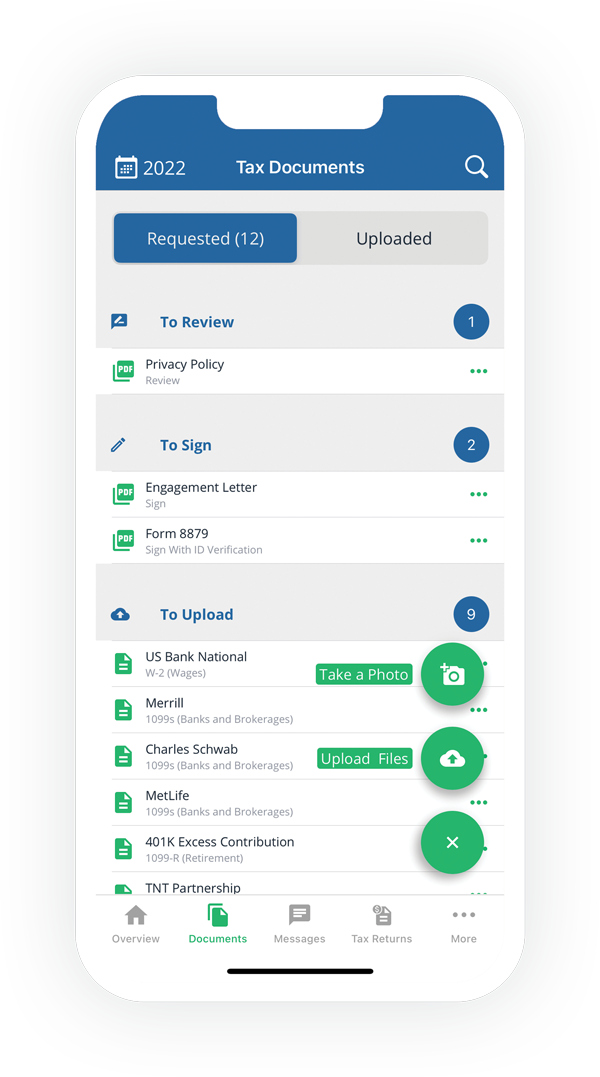

In your TaxCaddy account, you’ll find a Tax Questionnaire and a Document Request List. Navigate to the TaxCaddy Questionnaire and input your answers to complete the form. Next, You may provide documents by using the following options:

1. Setting up “Smart Links” with your financial institutions to automatically retrieve tax documents. As documents become available, they will be automatically retrieved and placed in your TaxCaddy account.

2. Photoscanning the document with the TaxCaddy mobile app.

3. Uploading files.

4. Manually entering form information. Learn more about documents.

Security of your data is our highest priority. As a TaxCaddy user, you will benefit from best-in-class technology, data centers, and infrastructure to meet the strict requirements of the most security-sensitive CPA firms in the world.

Infrasructure

TaxCaddy is built with layers of protection across a secure, reliable infrastructure. TaxCaddy leverages the Microsoft Azure cloud to ensure data security through encrypted communications, threat management, and threat mitigation practices, including regular penetration testing. TaxCaddy uses Amazon Web Services for secure, reliable storage. Your documents and data are encrypted in transit and at rest using Amazon’s best-in-class Secure Socket Layer and Server-Side Encryption technologies.

Testing and Validation

TaxCaddy has been audited, tested, and validated by Symosis Security, formerly C-Level Security, LLC. Symosis Security is an independent, security-focused consulting firm employing leaders in the industry. TaxCaddy was found to enforce security controls to support a secure processing solution. The Symosis Security attestation can be downloaded at taxcaddy.com. Additionally, TaxCaddy is used by two of the largest CPA firms in the world, and it’s been through rigorous security testing and validation.

SOC 2 Audit

SurePrep, the developer of TaxCaddy, received a SOC 2 Type 1, an independent service auditor’s report on controls relevant to security, availability, confidentiality, and processing integrity set forth by the AICPA Trust Services Criteria.

Smart Links

Credentials for your Smart Links accounts are encrypted from the moment you enter them, so nobody can ever see or steal your data as it is transmitted to or from your account. No matter what device you use, from your desktop browser to your mobile phone, your data is always sent using 256-bit Secure Socket Layer encryption.

Your tax documents are delivered directly to your TaxCaddy account—no other service gets access to your documents, nor are they stored anywhere else. If you choose to delete any of the documents in your TaxCaddy account, those documents are permanently deleted—you maintain full control of your tax documents. You can delete any (or all) of your Smart Links any time you want. When you delete a Smart Link, your encrypted username and password information is deleted immediately.

Passwords and Two-Factor Authentication

To help keep your TaxCaddy account safe, the system requires a strong password that includes a number, a special character, both uppercase and lowercase letters, and a minimum of 8 characters.

TaxCaddy uses two-factor authentication to help keep your account secure by prompting you to enter your password and a unique, one-time verification code each time you log in. Although you can select “Don't ask me for verification again on this computer,” we recommend you always keep the two-factor authentication enabled on all devices.

We regularly review and update security policies, provide security training; perform application and network security testing, including penetration testing; monitor compliance with security policies; and conduct internal and external risk assessments.

Sign Up For our TaxCaddy Paperless Organizer!

"*" indicates required fields