Essential Tips for Obtaining Your IP PIN

Image source: www.irs.gov

Tax season is here, and protecting your identity has never been more important. One of the best ways to safeguard yourself from tax-related identity theft is by obtaining an Identity Protection PIN (IP PIN). This six-digit code, issued by the IRS, ensures that only you can file a tax return using your Social Security number.

In this article, we’ll walk you through how to obtain an IP PIN, why it’s important, and what steps to take if you’re unable to use the online system. By the end, you’ll clearly understand how to protect your tax return and avoid unnecessary delays.

Featured Topics:

What Is an IP PIN and Why Do You Need It?

An IP PIN is a unique six-digit number issued annually by the IRS. Its purpose is to add an extra layer of protection for taxpayers against identity theft. When you file your return, the IRS uses your IP PIN to verify your identity, ensuring no one else can fraudulently file using your Social Security number.

The IRS strongly encourages taxpayers to enroll in the IP PIN program, especially those who:

- Have been victims of identity theft in the past.

- Want additional security for their tax information.

- Need to resolve issues related to dependents being claimed on multiple tax returns.

Starting in 2025, there’s another compelling reason to get your IP PIN: The IRS will now accept electronically filed tax returns even if a dependent has already been claimed—provided the return includes a valid IP PIN. Without it, you may be forced to file by mail, which can lead to lengthy delays.

Step-by-Step Guide to Obtaining Your IP PIN

1. Create or Access Your IRS Online Account

To begin, visit the official IRS Individual Online Account page. If you already have an account, log in using your credentials.

You’ll need to create an account if you’re new to the system. During the setup process, you’ll be required to:

- Verify your identity using personal details such as your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Provide a government-issued photo ID, such as a driver’s license or passport.

- Set up two-factor authentication for added security.

This step might take a little time, but it protects your account and personal information.

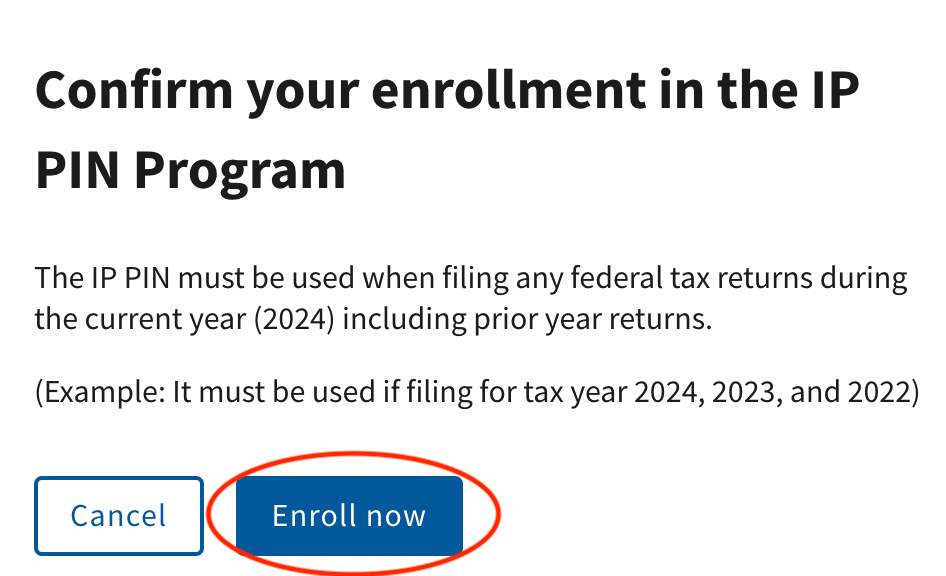

2. Enroll in the IP PIN Program

Once you’ve logged into your account, go to the Profile section in the screen’s upper-right corner. Scroll down to the bottom of the page and select the Enroll now button.

Follow the prompts to complete your enrollment. You’ll receive your IP PIN immediately after confirming.

3. Safeguard Your IP PIN

Alternatives for Those Without Online Access

If you’re unable to use the IRS online system, don’t worry—you have options. Taxpayers with an adjusted gross income (AGI) below certain thresholds can apply for an IP PIN using Form 15227.

Here’s how it works:

- Download Form 15227 from the IRS website.

- Fill out the form with your personal information, including your Social Security number, address, and prior-year tax information.

- Mail the completed form to the IRS.

Once the IRS processes your application, they will verify your identity and issue an IP PIN. Note that this method may take longer than the online option, so plan accordingly.

Important Timing Considerations

What About Dependents?

Dependents can also receive IP PINs, adding another layer of security for families. If your dependent has an IP PIN, you’ll need to include it on your electronically filed return.

For example, if you claim the Earned Income Tax Credit (EITC) or report child and dependent care expenses, you must include their IP PIN to avoid rejection. This requirement doesn’t apply to paper-filed returns but is vital for e-filing.

Why This Extra Step Matters

Tax-related identity theft is a growing concern, and resolving fraudulent filings can be time-consuming and stressful. By obtaining an IP PIN, you’re proactively protecting your personal and financial information.

Even if you haven’t experienced identity theft, the added security of an IP PIN is worth the effort. It provides peace of mind and prevents potential delays caused by filing complications.

Conclusion

Obtaining an IP PIN for the tax season is a smart and simple way to protect yourself from tax-related identity theft. Whether you use the IRS online account system or submit Form 15227, the process is straightforward and well worth your time.

Don’t wait until the last minute. Enroll today and safeguard your tax return. By taking this proactive step, you’ll enjoy a smoother, more secure filing experience.

For more information, visit the IRS IP PIN page or consult us at MBE CPAs. We’re here for you.