Celebrate Your Business During Manufacturing Month

Authored by: Glen Erdman — Director, EA | Date Published: October 13, 2025

October is Manufacturing Month, making it the perfect time to shift your focus from operational achievements to strategic year-end tax planning. As a business owner, don’t find yourself staring at tax obligations that are overshadowing your strong revenue growth. We don’t want you to be caught between celebrating another successful year and dreading the tax bills that follow.

This final quarter presents manufacturing businesses with an opportunity to take advantage of: Optimizing your tax position while strengthening next year’s financial foundation. Inventory management, equipment depreciation, and seasonal fluctuations require your full attention now. We’ll walk you through what to do between the October festivities.

Featured Topics:

Understand Your Position

Your business faces a distinctive set of tax considerations that distinguishes manufacturing from other industries. The key to moving into the next year with success is determining your financial position. What are the main contributors to these numbers?

It starts with the purchases you make each year. If you are looking to minimize your current tax burden, the timing of each equipment purchase becomes an important decision point. For qualifying assets placed in service before January 1, 2025, bonus depreciation is 60% of the eligible cost.

As a manufacturer, you may struggle with accurate cost accounting, especially when indirect costs like utilities, maintenance, and labor burden aren’t properly allocated. Delaying critical purchases may lead to a missed depreciation opportunity. For businesses where inventory turnover rates vary dramatically by season, these decisions become even more critical.

Purchases That Impact Taxes

It’s October, and we’re closing in on the final hours of making strategic purchases to impact your tax position.

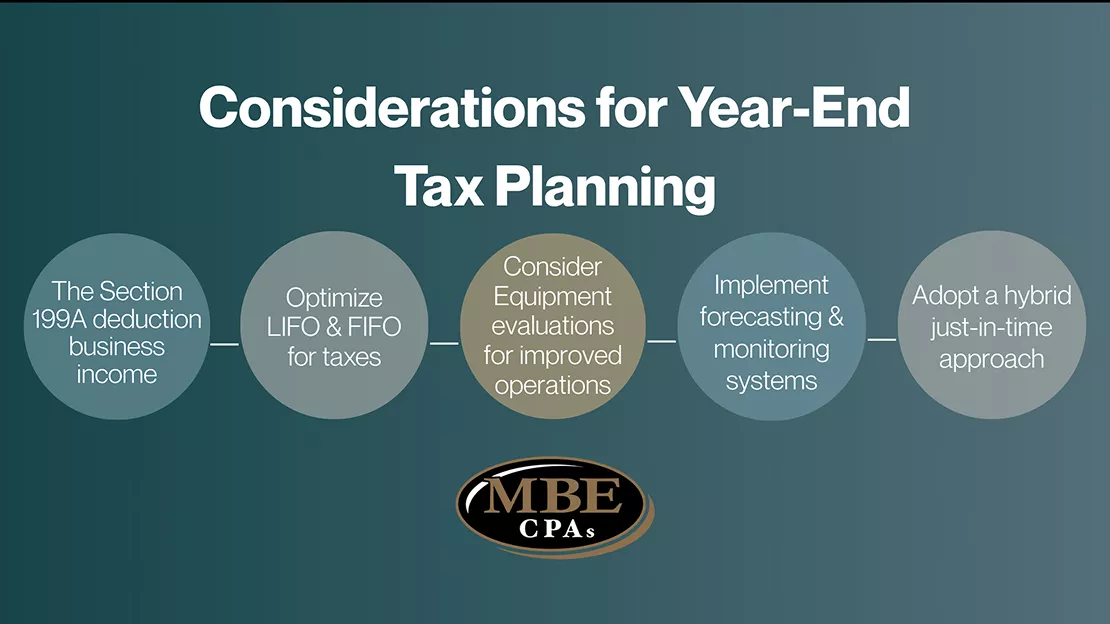

Key Insight: Manufacturers should consider the Section 199A deduction for qualified business income eligibility, which can provide additional tax savings. The window to qualify for these deductions closes December 31st, so optimizing your 2025 tax position will require immediate action.

What can this look like?

Purchasing energy-efficient equipment, new delivery trucks, or even evaluating your current assets for trade-ins. Thoughtful equipment timing combined with bonus depreciation can help fund new purchases, especially with continuous supply chain disruptions that affect specialized equipment lead times. For manufacturers running multiple shifts or planning capacity expansion, acquire new equipment before year-end to capture depreciation benefits immediately rather than waiting another full year.

Another choice that can impact your taxable income is FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) inventory accounting methods, particularly during periods of inflation or market fluctuations.

- LIFO: Both taxable and financial income can be lowered, but this can lead to lower reported income for shareholders. However, with higher inflation, LIFO becomes more beneficial from a tax perspective as the tax penalty associated with FIFO would be increased.

- FIFO: Both taxable income and financial income are raised, but FIFO may be a more transparent and accurate reflection of inventory valuation on the balance sheet, which is important for investors.

Finding opportunities where transactions align with current tax laws can positively impact your tax position. If you’re planning major equipment purchases, verify delivery schedules now to ensure assets arrive and can be placed in service before December 31st.

Cash Flow & Expense Timing

From season to season, your expense timing decisions can get complicated. Peak production could occur in late summer or fall and concentrate expenses in the final quarter. You’re investing in capital long before seeing a return, or even after selling a product, you’re not receiving payment until 90 days later.

How can the timing of your ordinary expenses be thoughtfully managed to optimize tax outcomes?

Here are some ways to better position your business by controlling cash flow:

- Equipment evaluations, process improvements, or regulatory compliance reviews before year-end can provide immediate deductions.

- What does this do? Your business can be better positioned for improved operations in the following year.

- Consider adopting a hybrid just-in-time approach. Approach high-value, reliably available items with just-in-time management, while maintaining critical components as an appropriate safety stock.

- How will I benefit? The amount of capital tied up in inventory is significantly reduced by only purchasing and producing as needed, improving your cash flow.

- Labor costs represent one of your largest expenses, yet many manufacturers overlook the tax benefits of bonuses and profit-sharing timing. Pay your bonuses within 2.5 months of year-end to satisfy IRS requirements and receive immediate tax deductions.

- What future cash does your business need? Consider implementing forecasting and monitoring systems, like projecting your weekly cash inflows and outflows. With an aligned manufacturing schedule, you can prevent outpacing cash with production.

We understand that the year-end adds extensive tasks to your to-do lists. A common pitfall that manufacturers make is miscalculating the year-end work-in-progress inventory, leading to unexpected tax consequences. If there’s one thing you should prioritize on your year-end plan, it’s conducting a thorough physical inventory count in December to avoid inaccurate financial reporting and IRS scrutiny.

Cash is your business’s critical resource—improve how you manage it before the year-end.

R&D Opportunities for Manufacturers

You want to grow, create new, valuable products, or even more efficient processes. This additional innovation of scientific and technological research is going to cost your business a high amount, but don’t let that hold you back from staying ahead.

The R&D tax credit for manufacturing supports the search for new solutions and products by incentivizing your business to take the risk of creating value. Every successful business can find creative ways to improve its bottom line, and tax credits can do just that.

Here are the activities that qualify:

- Business Improvement: The research activity has to be directly tied to the development of a new business component

- Activity Grounds: The research has to rely on sciences including biology, computer science, physics, engineering, chemistry, or geology.

- Process of Experimentation: The process of evaluation should include modeling, testing, simulating, and trial and error. The taxpayer must also test the feasibility and technical soundness.

As we approach the year-end, manufacturers can look at this tax credit to test future success. Next year, perhaps you want to expand your business offerings but don’t want to incur the expense of trial and error. Innovations like process optimization, safety improvements, and equipment modifications frequently qualify for these manufacturing tax credits.

Read more about how OBBBA has impacted manufacturing taxes.

The key: Proper documentation. With this tax credit, you can run the risk that comes with business development with the added benefit of writing off the cost. Manufacturers can also consider working with advisors who understand the specific requirements for manufacturing R&D tax deductions.

What are Work Opportunity Tax Credits?

If you are a business owner who employs certified members of targeted groups, you may be eligible for the Work Opportunity Tax Credit (WOTC). This credit provides equal to or up to 40% of the employee’s first-year wages up to a limit of $6,000 per employee. This employment tax credit allows manufacturing businesses to reduce their tax liability while supporting workforce development.

Why address this before year-end? The WOTC must be claimed for employees who begin work during the tax year, and certification applications must be submitted within 28 days of the employee’s start date.

Manufacturing businesses should evaluate their hiring practices to identify opportunities for claiming WOTC, amongst others. Here is a list of employees who would qualify for WOTC:

- Veterans

- Individuals from certain low-income families

- Other targeted groups

By identifying any employees hired in 2025 who may qualify, you won’t miss out on credits for this tax year. Taking action in October gives you time to properly document qualifications while addressing the manufacturing industry’s ongoing labor challenges.

Plan Ahead for Efficiency

As Manufacturing Month reminds us of the important role manufacturing plays in our economy, business owners recognize that successful growth stems from effective year-end tax planning.

The decisions you make in the coming weeks will impact your business’s financial position well into 2026. Contact MBE CPAs today to understand if your manufacturing business captures every available tax deduction, credit, and strategy while building a foundation for continued success.