No Tax on Tips Act Guide

Authored by: Doug Gross—Partner, CPA, CGMA & Kim Wegner — Partner, CPA, CVA, CGMA | Date Published: July 2, 2025

Picture this: You wrap up another busy Saturday night at your restaurant. Your servers count their tips, your kitchen staff cleans down, and you review the day’s numbers. Watching your hardworking team, you wonder how you can help them keep more of what they have earned while managing your operational challenges.

If you operate a restaurant, run a franchise, or manage a restaurant, you will discover how the No Tax on Tips Act will change everything for your business and your employees. This represents more than just another policy discussion; it creates a real opportunity that will reshape how you attract talent, retain your best team members, and position your restaurant for success.

Restaurant servers, bartenders, and front-of-house staff work incredibly hard for every dollar they earn. They smile through demanding customers, work split shifts, and often sacrifice weekends and holidays to serve your guests. Soon, they will get to keep significantly more of their hard-earned restaurant tips, and you will want to understand precisely what this means for your operation.

Featured Topics:

Understanding the No Tax on Tips Act

The No Tax on Tips Act transforms how the federal government treats tip income for tax purposes. Congress passed the Senate-approved No Tax on Tips Act (S. 129) by unanimous consent on May 20, 2025, and now sends it to the House for consideration. When lawmakers sign this legislation, the government will establish a new tax deduction of up to $25,000 annually for employees who typically receive cash tips and earn $160,000 annually or less. The system will adjust this income threshold annually for inflation, keeping the benefit relevant.

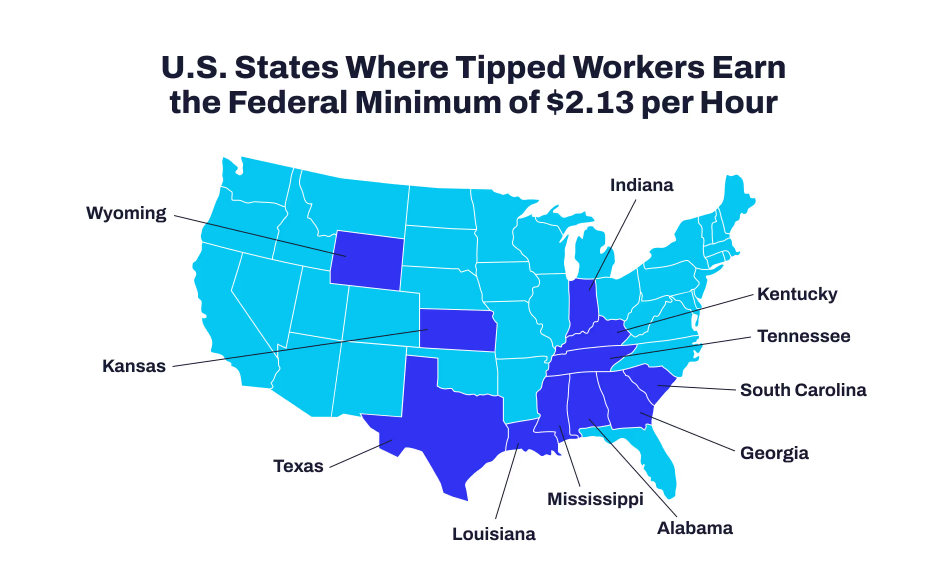

For Wisconsin restaurant owners, this development brings particular significance. Currently, the federal minimum wage stands at $7.25 an hour. Wisconsin’s minimum wage matches this amount. Therefore, tipped employees in Wisconsin earn $7.25 an hour. Your tipped employees face unique wage structures, and this federal change will provide meaningful relief.

Who Benefits from This Policy?

The legislation primarily targets service workers in industries where businesses customarily expect tipping, with restaurant servers and hospitality employees becoming the primary beneficiaries. Restaurant servers, bartenders, and other front-of-house staff who rely on restaurant tips as a significant portion of their income will see immediate tax relief under this policy.

Key Features of the Legislation:

- Income Cap: The benefit applies to employees who earn $160,000 or less annually.

- Maximum Deduction: The government exempts up to $25,000 in tip income from federal taxes.

- Inflation Adjustment: The system adjusts the income threshold annually to maintain purchasing power.

- Scope: The law covers employees who “typically receive cash tips” in their role.

The “No tax on tips” and “No tax on overtime” proposals will allow eligible employees to deduct qualified tips and overtime pay from federal taxable income for 2025–2028. However, Social Security and Medicare taxes still apply. Withholding and employment tax obligations remain unchanged.

The Potential Benefits for Restaurant Operations

Improve Employee Attraction and Retention

Every advantage counts when attracting and retaining quality staff. The National Restaurant Association notes that exempting tips from income tax could benefit the restaurant industry by reducing the administrative burden on small business owners and supporting workers who rely on tips to make a living.

This policy will position your restaurant as a more attractive workplace, particularly for experienced restaurant servers and bartenders who understand the financial impact of tax-free tip income. Higher take-home pay without raising wages can help you compete for skilled staff without increasing labor costs, creating a unique competitive advantage, especially for independent restaurants competing against larger chains.

Administrative Considerations

Currently, restaurant owners face demanding requirements for reporting tip income. If the employer charges for tips, room charges, decorations, and other chargeable services, only the tip amount must go to the employee at the end of the pay period in which they earn it. While the No Tax on Tips Act does not eliminate all reporting requirements, it will modify certain aspects of payroll administration.

Workforce Stability Benefits

When your team members take home more of their earned income, this often translates to improved job satisfaction and reduced turnover. This stability helps your business by:

- Lowering recruitment and training costs

- Improving service consistency for your guests

- Strengthening team chemistry and operational efficiency

- Delivering better guest experience through experienced staff

Key Considerations and Challenges

Wage Increase Dynamics

While the legislation offers clear benefits, you must understand potential wage structure implications. Some analysts suggest that no taxes on tips will lead restaurant owners to decline to raise base wages under the notion that workers keep more of their income from tips, which benefits owners.

As community-focused restaurant leaders, you must maintain fair compensation practices that support your team’s long-term financial well-being, regardless of tax policy changes.

Customer Behavior Considerations

The policy will influence how customers tip. Some industry observers note potential concerns about customers reducing tip amounts, particularly when consumers already experience “tipping fatigue” or when digital payment systems prompt “Would you like to leave a tip” for services that traditionally did not expect gratuities. You must maintain excellent service and clear communication about tipping practices.

Compliance Requirements Still Apply

- Monthly Reporting: Employees must accurately report all tips (cash and credit card tips) to their employer if they receive more than $20 in total tips every month.

- Record Keeping: You must maintain detailed records of tip income and distribution.

- Payroll Tax Responsibilities: Employers still carry obligations for Social Security and Medicare taxes on tip income.

Preparing Your Restaurant for Implementation

Review Your Current Tip Reporting Systems

Now presents an excellent time to evaluate your existing tip reporting and payroll systems. Make sure your processes:

- Maintain accuracy and comply with current regulations.

- Create efficiency for both management and staff.

- Adapts easily to upcoming policy updates.

- Integrate seamlessly with your POS and payroll systems

Download the ultimate restaurant accounting toolkit for detailed guidance on strengthening your financial system.

Educate Your Management Team

Your managers and supervisors should understand:

- Current tip reporting requirements and why they matter.

- How potential changes may affect daily operations.

- Why you must maintain fair compensation practices.

- Communication strategies for explaining staff changes.

Communicate Transparently with Your Team

Your employees will ask questions about how this legislation affects them. Consider:

- Hosting team meetings to discuss the policy implications.

- Providing written resources that explain the benefits.

- Connecting team members with qualified tax professionals

- Emphasizing your commitment to fair compensation regardless of tax policy

Expansion Discussions

More than four hundred operators — led by the Independent Restaurant Coalition — are pushing Congress to expand coverage beyond traditional front-of-house positions to include kitchen staff and other restaurant employees. This demonstrates how independent restaurants and larger operators commit to supporting all team members across their operations.

The coalition’s efforts reflect an understanding that restaurant success depends on every role, from servers to line cooks and dishwashers. Kitchen staff, who traditionally work for hourly wages rather than tips, would benefit significantly from expanded tax relief coverage. Many restaurant owners are asking when the No Tax on Tips legislation will take effect, as implementation timing will prove crucial for workforce planning and payroll management. Industry advocates argue that comprehensive coverage could help address labor shortages while leveling the playing field between front-of-house and back-of-house positions.

Moving Forward Together

At MBE CPAs, we believe strong restaurant operations build solid partnerships between owners, managers, and team members. The No Tax on Tips Act creates an opportunity to strengthen these relationships while improving your competitive position.

As this legislation moves through implementation, we commit to helping restaurant leaders manage these changes successfully. The restaurant industry has consistently demonstrated resilience and adaptability, and this Act provides another opportunity to showcase these qualities while supporting hardworking team members.

Policy changes work best when implemented thoughtfully with genuine consideration for all stakeholders. By focusing on transparency and fairness, restaurant leaders can transform this legislation into a positive force for their operations and communities.

We remain committed to providing the experience and partnership you need to prosper.

This analysis is based on current legislative proposals and industry reporting. Restaurant owners should consult with qualified tax and legal professionals to understand the specific implications for their operations. MBE CPAs is here to support restaurant leaders through policy changes and business growth opportunities.