Your Simple Checklist for Stress-Free Tax Season

Tax preparation isn’t just for tax season. Right now, you’re spending your time trying to reconstruct your year from bank statements. You’re pretty sure your business qualifies for some deductions from articles you read online, but you’re not confident enough to claim them. In the end, you’ll file what you can, pay more than you needed to, and vow that next year will be different.

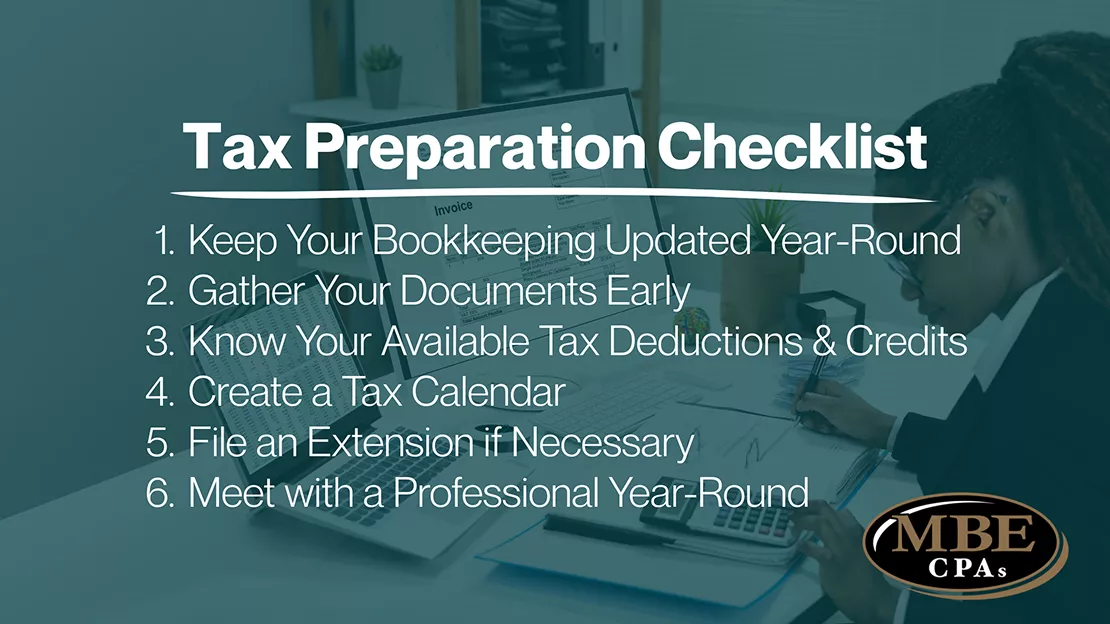

Preparing taxes as a small business owner can feel overwhelming, but treating your prep as a year-round process lays a solid foundation for success. Here’s your straightforward checklist to make tax season manageable.

Featured Topics:

Keep Your Bookkeeping Updated Year-Round

Treating your bookkeeping as a priority, not a chore, makes tax time much easier. By keeping your books updated throughout the year, you always know where your business stands.

You don’t need to become an accounting expert—you just need a system. Track your income and expenses consistently throughout the year using software like QuickBooks Online or similar platforms. These tools help you manage cash flow, create invoices, handle payroll, and generate reports instantly when you need them. This way, when tax time arrives, it’s simply a matter of finalizing numbers that were already accurate.

If bookkeeping feels overwhelming, consider working with a QuickBooks Pro Advisor who can help you stay organized and troubleshoot issues before they become problems.

Gather Your Documents Early

Once tax season has finally arrived, gather and prepare the required documents for your business return. Starting this list now means less stress later.

Make sure you have the following organized and ready:

- Business Essentials: Taxpayer Identification Number & personal information, previous year’s tax return, financial statements (profit & loss, balance sheet)

- Income and Expenses: All tax forms, income and expense records, receipts for cash purchases, and statements for credit cards and banks.

- Assets and Operations: Asset purchase information and depreciation schedules, loan documents and interest statements, payroll data, year-end inventory count, investment statements (stocks & bonds)

Now that you’ve organized your books and records and gathered your documentation, determine which business tax return you must prepare.

- S Corps: Form 1120-S

- C Corporations: Form 1120

- Partnerships & multi-member LLCs: Form 1065

- Sole Proprietors & Single-Member LLCs: Schedule C, E, F

You should also use this time to review your previous tax returns to check if you’ve missed any tax credits and deductions. You can file an amended return using IRS Form 1120-X if needed.

Know Your Available Tax Deductions & Credits

Tax deductions and credits save your business money, and your options will differ depending on which business tax return you must prepare.

Should you have used self-rental deductions or tracked your business mileage more carefully to reduce your tax liability? These are the kinds of questions that get answered when you have a professional in your corner before April rolls around.

While it varies for each business, here are a few tax deductions to research or discuss with your tax preparer:

Workspace and Operations

- Self-Rental: The best practice is to have your business pay monthly rent for the space to avoid higher tax liabilities, as this is a deductible business expense. The IRS requires that self-rentals be charged at a “fair market value” rental rate.

- Home Office Deduction (if used exclusively as principal place of business)

- Advertising & marketing expenses

Travel and Transportation

- Standard Mileage Deduction for business vehicle use: Be sure to keep a log of the trip’s details.

- Parking fees and tolls

- Cancellation and rescheduling fees for business trips

Technology and Professional Development

- Credit Card Convenience Fees: A small business that uses credit cards can deduct convenience fees charged by the card companies.

- Education and training expenses of the owners and employees

- Business-related cell phone usage

Special Deductions

- Qualified Business Income Deduction & Membership Dues

- Startup & Organizational Costs: You can deduct up to $5,000 in startup costs and $5,000 in organizational expenses.

- Self-employed health insurance premiums

While it varies for each business, here are a few tax credits to research or discuss with your tax preparer:

- R&D Tax Credit: The R&D tax credit supports activities related to product development, process improvements, and software innovation. It provides qualified businesses with $500,000 in claimable credit to further their R&D activities under the Inflation Reduction Act.

- Clean Energy Tax Credit: This tax credit incentivizes businesses’ sustainability efforts:

- 30% of the amount spent on switching to low-cost solar power

- 30% of purchase costs for clean commercial vehicles

- $5 per square foot for energy-efficient building improvements

- Work Opportunity Tax Credit: All employers who hire individuals with physical or mental disabilities receive 40% of the first $6,000 in first-year wages.

Keep good records by properly categorizing and filing receipts for all your expenses, including cash expenses. Staying up to date on recent tax changes affecting small businesses helps prevent missing out on tax deductions and credits you qualify for.

Create a Tax Calendar

Meeting the tax filing dates is essential, and they differ depending on your business structure. Consider creating a digital tax preparation calendar to help you stay on track and avoid incurring penalties for late tax filings.

Let’s look at the relevant dates:

- March 15, 2026: Partnerships, S Corps, and multi-member LLCs

- April 15, 2026: Single-member LLCs, C Corps, and sole proprietors

Mark these dates now, along with quarterly estimated payment deadlines, so you’re never caught off guard. These are not the only due dates that vary, and every business owner wants to avoid late fines and interest.

File an Extension if Necessary

Here’s something many business owners don’t realize: extensions exist for a reason.

If you find yourself scrambling to meet the deadline, you may overlook a form for an automatic six-month extension, giving yourself breathing room to get everything right and prevent overpaying. An extension doesn’t give you more time to pay your taxes, but it does give you more time to file accurately, which often leads to savings.

Use the guide below to determine which form you need to fill out:

- Form 7004: S Corps, corporations, multi-member LLCs, and partnerships

- Form 4868: Sole proprietor, single-member LLCs

Remember: an extension gives you more time to file, but any taxes owed are still due by the original deadline.

Meet with a Professional Year-Round

If you’re trying to stay cost-efficient, you may be leading yourself down an impractical approach this tax season. Tax laws are complicated, and many business owners pay more taxes when filing on their own.

The business owners who save the most money and sleep the best at night are the ones who view their CPA as a year-round partner, not a once-a-year service provider.

Consider hiring an accountant to file your return, but also to help you:

- Identify tax-saving opportunities throughout the year

- Make informed financial decisions

- Avoid mistakes and legal issues

- Generate reports that lead to business growth

Waiting until tax time to meet with an accountant means you are stuck filing on your own and are at risk of overpaying. Professional guidance often pays for itself through the savings it generates.

At MBE CPAs, we take pride in our work and would love to assist. Our CPAs will analyze financial data and reports to guide critical decisions that increase profits.