Make Year-End Tax Planning Your Main Course

Authored by: Doug Gross—Partner, CPA, CGMA & Kim Wegner — Partner, CPA, CVA, CGMA | Updated On: December 17, 2025

Another year, another season of managing restaurant payroll, juggling vendors, and keeping customers happy. With 2026 on the horizon and significant tax law changes set to come into effect, year-end planning might feel like one more item on an already overwhelming to-do list. But the decisions you make in these final weeks can directly impact your cash flow and profitability when you need it most.

Unlike most businesses, owners of restaurants operate with thin margins while managing high employee turnover, perishable inventory, tipped workers, and cash transactions. Add in franchise fees for quick-serve operators or luxury renovations for fine dining establishments, and restaurant taxes quickly become specialized. Whether you’re running a bustling quick-serve location or an upscale full-service establishment, understanding your tax obligations and available deductions can mean the difference between breaking even and building real profitability.

Working with a CPA who understands the restaurant industry isn’t just about filing returns. It’s about building a partnership that helps you identify saving opportunities throughout the year and positions your business for sustainable growth.

Featured Topics:

- What Financial Records Do You Need Before Year-End?

- Which Deductions Can Lower Your Restaurant’s Tax Bill?

- What Tax Credits Can Restaurant Owners Claim?

- Should You Prepay Expenses to Reduce This Year’s Income?

- How Should You Handle Your Restaurant’s Inventory?

- What Year-End Tax Considerations Matter Most for Quick-Serve Restaurants?

- What Tax Planning Is Specific to Full-Service Restaurants?

- How Can a CPA Help You Plan Better for Year-End?

- Why Start Your Year-End Tax Planning Now?

What Financial Records Do You Need Before Year-End?

Accurate bookkeeping forms the foundation of good tax planning. Before you can take advantage of any deductions or credits, you need to know exactly where your business stands financially.

Why accurate records matter:

- They provide a clear picture of your income and expenses, helping identify potential deductions you might otherwise miss.

- They allow you to make informed decisions about year-end purchases and prepayments.

- They make tax preparation smoother and reduce the risk of errors that could trigger audits.

Take time now to review your profit and loss statements, balance sheets, and cash flow reports. Look for patterns in your expenses and identify any categories where you might be able to maximize deductions before year-end. This review process often reveals opportunities that weren’t visible during the busy day-to-day operations.

Which Deductions Can Lower Your Restaurant's Tax Bill?

Several powerful tax deductions are available to restaurant owners, but the timing of when you incur and pay for these expenses, as well as having proper documentation, are key factors in determining when deductions can be claimed.

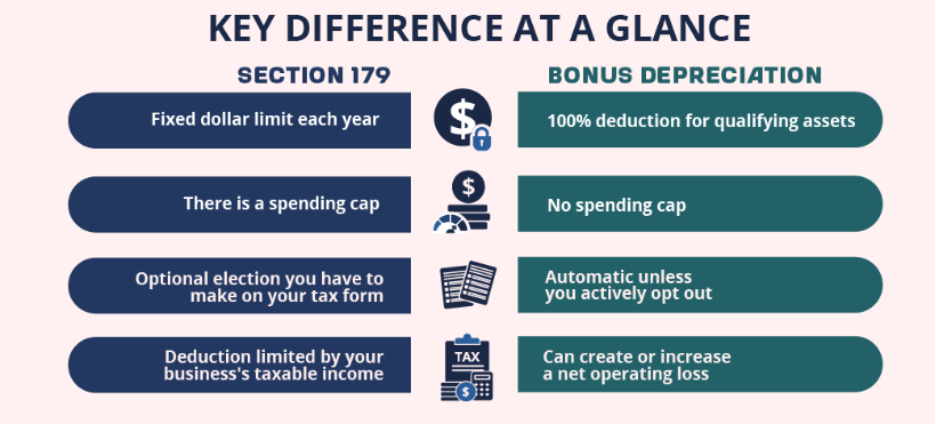

Section 179 and Bonus Depreciation

Recent changes under the One Big Beautiful Bill Act (OBBBA) made 100% bonus depreciation for qualified property placed in service after January 19, 2025. This means you can deduct the full cost of equipment, furnishings, or improvements in the purchase year, rather than spreading the deductions over several years. The Section 179 deduction limit is now $2.5 million, with a phase-out for purchases over $4 million.

If you are planning to replace kitchen equipment, update your point-of-sale (POS) system, or refresh dining room furniture, handling these purchases before year-end can make a big difference on this year’s tax return. Immediate deductions support your cash flow during high-activity months.

Qualified Business Income Deduction (QBID)

The Qualified Business Income Deduction allows owners of pass-through restaurant entities, such as LLCs, S corporations, or partnerships, to deduct 20% of their qualified business income. This allows an owner to take a substantial deduction on their personal return based on a percentage of the restaurant’s profits.

Common Business Expense Deductions

Restaurant owners who keep accurate records and take full advantage of the deductions for which they qualify can reduce their tax liabilities substantially. Common deductible expenses include:

- Food and beverage inventory

- Kitchen supplies and tableware

- Marketing and advertising costs

- Insurance premiums

- Maintenance and repairs (when they don’t extend the useful life of assets)

- Professional services, including accounting and legal fees

The key is organization. Keep all receipts systematically throughout the year, categorize expenses properly, and maintain documentation that shows how each expense relates to your business operations.

What Tax Credits Can Restaurant Owners Claim?

Tax credits directly reduce your tax liability dollar-for-dollar, making them even more valuable than deductions.

Work Opportunity Tax Credit (WOTC)

This federal credit rewards businesses that hire individuals from certain targeted groups, including veterans, long-term unemployment recipients, and individuals receiving government assistance. For restaurants facing ongoing labor challenges, WOTC provides a financial incentive while helping you build a diverse workforce.

FICA Tip Credit

For full-service restaurants with tipped employees, the FICA tip credit offers substantial savings. This credit is based on the employer’s share of Social Security and Medicare taxes on tips that exceed the minimum wage, potentially saving establishments with significant tip income thousands of dollars annually.

Employee Benefits Credits

Restaurants that offer health insurance or retirement plans may qualify for additional credits, especially for small businesses. These credits reduce your tax burden and help retain quality staff.

Should You Prepay Expenses to Reduce This Year's Income?

For cash-basis taxpayers, which includes many restaurants, prepaying certain expenses before year-end can shift deductions into the current tax year.

Consider prepaying expenses such as:

- Insurance premiums for the upcoming year.

- Rent for January (if permitted under your lease).

- Supplies you know you’ll need in the first quarter.

- Annual software subscriptions or licensing fees.

This strategy works best when you’ve had a particularly profitable year and want to reduce your current tax liability. However, make sure you have the cash flow to support these prepayments without disrupting your operations in the new year.

How Should You Handle Your Restaurant's Inventory?

Inventory management affects both your operations and your taxes. A year-end physical inventory count provides accurate information for your financial statements and tax returns.

Your inventory valuation method (FIFO, LIFO, or weighted average) can impact your taxable income, especially during periods of rising food costs. Work with your CPA to determine which method best suits your specific situation and apply it consistently.

For restaurants with significant alcohol inventory, proper tracking is particularly important given the tax implications of alcohol sales and the need for accurate reporting to various regulatory agencies.

What Year-End Tax Considerations Matter Most for Quick-Serve Restaurants?

Quick-serve restaurants operate on speed, volume, and technology. These operational realities create specific tax-planning opportunities that smart operators can use to their advantage.

Ongoing franchise fees and royalty payments are deductible as business expenses. Whether you’re operating a Culver’s franchise or multiple pizza locations, tracking these expenses is vital for accurate reporting. Multi-unit operators must manage sales tax compliance in each area. Third-party delivery fees are also deductible when tracked separately.

Actions to consider before year-end:

- Upgrade POS systems, kitchen display systems, or self-service kiosks to take advantage of 100% bonus depreciation.

- Review sales tax compliance across all locations to prevent penalties.

- Document and categorize all delivery service fees for proper deduction tracking.

- Calculate franchise fees and royalties across multiple units for accurate reporting.

What Tax Planning Is Specific to Full-Service Restaurants?

Full-service establishments focus on atmosphere, service, and beverage programs. These priorities lead to tax items that differ significantly from those in quick-serve restaurants.

Tip reporting is a major concern for full-service tax preparation. If records show tips are less than 8% of food and beverage revenue, restaurants must allocate tips to hit that number. The FICA tip credit helps by offsetting the employer’s payroll tax on tips above the minimum wage, potentially saving a business thousands of dollars annually. With discussions around no tax on tips and overtime gaining attention for 2025 and beyond, staying current on tip reporting rules is important for complying with the law and maintaining credit eligibility.

Actions to consider before year-end:

- Verify tip reporting accuracy to claim the FICA tip credit and maintain compliance.

- Explore cost segregation studies for recent or planned renovations to accelerate depreciation.

- Review alcohol inventory management to understand beverage program profitability and tax obligations.

- Separate employee meal deductions (100%) from business meal deductions (50%) for proper documentation.

How Can a CPA Help You Plan Better for Year-End?

With major tax legislation having changed this year, restaurant owners must adjust to new laws, specific credit qualifications, and compliance requirements. Thinking ahead and paying close attention to these details are necessary steps. These actions help you prevent mistakes and fully utilize all available tax savings.

A CPA with restaurant industry experience brings several advantages:

- They stay current on tax law changes affecting the hospitality sector.

- They understand the unique deductions and credits available to restaurants.

- They identify planning opportunities you might miss on your own.

- They help you avoid costly mistakes that could trigger audits or penalties.

Proactive tax planning means looking ahead, not just backward. Your CPA should help you forecast your tax liability for the current year, plan for major purchases or expansions, and structure your business in the most tax-advantageous way possible.

Why Start Your Year-End Tax Planning Now?

At MBE CPAs, our Restaurant and Franchise team understands the specific challenges you face. We don’t just prepare tax returns. We take the time to understand your business and your goals, so our advice is practical and relevant to your needs.

The restaurant industry is built on relationships, hard work, and attention to detail. Your tax planning deserves the same level of care you put into every dish you serve. Let’s work together to reduce your tax burden, improve your cash flow, and set your restaurant up for success in the year ahead.