Protect Your Family’s Wealth Now

Authored by: Kim Wegner — Partner, CPA, CVA, CGMA | Updated on: June 25, 2025

Have you inherited land from a loved one? If so, you might know the challenges of co-owning property with multiple heirs. You’ve inherited it alongside family, but without a clear plan, and this shared legacy could easily become a source of conflict—or even be lost forever. This is the reality for many co-owners of inherited property, especially when a landowner dies without a will. Fortunately, the Uniform Partition of Heirs Property Act (UPHPA) was designed to protect family land from unexpected circumstances. As a certified succession planner, I guide families through this complex process, crafting personalized strategies to ensure your family’s treasured land is preserved for future generations. Let’s explore how the UPHPA can safeguard your family’s legacy through strategic planning.

Featured Topics:

The Dilemma of Tenants-in-Common

Being a tenant-in-common means owning a percentage or fractional share of the entire property instead of owning a specific, delineable portion of the property. This form of ownership may seem straightforward but becomes complicated regarding property management or the decision to sell. Property partition laws become crucial for understanding and managing these situations. It opens a pathway for external investors to exploit the problem by buying a fraction of the land at prices significantly lower than its market value, undermining the full economic potential of the property for the heirs.

How UPHPA Helps

The UPHPA aims to reduce these difficulties by creating a legal structure that focuses on keeping the property within the family and maintaining its worth. Here is how it achieves its objectives:

Due Process Protections:

The act introduces due process protections that the courts supervise. This framework aligns with property partition law. Any action involving heirs’ property, especially those leading to land sale or division, must undergo a transparent, impartial legal process. All parties’ rights are protected.

Co-ownership Agreement Encouragement:

It encourages families to enter into co-ownership agreements that specify the rights and responsibilities of each co-owner, paving the way for more structured property management.

Buyout Procedures:

Before any sale or partition action, the question arises, “How long does a partition action take?” Family members must be given the option to buy out the interest of a co-owner who wishes to sell. This provision aims to keep the property within the family whenever possible.

Fair Valuation:

In cases where the sale of the property becomes inevitable, the UPHPA mandates a fair market price. This shields heirs from investors buying the property below its actual value.

The Broader Impact

By implementing these measures, UPHPA effectively protects family-owned land and wealth. It recognizes the deep emotional and financial significance of a family’s land and aims to secure it for future generations. This act aligns with broader estate planning and succession strategies, ensuring that documents listing heirs are properly utilized and understood within the context of partition property law.

Inherited land represents more than just property; it often embodies years of tireless effort, sacrifice, and dreams. It’s a tangible testament to a family’s legacy, built with sweat, tears, and unwavering determination. UPHPA understands this profound connection and strives to shield these invaluable assets from unnecessary division, preserving not just land but the stories and aspirations woven into its very soil.

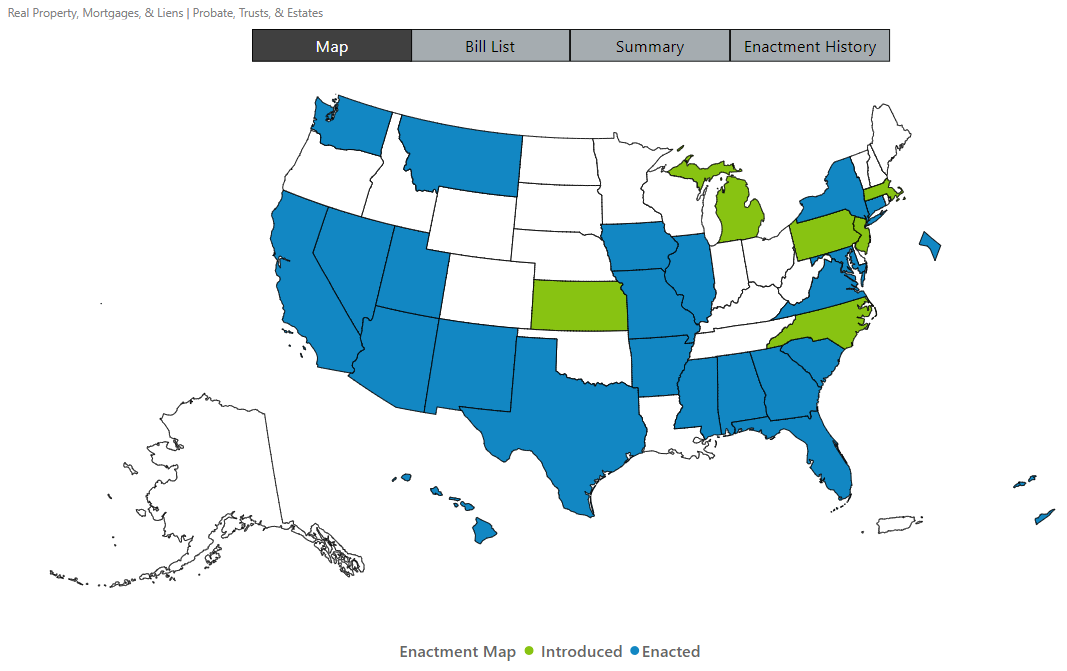

State-Level Adoption

The UPHPA has seen varying levels of adoption across the United States, with several states introducing and enacting the legislation. Each state’s adoption and implementation of the UPHPA underscores the broader recognition of protecting heirs’ property rights and preserving family wealth at the state level. This is a critical area of succession planning consulting and can significantly affect farm succession planning consultants who deal with these issues. Knowing the importance of this, our succession planning team at MBE is here to assist.

Strategies for States Without UPHPA Adoption

For residents in states that have not yet adopted the UPHPA, there are several proactive measures to safeguard their family’s land and wealth. Consulting a certified succession planning consultant is an important first step, offering strategies to protect property without state-specific UPHPA protections. Key actions include creating a comprehensive estate plan and establishing trusts for property management.

Property owners should also educate themselves and their heirs on their state’s interstate succession laws, ensuring all family members are prepared and aligned for future property management. Specifically, for farm and agricultural lands, engaging with farm succession planning consultants can help preserve operational continuity and establish supportive business structures.

Moreover, advocating for the UPHPA’s adoption within their state and engaging with community organizations focused on land preservation can provide additional avenues for support. These organizations often host workshops and legal clinics, providing valuable resources for property owners aiming to secure their family assets and legacy.

Protecting Family Legacy with the UPHPA

The Uniform Partition of Heirs Property Act (UPHPA) represents a vital step forward in protecting the interests of families and preserving generational wealth. By preventing the involuntary loss of property and guaranteeing fair procedures for its sale or partition, the act helps keep property in the heirs’ hands. Succession planning challenges often complicate these issues, but the principles laid out in the UPHPA can offer solid ground for families navigating these waters. As more states consider introducing or enacting this legislation, it is hoped that more families will be protected from the vulnerability of fractional ownership, securing both their heritage and their financial future.

Drawing on their knowledge and experience in estate planning, tax, and financial management, MBE CPAs can help families understand their options, develop comprehensive strategies, and create a smooth transition of assets. By working closely with legal counsel, we can offer insights into the financial implications of different succession plans and help protect family wealth for generations to come. We know it’s important.

1 thought on “Protect Your Family’s Wealth Now”

Comments are closed.