Claim Your ERC

You Can Still Claim Your Employee Retention Tax Credit

The COVID-19 pandemic is almost over and people are ready to leave it behind. However, some things, specifically the offshoots of COVID-19, cannot be left for the books to tell; and for some, its aftermath will linger on for another couple of years.

One such thing that cannot be cast aside is the claiming of the Employee Retention Tax Credit (ERC) which was designed to provide employers with a refundable tax credit on qualified wages. It originated from the Coronavirus Aid, Relief, and Economic Security (CARES) Act and was terminated with the passage of the Infrastructure Investment and Jobs Act.

You can retroactively file your claims within three years from the ERC program’s termination.

Before you go on and file your claim, here’s a quick guide on the ERC.

Who Are Eligible to Claim?

The employers qualified for the program are determined by any of the following factors:

- Businesses that were fully or partially suspended or had to reduce hours due to government restrictions or order;

- Businesses that had significant decline in gross receipts.

What Are Qualified Wages?

Wages, including qualified health expenses, paid from March 13, 2020 until the termination of the ERC and that are subject to Federal Insurance Contributions Act (FICA) taxes are generally qualified wages with respect to the computation of the employee retention credit.

As an exception, under IRS Notice 2021-49, the wages paid to employees with the following relationships to a majority owner of a business are not qualified:

- A child or a descendant of a child;

- A brother, sister, stepbrother, or stepsister;

- The father or mother, or an ancestor of either

- A stepfather or stepmother;

- A niece or nephew;

- An aunt or uncle;

- A son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law;

- An individual (other than a spouse) who, for the taxable year of the taxpayer, has the same principal place of abode as the taxpayer and is a member of the taxpayer’s household.

Wages are further qualified by the number of employees and other factors depending on the applicable law.

CARES Act

Employers with 100 or fewer full-time employees: All wages can be used when computing the employee retention credit, except for paid leaves in accordance with the Families First Coronavirus Response Act.

Employers with more than 100 full-time employees: Employers under this category can only include the wages of employees that are not working due to the suspension of or decline in business, and does not cover any paid leaves given to employees in accordance with the company’s current policy.

Consolidated Appropriations Act of 2021

American Rescue Plan Act of 2021

This law relaxed the rule for hardest-hit businesses and allowed them to claim credit against qualified wages paid to all employees, whether providing services or not.

For purposes of this Act, hardest-hit businesses are those “whose gross receipts in the quarter are less than 10% of what they were in a comparable quarter in 2019 or 2020.”

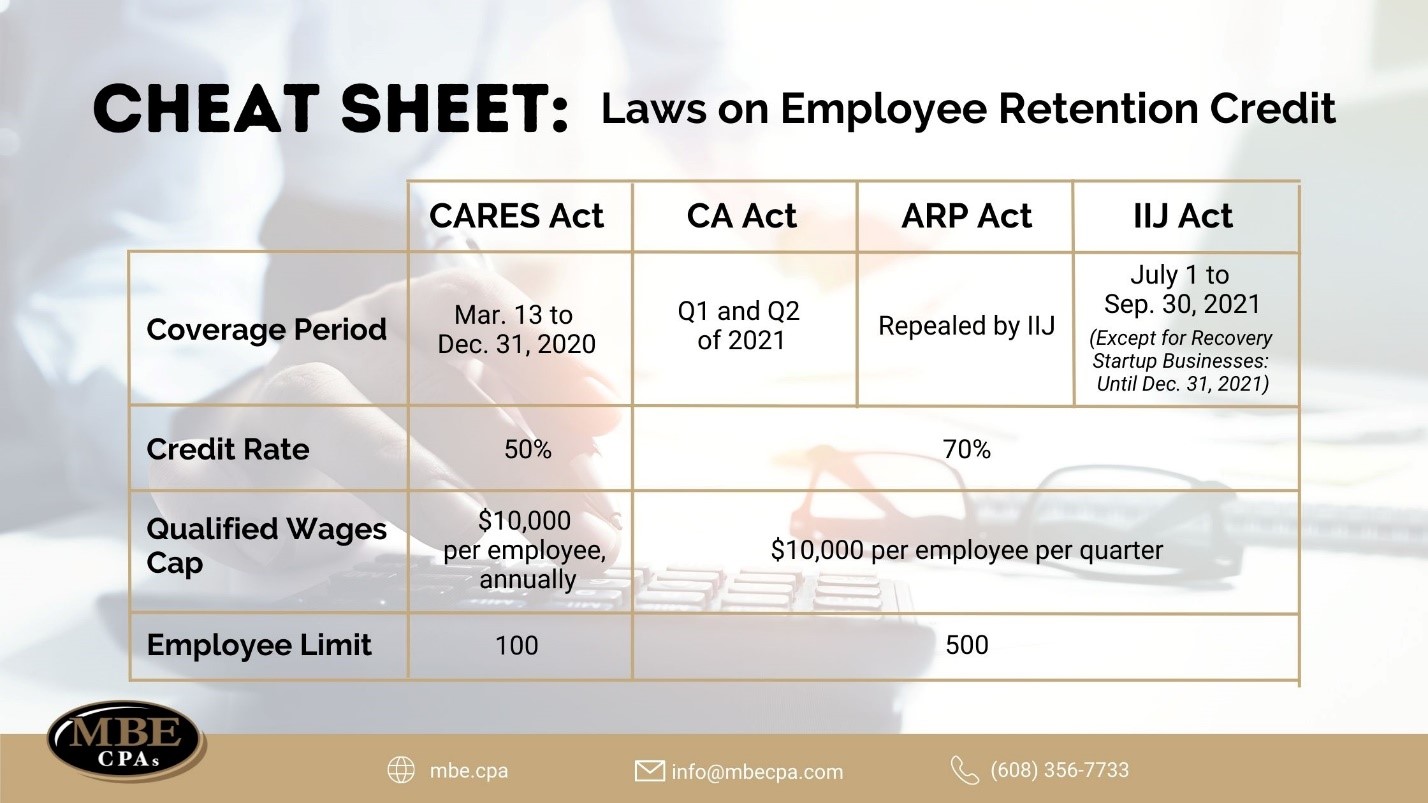

What Are The Periods Covered and How Much Can Be Claimed?

The amount that can be claimed depends on the law in effect with respect to the period when you paid qualified wages to your employees.

CARES Act

The CARES Act covers qualified wages paid between March 13 and December 31, 2020. Under the said law, the credit can be claimed against 50% of the qualified wages paid which is capped at $10,000 per employee annually. This means that you can claim only up to $5,000 per employee during the period.

Consolidated Appropriations Act of 2021

The Consolidated Appropriations act extended the ERC program and increased the percentage of qualified wages claimable as tax credit to 70%. Furthermore, it increased the qualified wages to $10,000 per employee per quarter, as opposed to the annual $10,000 cap per employee under the CARES Act.

With this law, employers can claim credit against 70% of qualified wages paid during the first two quarters of 2021. Thus, an employer can claim up to 14,000 per employee for the two quarters covered.

American Rescue Plan Act of 2021

Infrastructure Investment and Jobs Act

What Is A Recovery Startup Business?

Under Section 9615(5) of the Infrastructure Investment and Jobs Act, a recovery startup business is any employer:

- Which began carrying on any trade or business after February 15, 2020,

- For which the average annual gross receipts of such employer for the 3-taxable-year period ending with the taxable year which precedes the calendar quarter for which the credit is determined does not exceed $1,000,000, and

- Which, with respect to such calendar quarter, is not described in subclause (I) or (II) of paragraph (2)(A)(ii).

How Can I Claim the ERC Retroactively?

Eligible employers must file a Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund covering the applicable quarters in which the qualified wages were paid.

Can Small Businesses That Received A PPP Loan Claim The ERC?

Yes, but only if your PPP loan forgiveness application was not approved.

There are many other factors to consider but it’s not late to file for an employee retention tax credit. Contact us now and we’ll walk you through the process, comb through your books, and take care of all the nitty-gritty of the ERC.