How to Read a Financial Statement Like a Pro (Even if You’re Not an Accountant)

Comprehending your company’s financial position is essential for its success. A financial statement can reveal whether your company is making a profit or facing financial difficulties.

The balance sheet, income statement, and cash flow statement are three prevalent types of financial statements. Small business owners need to understand the significance of these financial reports and how to utilize them for making informed decisions based on data.

What’s a financial statement?

Financial statements are reports that explain a company’s financial performance and profitability for a certain period. It serves as an objective evaluation of a company’s financial health during financial reporting. There are three primary types of financial statements:

- Balance sheet: This statement lists a company’s assets, liabilities, and equity balances. It showcases a business’s financial position at a particular point in time.

- Income statement: An income statement shows a company’s revenue and expenses for a given period. It provides information on investment returns, risks, financial flexibility, and operational capabilities.

- Cash flow statement: A cash flow statement documents a company’s cash inflows and outflows. It can be separated into three categories: operating, investing, and financing.

Business owners use three financial statements to understand their bottom lines and make smarter business decisions. Financial statements also let stakeholders – such as shareholders, creditors, and regulators – understand a company’s financial performance and health. They are essential when seeking funding for your business or fulfilling regulatory requirements.

Now, let’s take a closer look at each type of financial statement and how they provide valuable information for your business.

Balance Sheet

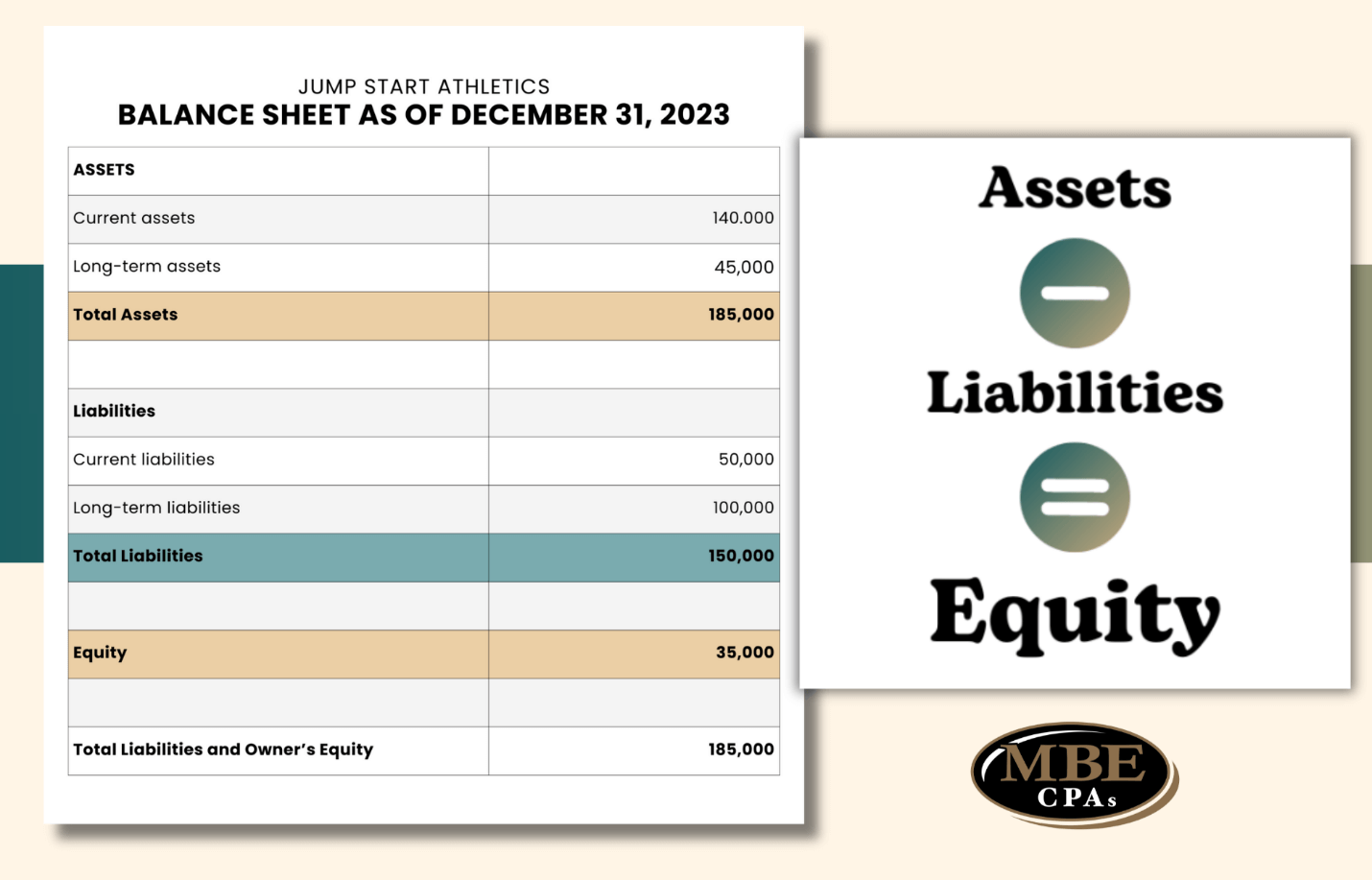

A balance sheet, or statement of financial position, lists a company’s assets, liabilities, and equity balances and showcases its financial position at a particular point in time.

- Assets refer to resources that generate revenue, sales, and profits. These resources can be tangible assets such as vehicles or intangible assets such as patents or intellectual property.

- Liabilities are the amounts owed to other parties, including current liabilities like accounts payable and long-term debt.

- Equity represents a business’s actual value and is calculated as the difference between assets and liabilities. It encompasses common stock, additional paid-in capital, and retained earnings and is also known as shareholder’s equity, owner’s equity, or net worth.

Assets – Liabilities = Equity

By analyzing the balance sheet, business owners can assess their economic resources and obligations, earning capacity, potential cash flows, management status, and accounting policies. It provides a snapshot of the company’s financial health and helps guide decision-making.

Income Statement

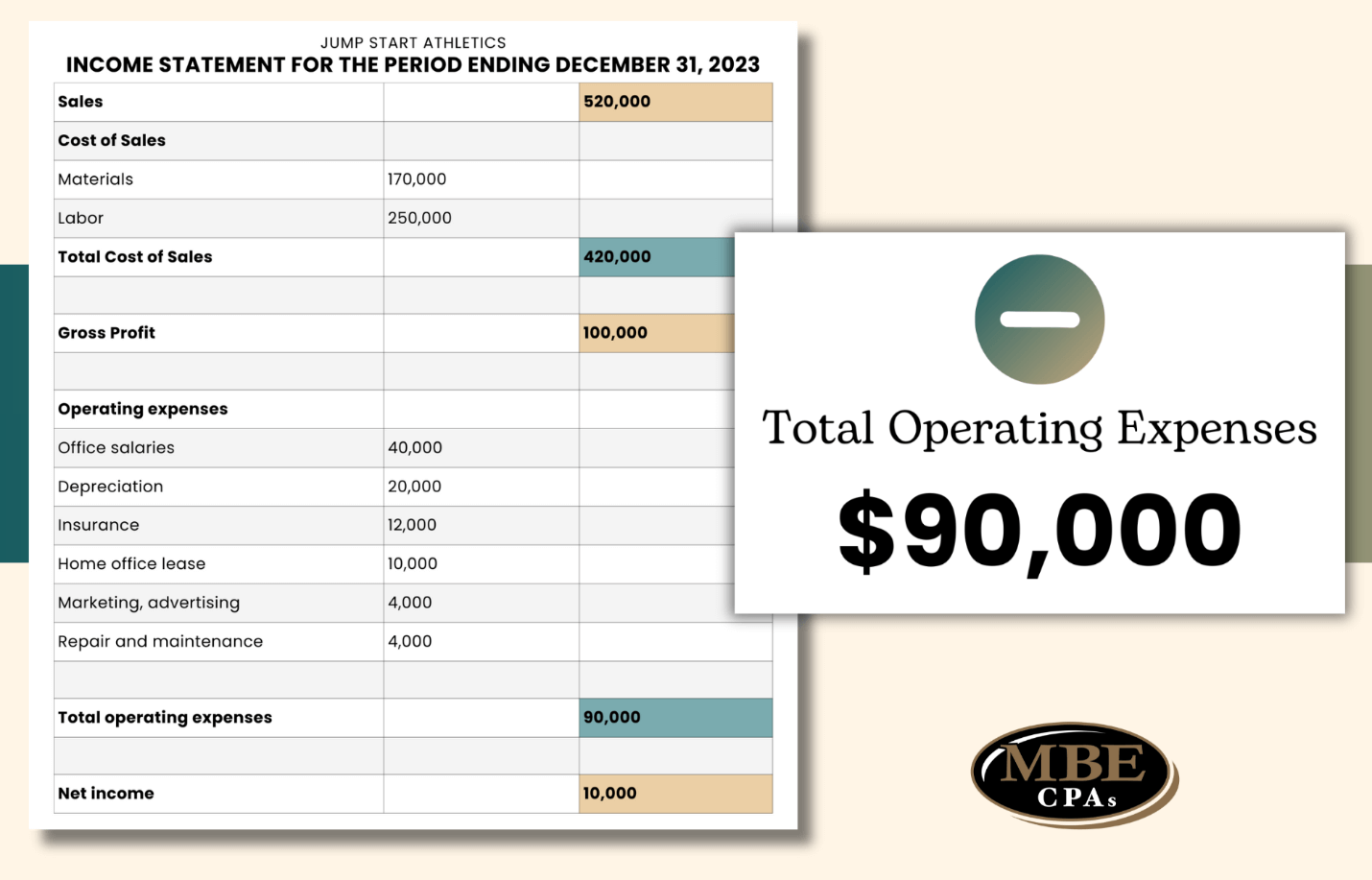

An income statement shows a company’s revenue and expenses for a specific period. It provides valuable insights into the company’s profitability and financial performance. Understanding the income statement allows business owners to evaluate their return on investment, identify risks, assess financial flexibility, and analyze operational capabilities.

The income statement includes vital financial metrics such as sales, cost of goods sold, gross profit, operating expenses, non-operating income, and net income. By carefully reviewing these numbers, business owners can identify areas for improvement and make informed business decisions.

Cash Flow Statement

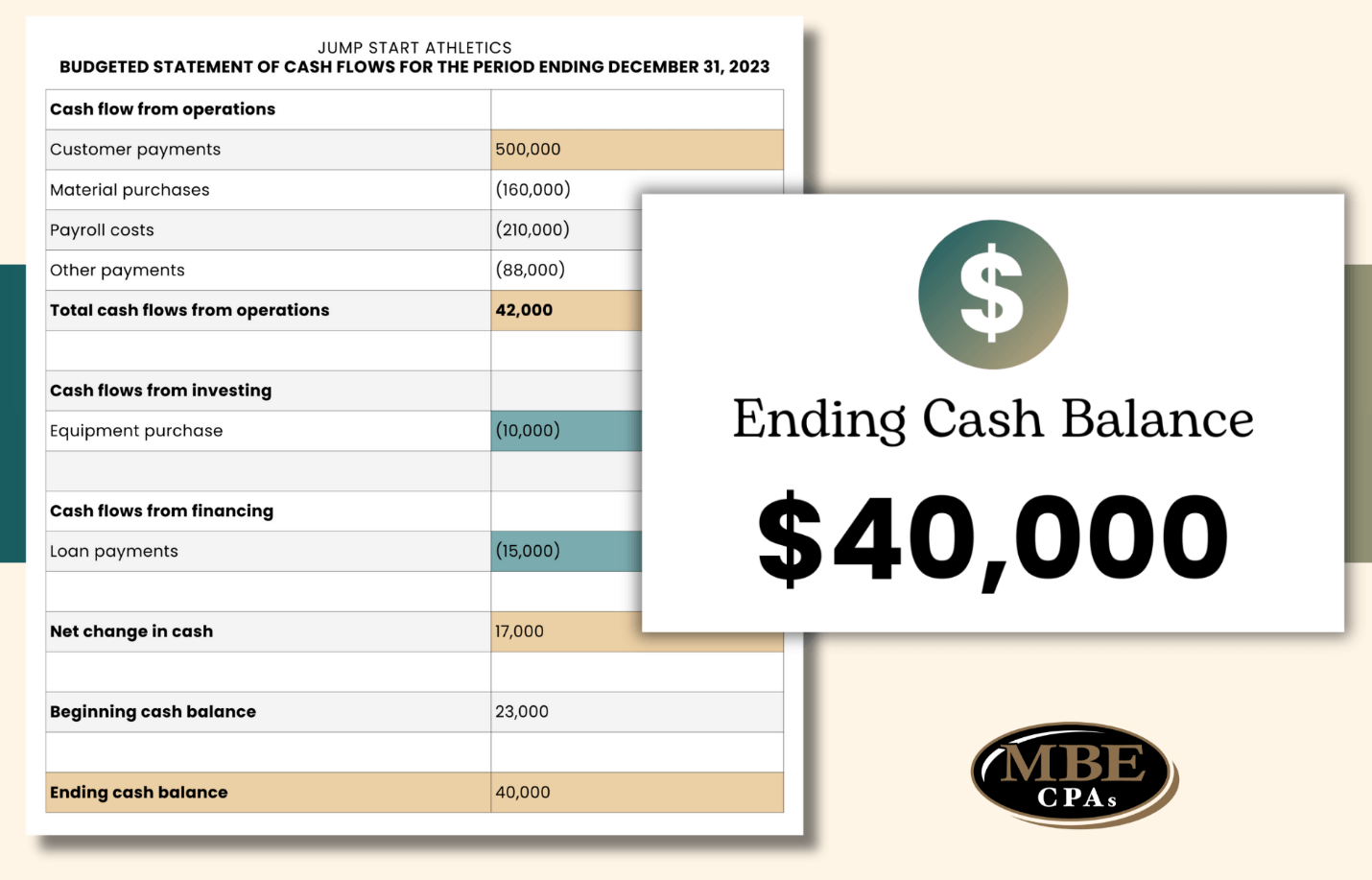

The cash flow statement documents a company’s cash inflows and outflows over a specific period. It provides valuable insights into the sources and uses of cash related to a business’s daily activities, investments, and financing. The cash flow statement is divided into three categories:

- Operating activities: This category includes cash from customer sales and inventory. A healthy business should generate most of its cash inflow from day-to-day operations that it can sustain over months and years.

- Investing activities: This category refers to cash activity related to buying and selling assets such as machinery, equipment, and vehicles.

- Financing activities: This category occurs when a company earns money from a stock or bond issue and accounts for cash repayments to investors.

By analyzing the cash flow statement, business owners can gain insights into the company’s ability to generate cash, invest in growth opportunities, and manage its financial obligations

How to Prepare a Financial Statement

Using accounting software like QuickBooks Online can simplify generating financial statements. MBE CPAs’ QuickBooks ProAdvisors can help you create accurate and reliable financial reports. If you prefer to prepare financial statements manually, resources are available to guide you through the process.

Remember, financial statements require accurate and consistent data. Applying accounting conventions, recording factual information, and making informed judgments are vital to ensuring the reliability and usefulness of your financial statements. By maintaining accurate financial statements and reviewing them regularly, you can make better-informed business decisions and identify areas for improvement.

The Power of Incorporating Financial Statements

Incorporating financial statements into your business workflow and processes can help you better manage your business, highlight improvement areas, and identify growth opportunities. Please take advantage of accounting software like QuickBooks Online, which not only simplifies the creation of financial statements but allows you to reach out to our QuickBooks ProAdvisors, who can answer your questions and offer guidance. Reviewing your financial statements regularly is essential for gaining valuable insights into your business’s economic health and ensuring its long-term success.

Tailored Guidance at Your Fingertips: The Value of QuickBooks ProAdvisors

At MBE CPAs, we understand the importance of having tailored guidance at your fingertips, especially when managing your business finances. That’s why we offer the incredible value of QuickBooks ProAdvisors. Our highly qualified professionals are dedicated to providing you with the support and insights you need to make informed financial decisions. Whether you have questions about creating financial statements, optimizing budgets, or maximizing tax deductions, our QuickBooks ProAdvisors are here to help. With their extensive knowledge and experience, they can guide you through the intricacies of QuickBooks software, ensuring accuracy and efficiency in your financial management processes. By leveraging our QuickBooks ProAdvisors’ knowledge, you can confidently navigate the complexities of accounting, allowing you to focus on what you do best – growing your business.

Looking for personalized marketing strategies? Brand House Marketing, our affiliated agency, wrote this insightful article.